Answered step by step

Verified Expert Solution

Question

1 Approved Answer

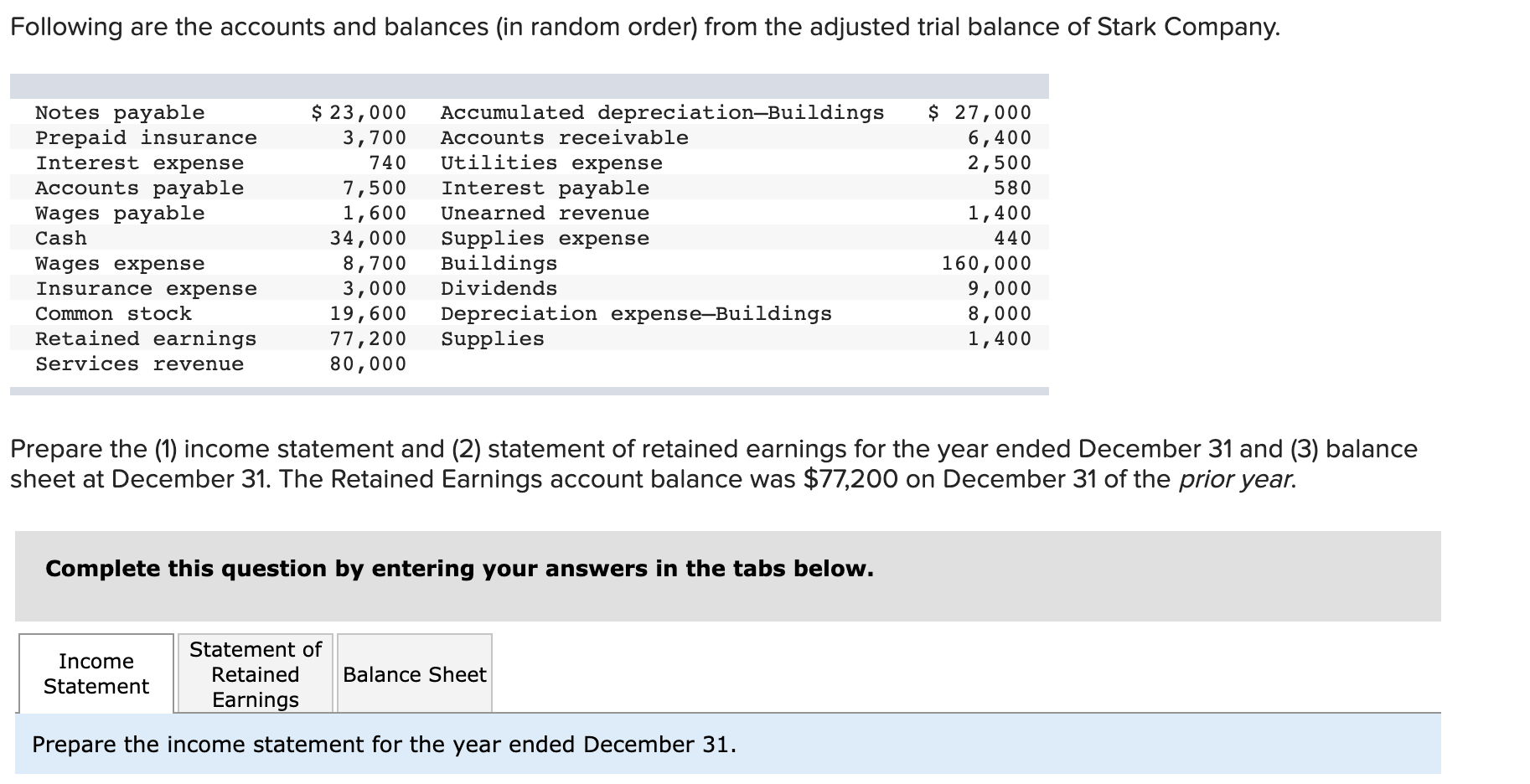

Following are the accounts and balances (in random order) from the adjusted trial balance of Stark Company. Notes payable $ 23,000 Accumulated depreciationBuildings $ 27,000

Following are the accounts and balances (in random order) from the adjusted trial balance of Stark Company.

| Notes payable | $ | 23,000 | Accumulated depreciationBuildings | $ | 27,000 | ||

