Answered step by step

Verified Expert Solution

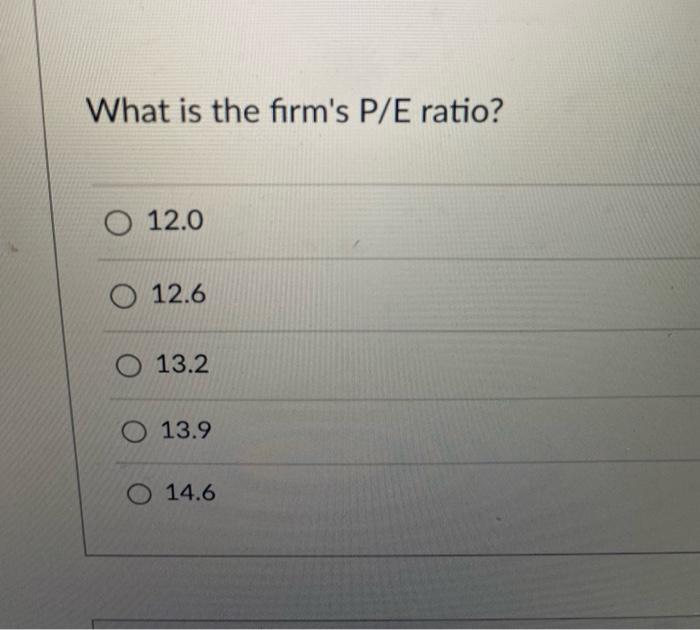

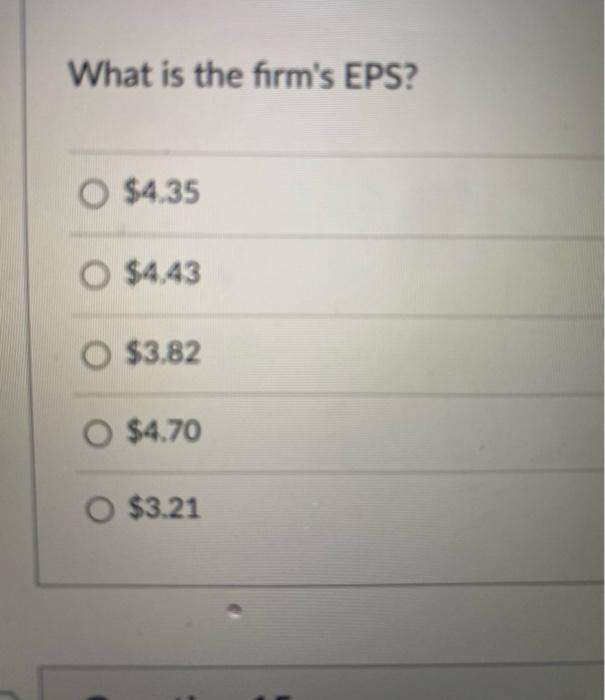

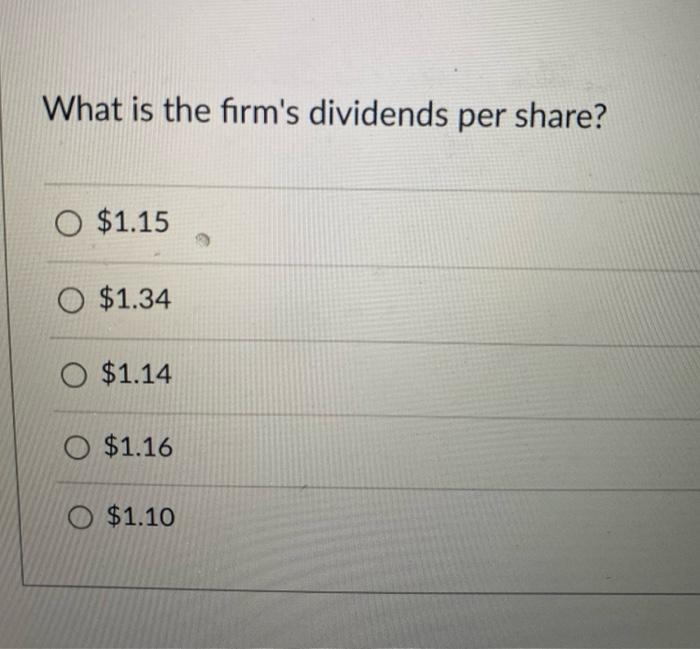

