Read the information and answer the following question. Using the market value weights, calculate the weighted average cost of capital (WACC) for Makhubela Ltd

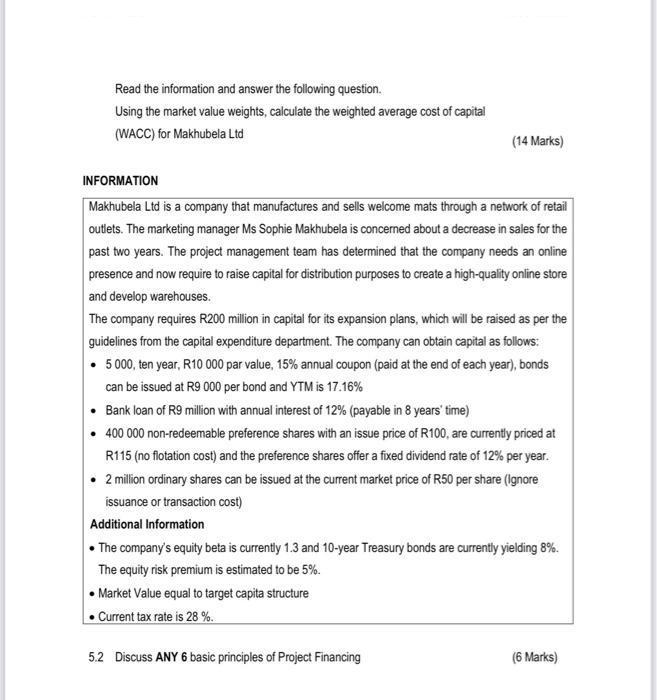

Read the information and answer the following question. Using the market value weights, calculate the weighted average cost of capital (WACC) for Makhubela Ltd INFORMATION Makhubela Ltd is a company that manufactures and sells welcome mats through a network of retail outlets. The marketing manager Ms Sophie Makhubela is concerned about a decrease in sales for the past two years. The project management team has determined that the company needs an online presence and now require to raise capital for distribution purposes to create a high-quality online store and develop warehouses. The company requires R200 million in capital for its expansion plans, which will be raised as per the guidelines from the capital expenditure department. The company can obtain capital as follows: 5 000, ten year, R10 000 par value, 15% annual coupon (paid at the end of each year), bonds can be issued at R9 000 per bond and YTM is 17.16% Bank loan of R9 million with annual interest of 12% (payable in 8 years' time) (14 Marks) 400 000 non-redeemable preference shares with an issue price of R100, are currently priced at R115 (no flotation cost) and the preference shares offer a fixed dividend rate of 12% per year. 2 million ordinary shares can be issued at the current market price of R50 per share (Ignore issuance or transaction cost) Additional Information The company's equity beta is currently 1.3 and 10-year Treasury bonds are currently yielding 8%. The equity risk premium is estimated to be 5%. Market Value equal to target capita structure Current tax rate is 28 %. 5.2 Discuss ANY 6 basic principles of Project Financing (6 Marks)

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the weighted average cost of capital WACC for Makhubela Ltd we need to determine the cost of each component of the capital structure and then apply the market value weights Here are the c...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started