Answered step by step

Verified Expert Solution

Question

1 Approved Answer

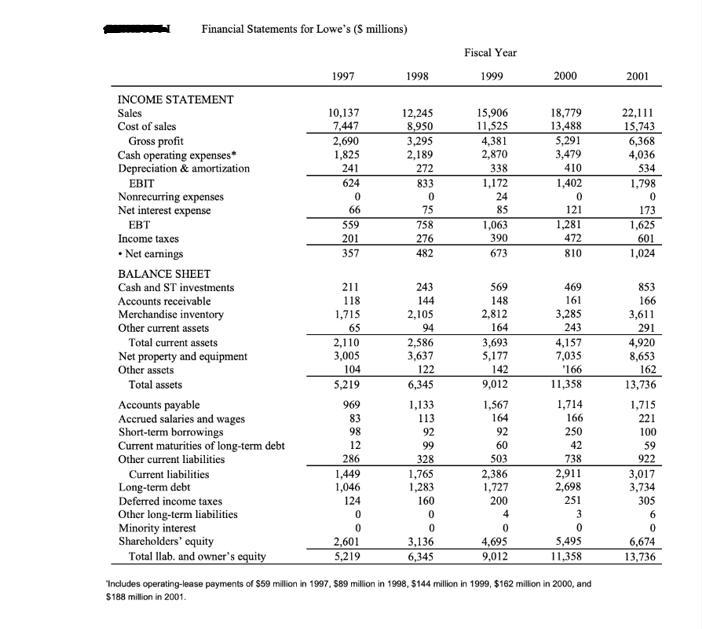

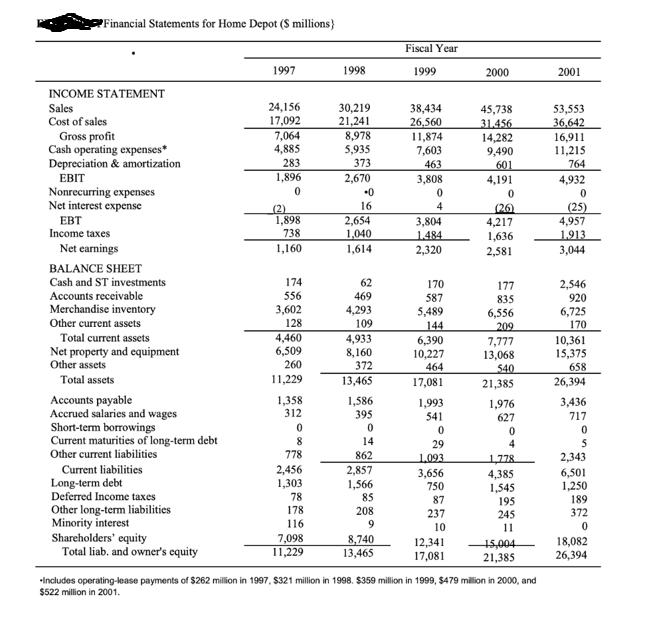

Following are the income statements of Lowe's and Home Depot Required What is the historic ROIC and also the firms WACC? Can you compare

Following are the income statements of Lowe's and Home Depot

Required

Required

What is the historic ROIC and also the firm’s WACC?

Can you compare the two?

What does the ROIC – WACC spread tell us?

What does it suggest concerning the efficient deployment of capital?

Given the historical analysis you have performed, what is the overall financial condition of Home Depot?

Financial Statements for Lowe's (S millions) INCOME STATEMENT Sales Cost of sales Gross profit Cash operating expenses* Depreciation & amortization EBIT Nonrecurring expenses Net interest expense EBT Income taxes Net earnings BALANCE SHEET Cash and ST investments Accounts receivable Merchandise inventory Other current assets Total current assets Net property and equipment Other assets Total assets Accounts payable Accrued salaries and wages Short-term borrowings Current maturities of long-term debt Other current liabilities Current liabilities Long-term debt Deferred income taxes Other long-term liabilities Minority interest Shareholders' equity Total llab. and owner's equity 1997 10,137 7,447 2,690 1,825 241 624 0 66 559 201 357 211 118 1,715 65 2,110 3,005 104 5,219 969 83 98 12 286 1,449 1,046 124 0 0 2,601 5,219 1998 12,245 8,950 3,295 2,189 272 833 0 75 758 276 482 243 144 2,105 94 2,586 3,637 122 6,345 1,133 113 92 99 328 1,765 1,283 160 0 0 3,136 6,345 Fiscal Year 1999 15,906 11,525 4,381 2,870 338 1,172 24 85 1,063 390 673 569 148 2,812 164 3,693 5,177 142 9,012 1,567 164 92 60 503 2,386 1,727 200 4 0 4,695 9,012 2000 18,779 13,488 5,291 3,479 410 1,402 0 121 1,281 472 810 469 161 3,285 243 4,157 7,035 '166 11,358 1,714 166 250 42 738 2,911 2,698 251 3 0 5,495 11,358 "Includes operating-lease payments of $59 million in 1997, $89 million in 1998, $144 million in 1999, $162 million in 2000, and $188 million in 2001. 2001 22,111 15,743 6,368 4,036 534 1,798 0 173 1,625 601 1,024 853 166 3,611 291 4,920 8,653 162 13,736 1,715 221 100 59 922 3,017 3,734 305 6 0 6,674 13,736

Step by Step Solution

★★★★★

3.32 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

To answer your questions we need to calculate the Return on Invested Capital ROIC for both Lowes and Home Depot and the Weighted Average Cost of Capit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started