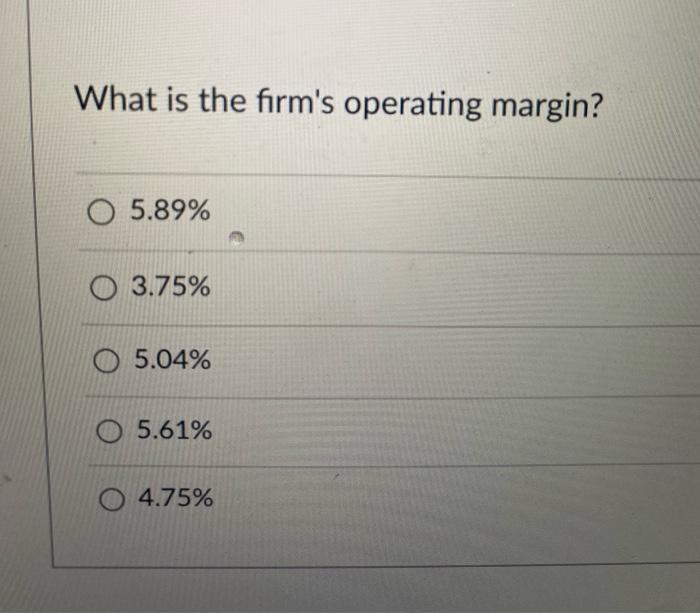

Question

1 Approved Answer

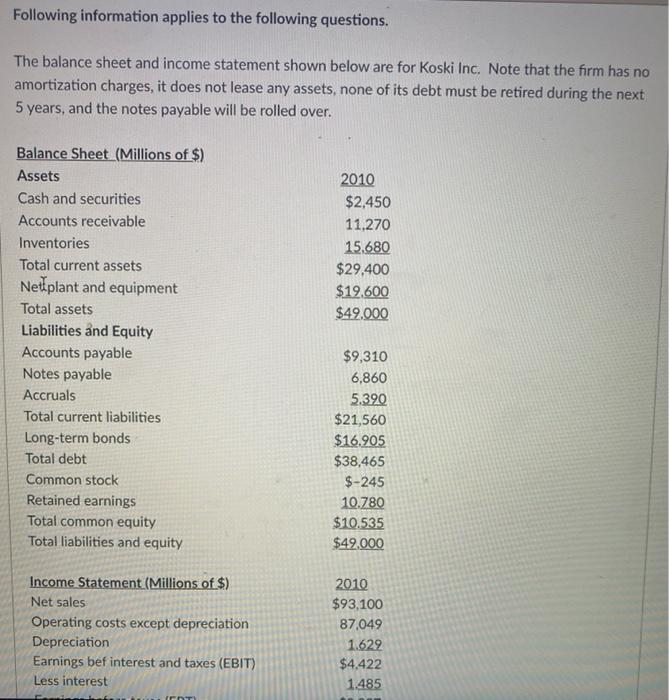

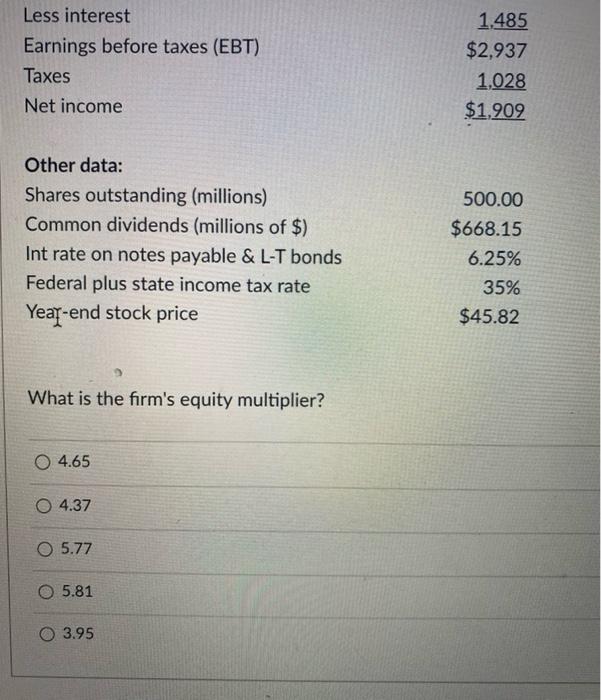

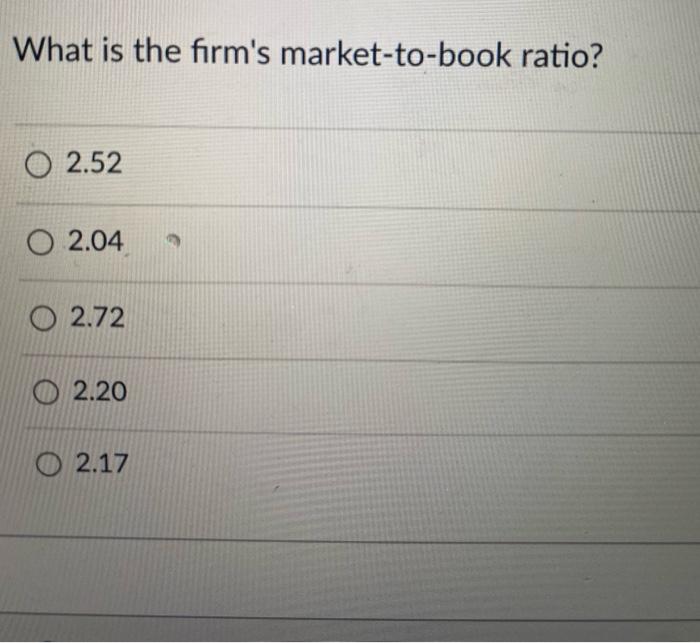

