Answered step by step

Verified Expert Solution

Question

1 Approved Answer

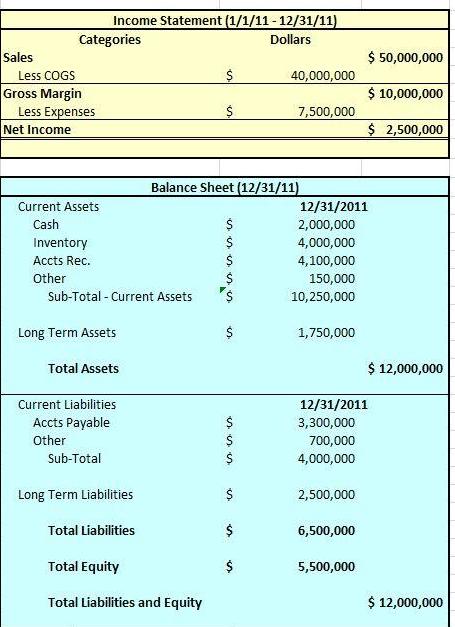

Following are the financial statements of the company. Sales Less COGS Gross Margin Categories Less Expenses Net Income Current Assets Cash. Inventory Accts Rec. Other

Following are the financial statements of the company.

Sales Less COGS Gross Margin Categories Less Expenses Net Income Current Assets Cash. Inventory Accts Rec. Other Income Statement (1/1/11 - 12/31/11) Dollars Sub-Total - Current Assets Long Term Assets Total Assets Current Liabilities Accts Payable Other Sub-Total Long Term Liabilities Total Liabilities $ Total Equity Total Liabilities and Equity $ Balance Sheet (12/31/11) $ sssssssss $ $ $ $ sss $ $ 40,000,000 $ $ $ 7,500,000 1,750,000 12/31/2011 2,000,000 4,000,000 4,100,000 150,000 10,250,000 12/31/2011 3,300,000 700,000 4,000,000 2,500,000 6,500,000 $ 50,000,000 $ 10,000,000 5,500,000 $ 2,500,000 $ 12,000,000 $ 12,000,000

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

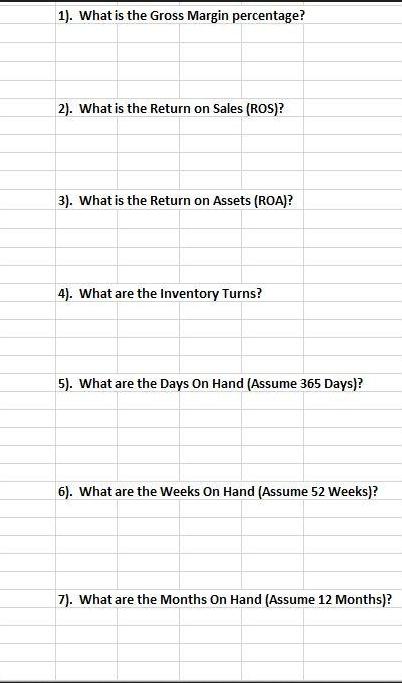

1 The gross margin percentage is 40 Gross margin 500000 Sales 1250000 Gross margi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started