| Prepaid insurance | 3,700 | Accounts receivable | 6,400 | ||||

| Interest expense | 740 | Utilities expense | 2,500 | ||||

| Accounts payable | 7,500 | Interest payable | 580 | ||||

| Wages payable | 1,600 | Unearned revenue | 1,400 | ||||

| Cash | 34,000 | Supplies expense | 440 | ||||

| Wages expense | 8,700 | Buildings | 160,000 | ||||

| Insurance expense | 3,000 | Dividends | 9,000 | ||||

| Common stock | 19,600 | Depreciation expenseBuildings | 8,000 | ||||

| Retained earnings | 77,200 | Supplies | 1,400 | ||||

| Services revenue | 80,000 | ||||||

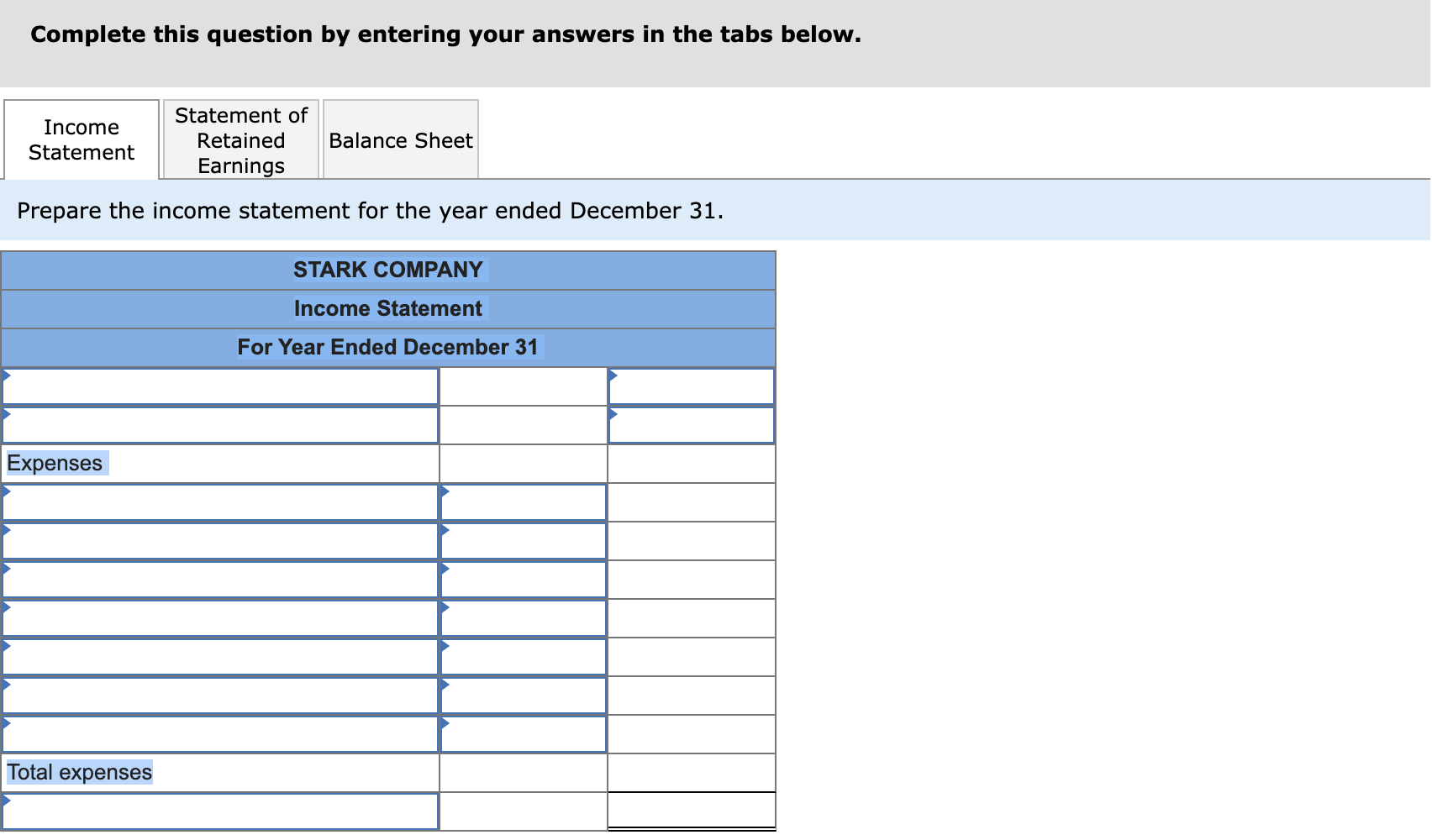

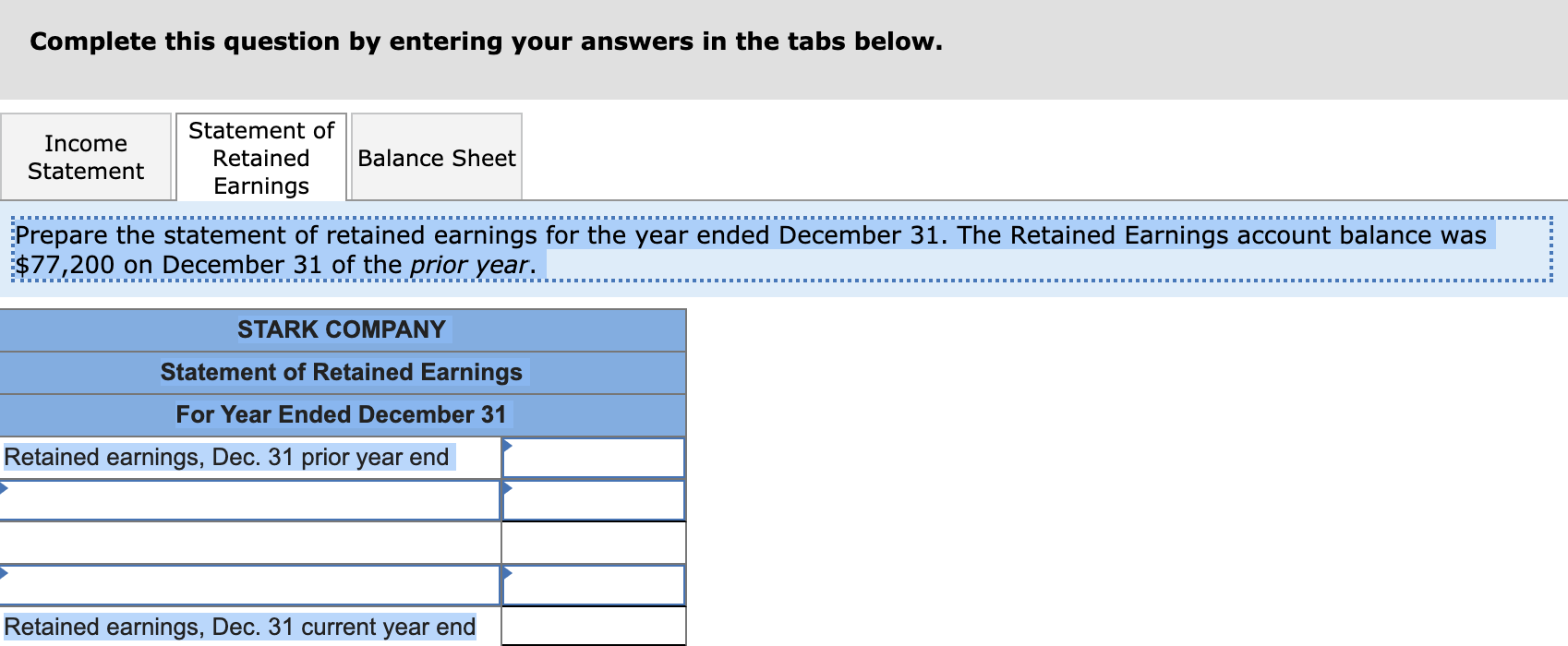

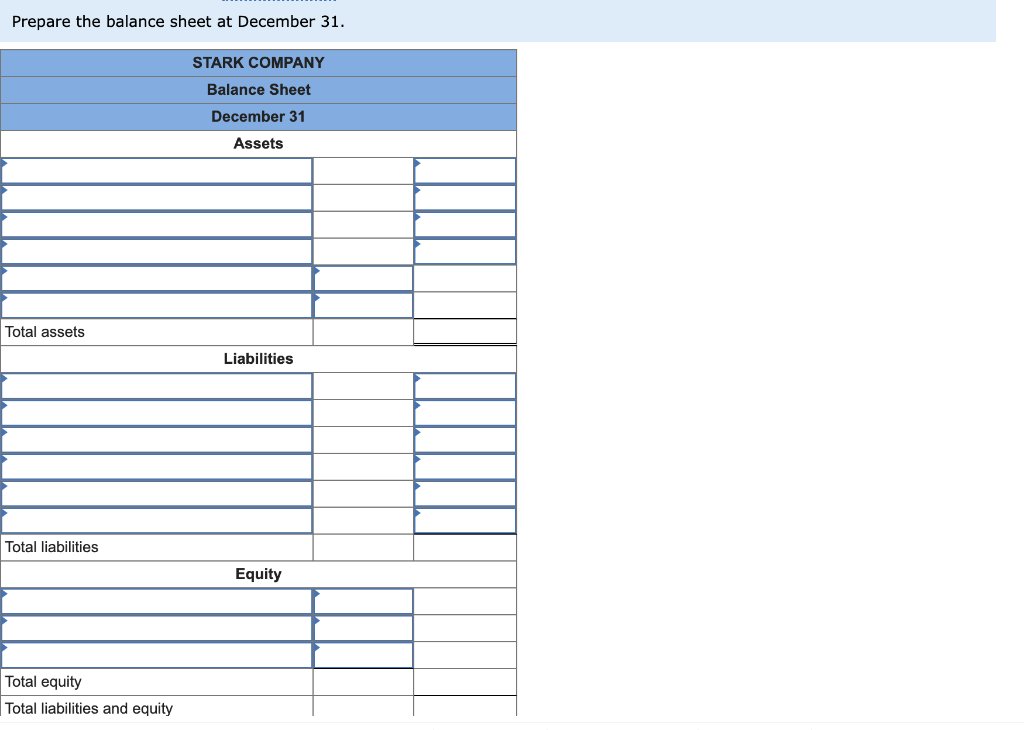

Prepare the (1) income statement and (2) statement of retained earnings for the year ended December 31 and (3) balance sheet at December 31. The Retained Earnings account balance was $77,200 on December 31 of the prior year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started