Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following from a market research report that cost 7,500 (paid in full last month) a golf club is considering a 750,000 investment in 20X6 on

Following from a market research report that cost £7,500 (paid in full last month) a golf club is considering a £750,000 investment in 20X6 on gymnasium facilities. The gymnasium is planned for a part of the club’s existing premises for which the club currently receives annual rent of £85,000 (at 20X6 prices) receivable in arrears. The company estimates that corporation tax will be 17% per annum and the cost of capital will be 10% per annum for the next five years. All cash flows can be assumed to arise at the end of the year to which they relate.

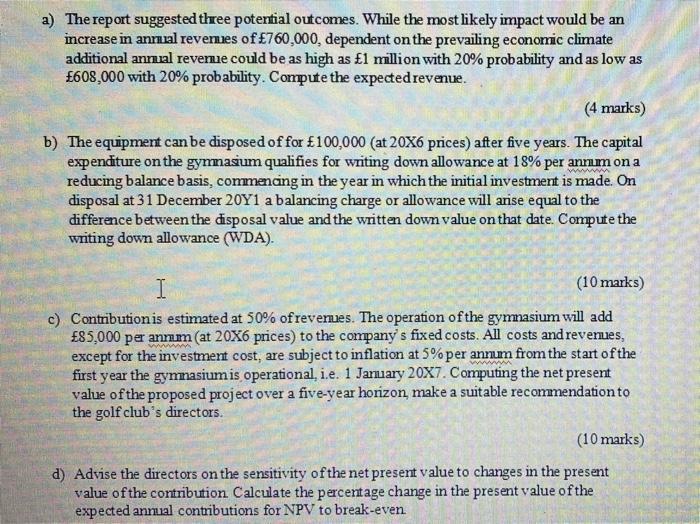

a) The report suggested three potertial outcomes. While the most likely impact would be an increase in annal revenes of 760,000, dependent on the prevailing economic climate additional annal reverue could be as high as 1 million with 20% probability and as low as 608,000 with 20% probability. Compute the expectedrevenue. (4 marks) b) The equipment can be disposed of for 100,000 (at 20X6 prices) after five years. The capital expenditure on the gymnasum qualifies for writing down allowance at 18% per annm on a reducing balance basis, commenaing in the year in which the initial investment is made. On disposal at 31 December 20Y1 a balancing charge or allowance will arise equal to the difference between the disposal value and the written down value on that date. Compute the writing down allowance (WDA). (10 marks) c) Contributionis estimated at 50% of revemues. The operation of the gymnasium will add 85,000 per annm (at 20X6 prices) to the company' s fixed costs. All costs and revenues, except for the investment cost, are subject to inflation at 5% per annum from the start of the first year the gymnasiumis operational, i.e. 1 January 20X7. Computing the net present value of the proposed project over a five-year hoizon, make a suitable recommendation to the golf club's directors. (10 marks) d) Advise the directors on the sensitivity ofthe net present value to changes in the present value ofthe contribution Calculate the percentage change in the present value ofthe expected annual contributions for NPV to break-even

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

aExpected revenue Sum of Probability x Revenue in state ie6076000020100000020608000 777600 bYear WDA Book value 0 750000 1 135000 615000 2 110700 5043...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started