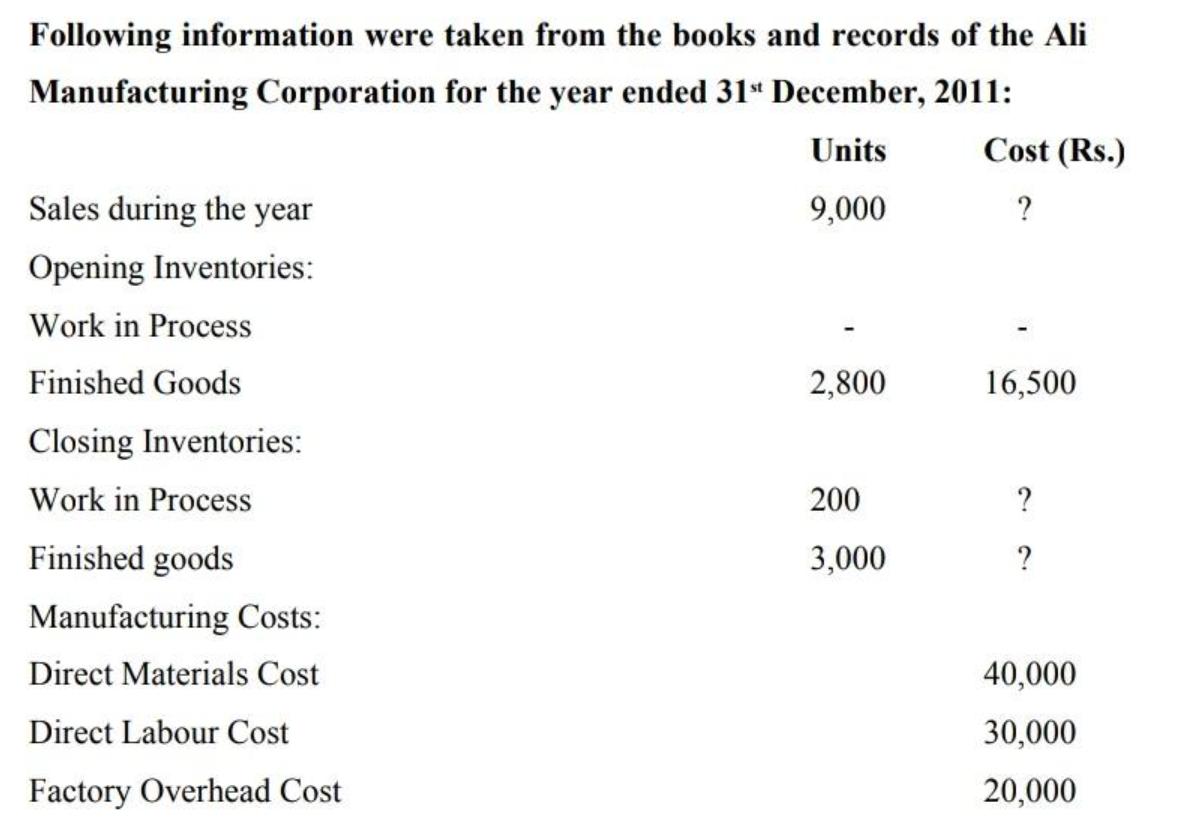

Following information were taken from the books and records of the Ali Manufacturing Corporation for the year ended 31 December, 2011: Units Cost (Rs.)

