Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following are the financial statements of Jax Berhad, Peri Berhad, Luz Berhad and Alo Berhad for year ended 2019. Less Statement of Profit or

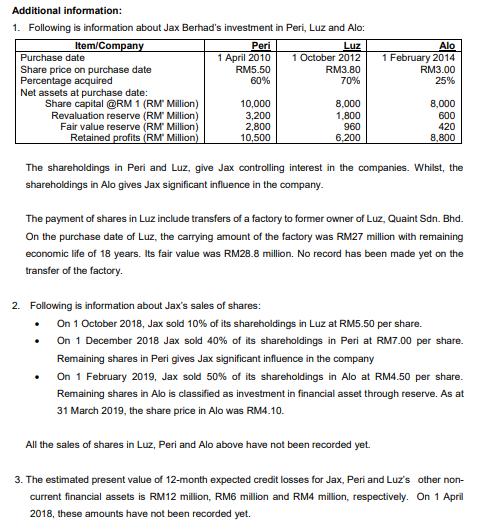

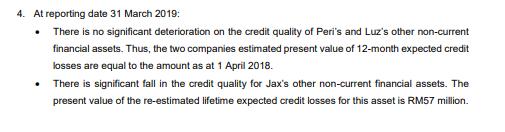

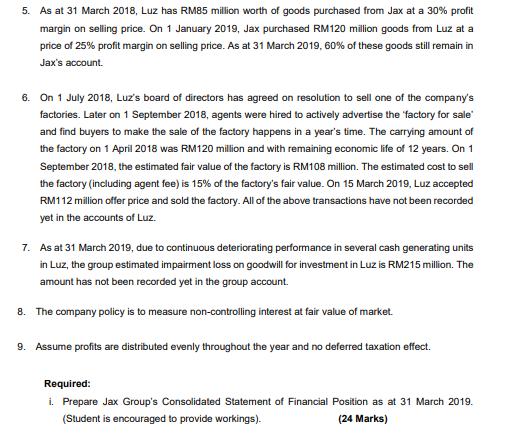

Following are the financial statements of Jax Berhad, Peri Berhad, Luz Berhad and Alo Berhad for year ended 2019. Less Statement of Profit or Loss and Other Comprehensive Income for financial year ended 31 March 2019 (RM'Mil) Jax Peri Luz Alo Profit before taxation Taxation Profit after taxation Other Comprehensive Income Revaluation reserve Fair value reserve Total Other Comprehensive Income Total Comprehensive Income Assets Non-current Property, plant and equipment Investment in Peri Investment in Luz Investment in Alo Other Assets Current Inventories Other assets Total assets Liabilities Non-current Bonds Other liabilities 585 (130) 455 Statement of Financial Position as at 31 March 2019 (RM' Million) Jax Peri Luz Alo Current Payables Total liabilities Equities Share capital @ RM 1 Revaluation reserve Fair value reserve Retained profits Total equities Total equities and liabilities 80 (30) 50 20 15 16 (53) 36 (38) 505 384 190 132 448 298 138 (100) (70) (30) 348 228 108 1,200 5,800 67,305 50,334 26,530 23,202 39,000 22,400 6,400 16,970 152,075 600 4,400 900 2,600 159,075 62,200 31,387 25,638 8,366 3,747 2,006 58,700 30,277 25,208 350 760 2,000 1,500 1,800 1,200 3,800 2,700 1,400 18 800 600 6 24 150 400 3,100 1,550 15,000 10,000 8,000 15,280 5,020 2,415 11,970 6,866 2,447 112,425 37,214 16,975 150 280 600 300 900 50 950 8,000 1,368 1,206 14,114 154,675 59,100 29,837 24,688 159,075 62,200 31,387 25,638 Additional information: 1. Following is information about Jax Berhad's investment in Peri, Luz and Alo: Item/Company Purchase date Share price on purchase date Percentage acquired Net assets at purchase date: Share capital @RM 1 (RM' Million) Revaluation reserve (RM" Million) Fair value reserve (RM" Million) Retained profits (RM' Million) Peri 1 April 2010 RM5.50 60% 10,000 3,200 2,800 10,500 . 2. Following is information about Jax's sales of shares: . Luz 1 October 2012 RM3.80 70% 8,000 1,800 960 6,200 The shareholdings in Peri and Luz, give Jax controlling interest in the companies. Whilst, the shareholdings in Alo gives Jax significant influence in the company. The payment of shares in Luz include transfers of a factory to former owner of Luz, Quaint Sdn. Bhd. On the purchase date of Luz, the carrying amount of the factory was RM27 million with remaining economic life of 18 years. Its fair value was RM28.8 million. No record has been made yet on the transfer of the factory. Alo 1 February 2014 RM3.00 25% 8,000 600 420 8,800 On 1 October 2018, Jax sold 10% of its shareholdings in Luz at RM5.50 per share. On 1 December 2018 Jax sold 40% of its shareholdings in Peri at RM7.00 per share. Remaining shares in Peri gives Jax significant influence in the company All the sales of shares in Luz, Peri and Alo above have not been recorded yet. On 1 February 2019, Jax sold 50% of its shareholdings in Alo at RM4.50 per share. Remaining shares in Alo is classified as investment in financial asset through reserve. As at 31 March 2019, the share price in Alo was RM4.10. 3. The estimated present value of 12-month expected credit losses for Jax, Peri and Luz's other non- current financial assets is RM12 million, RM6 million and RM4 million, respectively. On 1 April 2018, these amounts have not been recorded yet. 4. At reporting date 31 March 2019: There is no significant deterioration on the credit quality of Peri's and Luz's other non-current financial assets. Thus, the two companies estimated present value of 12-month expected credit losses are equal to the amount as at 1 April 2018. There is significant fall in the credit quality for Jax's other non-current financial assets. The present value of the re-estimated lifetime expected credit losses for this asset is RM57 million. 5. As at 31 March 2018, Luz has RM85 million worth of goods purchased from Jax at a 30% profit margin on selling price. On 1 January 2019, Jax purchased RM120 million goods from Luz at a price of 25% profit margin on selling price. As at 31 March 2019, 60% of these goods still remain in Jax's account. 6. On 1 July 2018, Luz's board of directors has agreed on resolution to sell one of the company's factories. Later on 1 September 2018, agents were hired to actively advertise the factory for sale and find buyers to make the sale of the factory happens in a year's time. The carrying amount of the factory on 1 April 2018 was RM120 million and with remaining economic life of 12 years. On 1 September 2018, the estimated fair value of the factory is RM108 million. The estimated cost to sell the factory (including agent fee) is 15% of the factory's fair value. On 15 March 2019, Luz accepted RM112 million offer price and sold the factory. All of the above transactions have not been recorded yet in the accounts of Luz. 7. As at 31 March 2019, due to continuous deteriorating performance in several cash generating units in Luz, the group estimated impairment loss on goodwill for investment in Luz is RM215 million. The amount has not been recorded yet in the group account. 8. The company policy is to measure non-controlling interest at fair value of market. 9. Assume profits are distributed evenly throughout the year and no deferred taxation effect. Required: i. Prepare Jax Group's Consolidated Statement of Financial Position as at 31 March 2019. (Student is encouraged to provide workings). (24 Marks)

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Jax Groups Consolidated Statement of Financial Position as ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started