Answered step by step

Verified Expert Solution

Question

1 Approved Answer

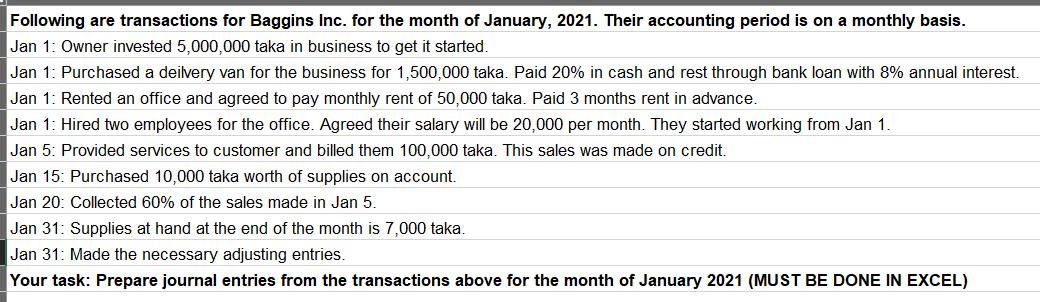

Following are transactions for Baggins Inc. for the month of January, 2021. Their accounting period is on a monthly basis. Jan 1: Owner invested

Following are transactions for Baggins Inc. for the month of January, 2021. Their accounting period is on a monthly basis. Jan 1: Owner invested 5,000,000 taka in business to get it started. Jan 1: Purchased a deilvery van for the business for 1,500,000 taka. Paid 20% in cash and rest through bank loan with 8% annual interest. Jan 1: Rented an office and agreed to pay monthly rent of 50,000 taka. Paid 3 months rent in advance. Jan 1: Hired two employees for the office. Agreed their salary will be 20,000 per month. They started working from Jan 1. Jan 5: Provided services to customer and billed them 100,000 taka. This sales was made on credit. Jan 15: Purchased 10,000 taka worth of supplies on account. Jan 20: Collected 60% of the sales made in Jan 5. Jan 31: Supplies at hand at the end of the month is 7,000 taka. Jan 31: Made the necessary adjusting entries. Your task: Prepare journal entries from the transactions above for the month of January 2021 (MUST BE DONE IN EXCEL)

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

In the Books of Baggins Inc Particulars Dr taka Cr taka Date Jan 1 2021 Bank Alc ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started