Answered step by step

Verified Expert Solution

Question

1 Approved Answer

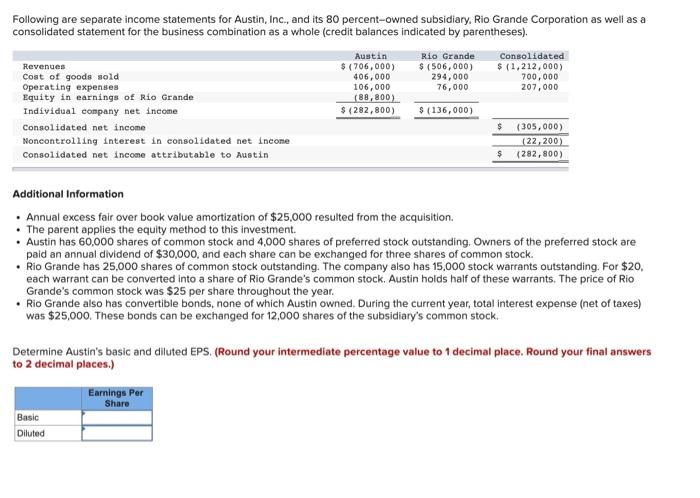

Following are separate income statements for Austin, Inc., and its 80 percent-owned subsidiary, Rio Grande Corporation as well as a consolidated statement for the

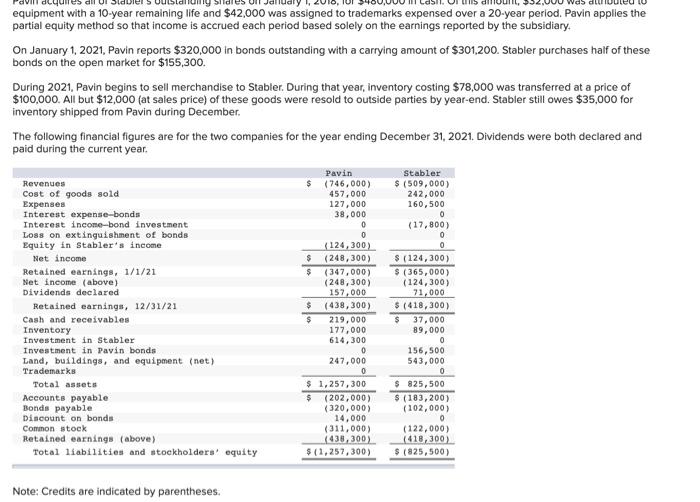

Following are separate income statements for Austin, Inc., and its 80 percent-owned subsidiary, Rio Grande Corporation as well as a consolidated statement for the business combination as a whole (credit balances indicated by parentheses). Revenues Cost of goods sold Austin $ (706,000) 406,000 Operating expenses 106,000 Rio Grande $ (506,000) 294,000 76,000 Consolidated $ (1,212,000) 700,000 207,000 Equity in earnings of Rio Grande Individual company net income (88,800) $ (282,800) $ (136,000) Consolidated net income $ (305,000) Noncontrolling interest in consolidated net income. (22,200) Consolidated net income attributable to Austin $ (282,800) Additional Information Annual excess fair over book value amortization of $25,000 resulted from the acquisition. The parent applies the equity method to this investment. Austin has 60,000 shares of common stock and 4,000 shares of preferred stock outstanding. Owners of the preferred stock are paid an annual dividend of $30,000, and each share can be exchanged for three shares of common stock. Rio Grande has 25,000 shares of common stock outstanding. The company also has 15,000 stock warrants outstanding. For $20, each warrant can be converted into a share of Rio Grande's common stock. Austin holds half of these warrants. The price of Rio Grande's common stock was $25 per share throughout the year. Rio Grande also has convertible bonds, none of which Austin owned. During the current year, total interest expense (net of taxes) was $25,000. These bonds can be exchanged for 12,000 shares of the subsidiary's common stock. Determine Austin's basic and diluted EPS. (Round your intermediate percentage value to 1 decimal place. Round your final answers to 2 decimal places.) Basic Diluted Earnings Per Share equipment with a 10-year remaining life and $42,000 was assigned to trademarks expensed over a 20-year period. Pavin applies the partial equity method so that income is accrued each period based solely on the earnings reported by the subsidiary. On January 1, 2021, Pavin reports $320,000 in bonds outstanding with a carrying amount of $301,200. Stabler purchases half of these bonds on the open market for $155,300. During 2021, Pavin begins to sell merchandise to Stabler. During that year, inventory costing $78,000 was transferred at a price of $100,000. All but $12,000 (at sales price) of these goods were resold to outside parties by year-end. Stabler still owes $35,000 for inventory shipped from Pavin during December. The following financial figures are for the two companies for the year ending December 31, 2021. Dividends were both declared and paid during the current year. Revenues Cost of goods sold Expenses Interest expense-bonds Interest income-bond investment Loss on extinguishment of bonds. Equity in Stabler's income Net income Retained earnings, 1/1/21 Net income (above) Dividends declared Retained earnings, 12/31/21 Cash and receivables Inventory Investment in Stabler Investment in Pavin bonds Land, buildings, and equipment (net) Trademarks Total assets Accounts payable Bonds payable Discount on bonds Common stock Retained earnings (above) Total liabilities and stockholders' equity Pavin Stabler $ (746,000) $ (509,000) 457,000 127,000 242,000 160,500 38,000 0 0 (17,800) 0 0 (124,300) 0 $ $ (248,300) $ (347,000) (248,300) 157,000 (438,300) $ (124,300) $ (365,000) (124,300) 71,000 $ (418,300) $ 219,000 $ 37,000 177,000 614,300 0 247,000 0 0 $ 1,257,300 $ (202,000) (320,000) 14,000 (311,000) (438,300) $ (1,257,300) 89,000 0 156,500 543,000 $ 825,500 $ (183,200) (102,000) (122,000) (418,300) $ (825,500) Note: Credits are indicated by parentheses.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started