Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following are the transactions of JonesSpa Corporation, for the month of January. a. Borrowed $30,000 from a local bank; the loan is due in

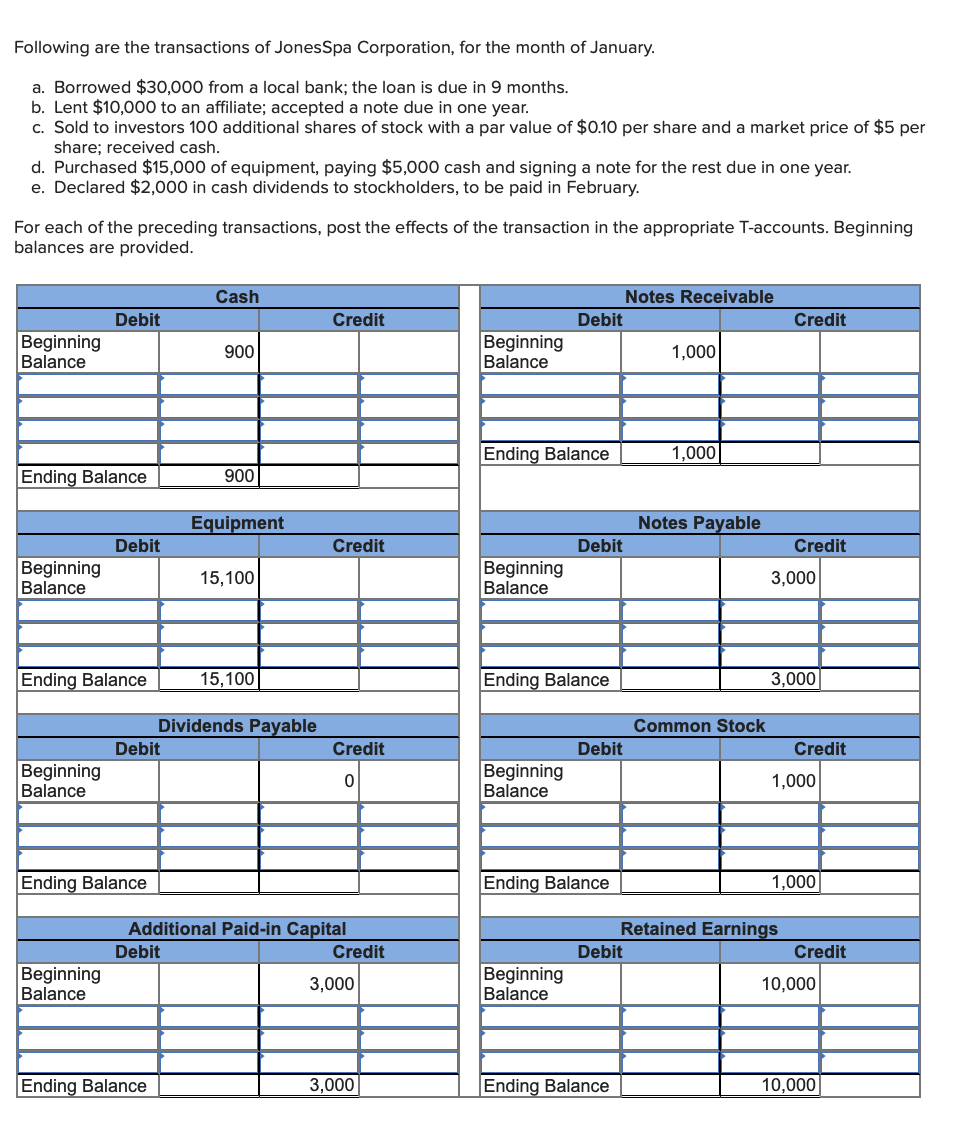

Following are the transactions of JonesSpa Corporation, for the month of January. a. Borrowed $30,000 from a local bank; the loan is due in 9 months. b. Lent $10,000 to an affiliate; accepted a note due in one year. c. Sold to investors 100 additional shares of stock with a par value of $0.10 per share and a market price of $5 per share; received cash. d. Purchased $15,000 of equipment, paying $5,000 cash and signing a note for the rest due in one year. e. Declared $2,000 in cash dividends to stockholders, to be paid in February. For each of the preceding transactions, post the effects of the transaction in the appropriate T-accounts. Beginning balances are provided. Cash Notes Receivable Debit Credit Debit Credit Beginning Balance 900 Beginning Balance 1,000 Ending Balance 1,000 Ending Balance 900 Equipment Notes Payable Debit Credit Debit Credit Beginning Balance Beginning 15,100 3,000 Balance Ending Balance 15,100 Ending Balance 3,000 Dividends Payable Common Stock Debit Beginning Balance Credit 0 Debit Credit Beginning 1,000 Balance Ending Balance Ending Balance 1,000 Additional Paid-in Capital Retained Earnings Debit Credit Debit Credit Beginning Beginning 3,000 10,000 Balance Balance Ending Balance 3,000 Ending Balance 10,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To record the transactions for JonesSpa Corporation in January post each transaction into the approp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started