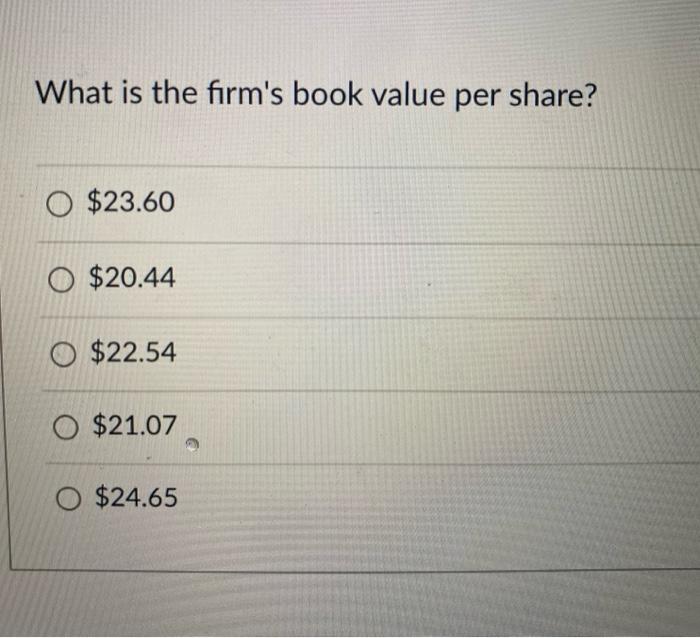

Following information applies to the following questions. The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started