Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following Financial Ratios from the below balance sheet and income statements to examine critically the performance of the organization for the F.Y.- 2018-19 & 2019-20.

Following Financial Ratios from the below balance sheet and income statements to examine critically the performance of the organization for the F.Y.- 2018-19 & 2019-20.

1. Current Ratio

2. Quick ratio

3. Debt Ratio

4. Debt to equity ratio

5. Interest coverage ratio

6. Gross Profit ratio

7. Net income ratio

8. Price earning ratio

9. ROA

10. ROE

Also comments on the performance of the company of three years.

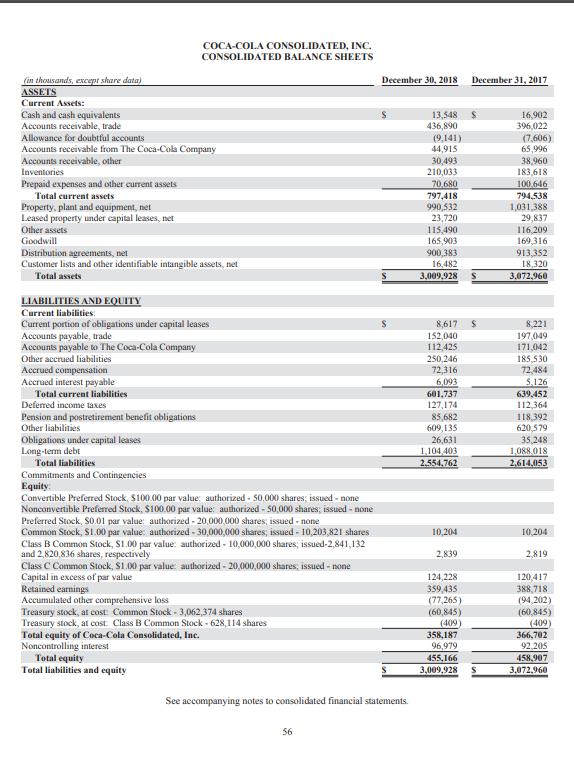

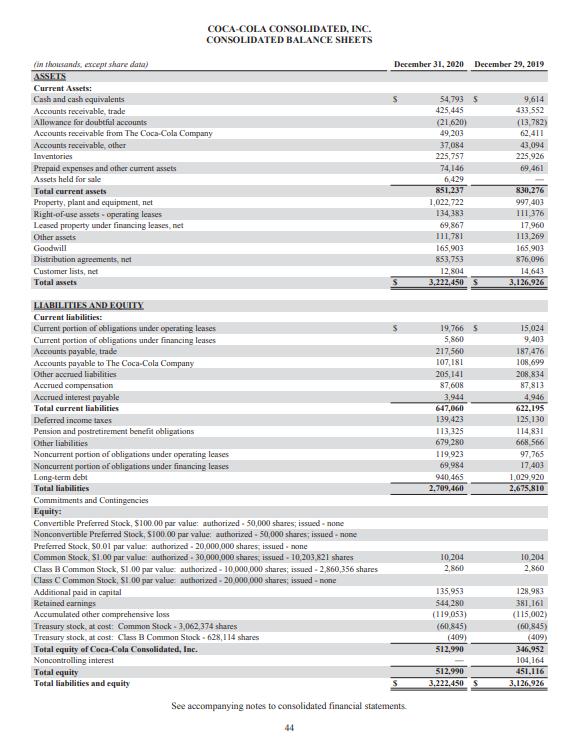

Three years balance sheets 2018, 2019, 2020

.

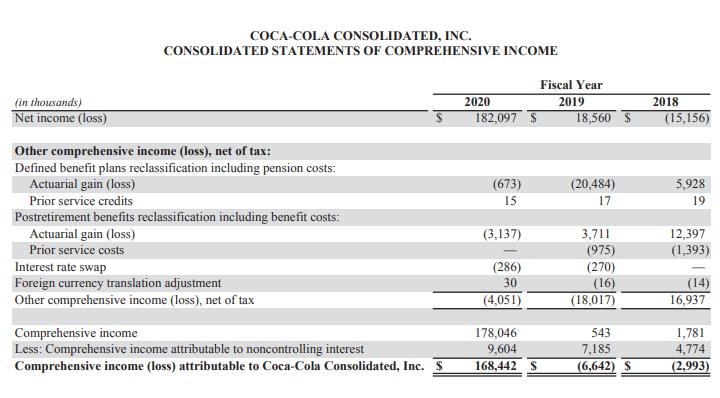

Three years Income statements 2018, 2019, 2020

(in thousands, except share data) ASSETS Current Assets: Cash and cash equivalents Accounts receivable, trade Allowance for doubtful accounts Accounts receivable from The Coca-Cola Company Accounts receivable, other Inventories Prepaid expenses and other current assets Total current assets Property, plant and equipment, net Leased property under capital leases, net Other assets Goodwill Distribution agreements, net Customer lists and other identifiable intangible assets, net Total assets LIABILITIES AND EQUITY Current liabilities: Current portion of obligations under capital leases Accounts payable, trade Accounts payable to The Coca-Cola Company Other accrued liabilities Accrued compensation Accrued interest payable Total current liabilities COCA-COLA CONSOLIDATED, INC. CONSOLIDATED BALANCE SHEETS Deferred income taxes Pension and postretirement benefit obligations Other liabilities Obligations under capital leases Long-term debt Total liabilities Commitments and Contingencies Equity Convertible Preferred Stock, $100.00 par value: authorized - 50.000 shares; issued - none Nonconvertible Preferred Stock, $100.00 par value: authorized - 50,000 shares; issued - none Preferred Stock, $0.01 par value: authorized - 20,000,000 shares; issued - none Common Stock, $1.00 par value: authorized - 30,000,000 shares; issued - 10,203,821 shares Class B Common Stock, $1.00 par value: authorized - 10,000,000 shares; issued-2,841,132 and 2,820,836 shares, respectively Class C Common Stock, $1.00 par value: authorized - 20,000,000 shares, issued - none Capital in excess of par value Retained earnings Accumulated other comprehensive loss Treasury stock, at cost Common Stock - 3,062,374 shares Treasury stock, at cost: Class B Common Stock-628,114 shares Total equity of Coca-Cola Consolidated, Inc. Noncontrolling interest Total equity Total liabilities and equity December 30, 2018 56 $ See accompanying notes to consolidated financial statements. 13,548 436,890 (9,141) 44,915 30,493 210,033 70,680 797,418 990,532 23,720 115,490 165,903 900,383 16,482 3,009,928 8,617 152,040 112,425 250,246 72,316 6,093 601,737 127,174 85,682 609,135 26,631 1,104,403 2.554,762 10,204 2,839 124,228 359,435 (77,265) (60,845) (409) 358,187 96,979 455,166 3,009,928 December 31, 2017 $ 16,902 396,022 (7,606) 65,996 38,960 183,618 100.646 794,538 1,031,388 29,837 116,209 169,316 913,352 18,320 3,072,960 8,221 197,049 171,042 185,530 72,484 5,126 639,452 112,364 118,392 620,579 35,248 1,088,018. 2,614,053 10,204 2,819 120,417 388,718 (94,202) (60,845) (409) 366,702 92,205 458.907 3.072,960

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided images of the balance sheets and the statement of comprehensive income lets calculate the financial ratios for CocaCola for the fiscal years 20182019 and 20192020 1 Current Ratio ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started