Answered step by step

Verified Expert Solution

Question

1 Approved Answer

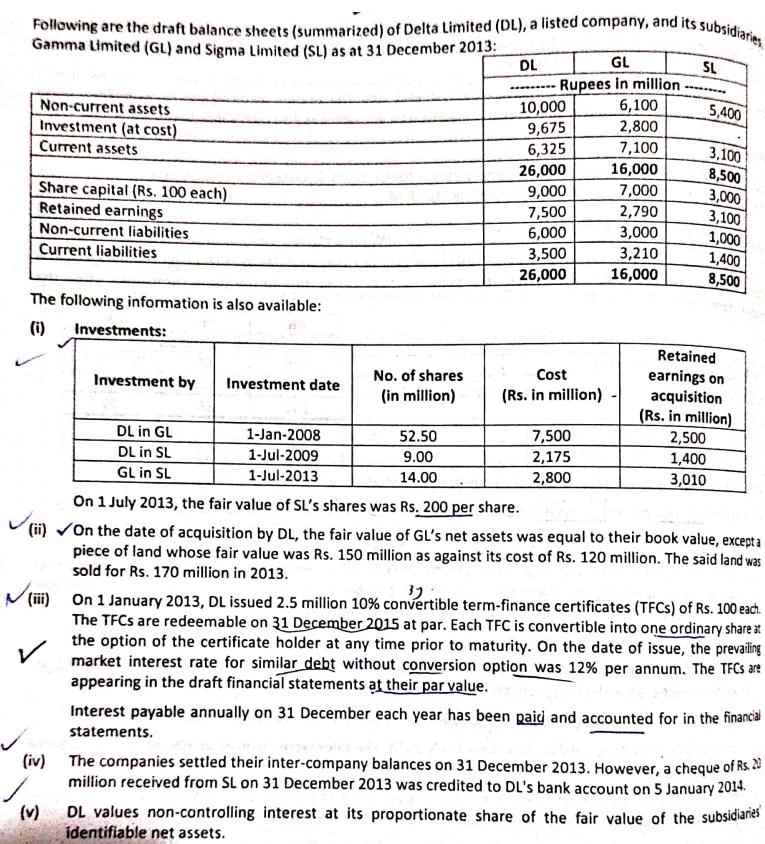

Following are the draft balance sheets (summarized) of Delta Limited (DL), a listed company, and its subsidiaries Gamma Limited (GL) and Sigma Limited (SL)

Following are the draft balance sheets (summarized) of Delta Limited (DL), a listed company, and its subsidiaries Gamma Limited (GL) and Sigma Limited (SL) as at 31 December 2013: Non-current assets Investment (at cost) Current assets Share capital (Rs. 100 each) Retained earnings Non-current liabilities Current liabilities The following information is also available: (i) Investments: (iv) Investment by (v) DL in GL DL in SL GL in SL Investment date 1-Jan-2008 1-Jul-2009 1-Jul-2013 No. of shares (in million) 52.50 9.00 14.00 DL ......... GL Rupees in million 6,100 2,800 7,100 16,000 7,000 10,000 9,675 6,325 26,000 9,000 7,500 6,000 3,500 26,000 Cost (Rs.in million) 7,500 2,175 2,800 2,790 3,000 3,210 16,000 SL 5,400 3,100 8,500 3,000 3,100 1,000 1,400 8,500 On 1 July 2013, the fair value of SL's shares was Rs. 200 per share. (ii) On the date of acquisition by DL, the fair value of GL's net assets was equal to their book value, except a piece of land whose fair value was Rs. 150 million as against its cost of Rs. 120 million. The said land was sold for Rs. 170 million in 2013. Retained earnings on acquisition (Rs. in million) 2,500 1,400 3,010 39 On 1 January 2013, DL issued 2.5 million 10% convertible term-finance certificates (TFCs) of Rs. 100 each. The TFCs are redeemable on 31 December 2015 at par. Each TFC is convertible into one ordinary share at the option of the certificate holder at any time prior to maturity. On the date of issue, the prevailing market interest rate for similar debt without conversion option was 12% per annum. The TFCs are appearing in the draft financial statements at their par value. Interest payable annually on 31 December each year has been paid and accounted for in the financial statements. The companies settled their inter-company balances on 31 December 2013. However, a cheque of Rs. 20 million received from SL on 31 December 2013 was credited to DL's bank account on 5 January 2014. DL values non-controlling interest at its proportionate share of the fair value of the subsidiaries identifiable net assets. Required: Prepare a consolidated statement of financial position as at 31 December 2013 in accordance with the requirements of the International Financial Reporting Standards. (20)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare a consolidated statement of financial position as at 31 December 2013 we need to consolid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started