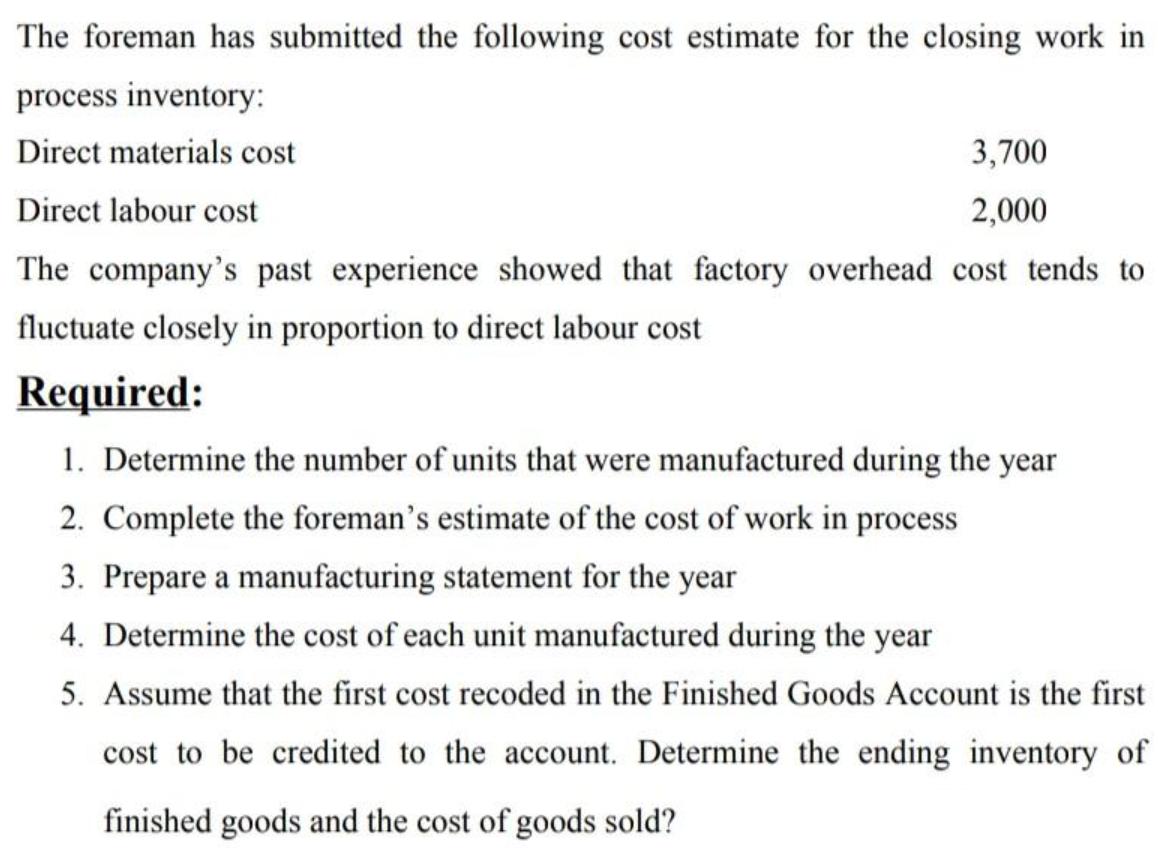

Following information were taken from the books and records of the Ali Manufacturing Corporation for the year ended 31" December, 2011: Units Cost (Rs.) Sales during the year 9,000 ? Opening Inventories: Work in Process Finished Goods 2,800 16,500 Closing Inventories: Work in Process 200 ? Finished goods 3,000 ? Manufacturing Costs: Direct Materials Cost 40,000 Direct Labour Cost 30,000 Factory Overhead Cost 20,000 The foreman has submitted the following cost estimate for the closing work in process inventory: Direct materials cost 3,700 Direct labour cost 2,000 The company's past experience showed that factory overhead cost tends to fluctuate closely in proportion to direct labour cost Required: 1. Determine the number of units that were manufactured during the year 2. Complete the foreman's estimate of the cost of work in process 3. Prepare a manufacturing statement for the year 4. Determine the cost of each unit manufactured during the year 5. Assume that the first cost recoded in the Finished Goods Account is the first cost to be credited to the account. Determine the ending inventory of finished goods and the cost of goods sold?

Step by Step Solution

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Ali Manufacturing Corporation 1 Units Note Closing Finished goods inventory 300000 Add Units sold 90...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started