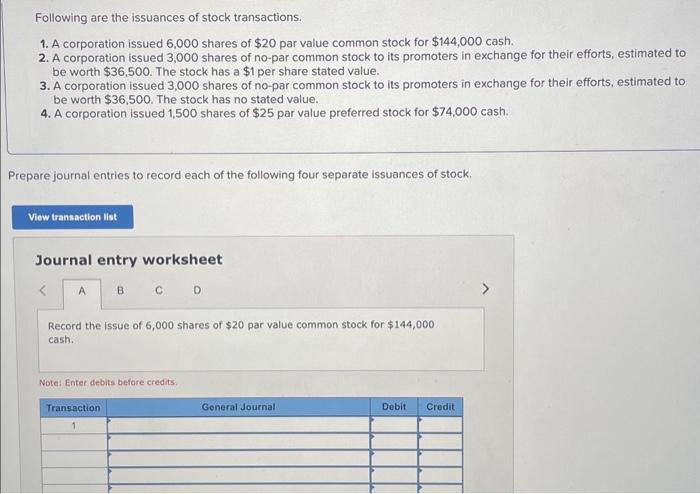

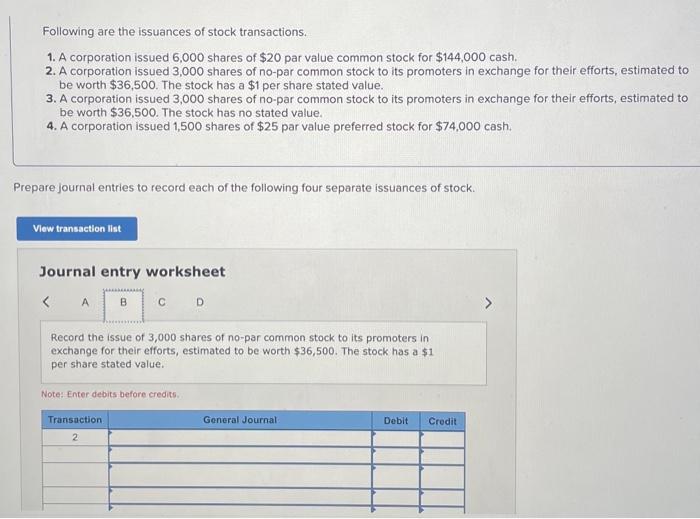

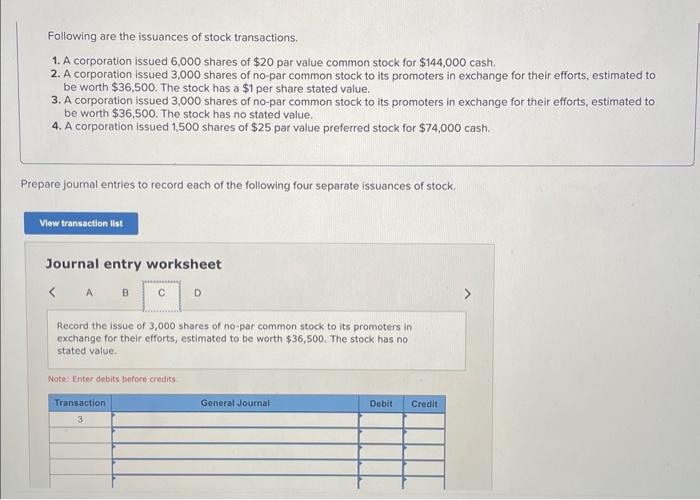

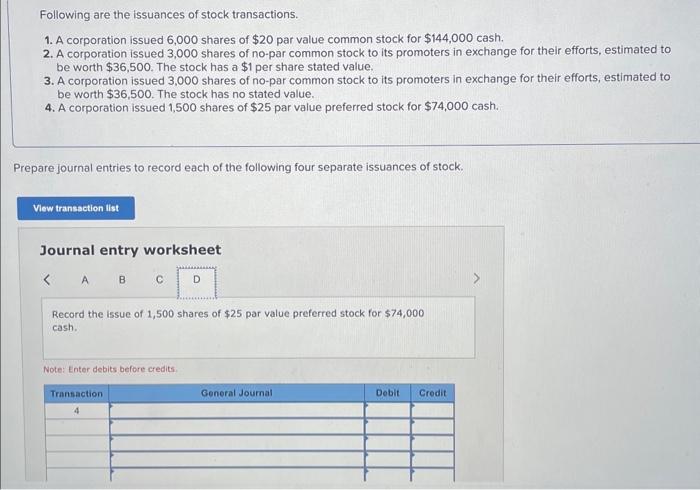

Following are the issuances of stock transactions. 1. A corporation issued 6,000 shares of $20 par value common stock for $144,000 cash. 2. A corporation issued 3,000 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,500. The stock has a $1 per share stated value. 3. A corporation issued 3,000 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,500. The stock has no stated value. 4. A corporation issued 1,500 shares of $25 par value preferred stock for $74,000 cash. Prepare journal entries to record each of the following four separate issuances of stock. Journal entry worksheet Record the issue of 6,000 shares of $20 par value common stock for $144,000 cash. Note: Enter debits before credits. Following are the issuances of stock transactions. 1. A corporation issued 6,000 shares of $20 par value common stock for $144,000 cash. 2. A corporation issued 3,000 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,500. The stock has a $1 per share stated value. 3. A corporation issued 3,000 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,500. The stock has no stated value. 4. A corporation issued 1,500 shares of $25 par value preferred stock for $74,000cash. Prepare journal entries to record each of the following four separate issuances of stock. Journal entry worksheet Record the issue of 3,000 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,500. The stock has a $1 per share stated value. Note: Enter debits before credits. Following are the issuances of stock transactions. 1. A corporation issued 6,000 shares of $20 par value common stock for $144,000cash. 2. A corporation issued 3,000 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,500. The stock has a $1 per share stated value. 3. A corporation issued 3,000 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,500. The stock has no stated value. 4. A corporation issued 1,500 shares of $25 par value preferred stock for $74,000 cash. Prepare journal entries to record each of the following four separate issuances of stock. Journal entry worksheet Record the issue of 3,000 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,500. The stock has no stated value. Notes Enter debits Bifore credits Following are the issuances of stock transactions. 1. A corporation issued 6,000 shares of $20 par value common stock for $144,000 cash. 2. A corporation issued 3,000 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,500. The stock has a $1 per share stated value. 3. A corporation issued 3,000 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,500. The stock has no stated value. 4. A corporation issued 1,500 shares of $25 par value preferred stock for $74,000 cash. Prepare journal entries to record each of the following four separate issuances of stock. Journal entry worksheet Record the issue of 1,500 shares of $25 par value preferred stock for $74,000 cash. Note: Enter debits before credits