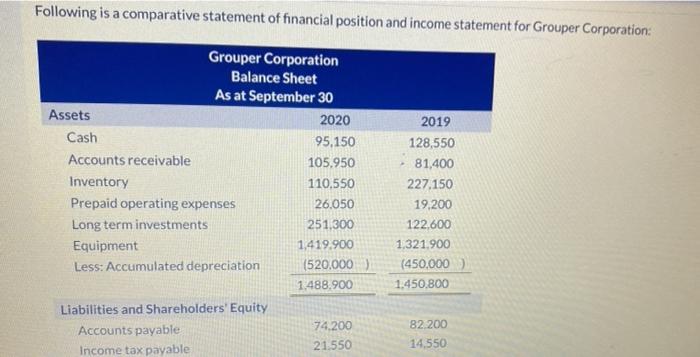

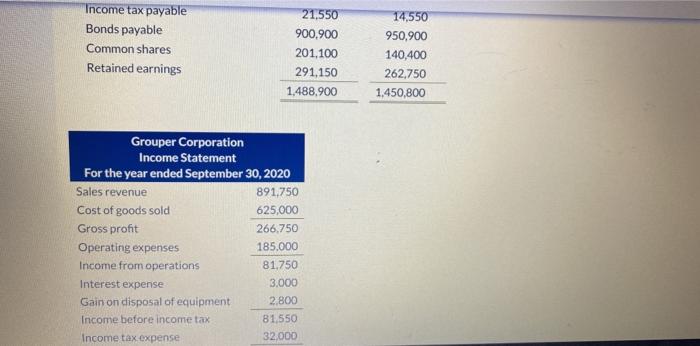

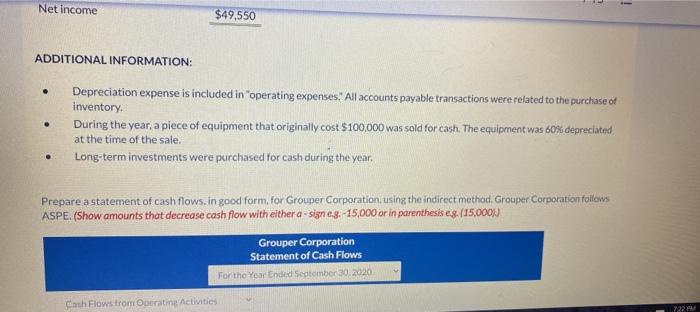

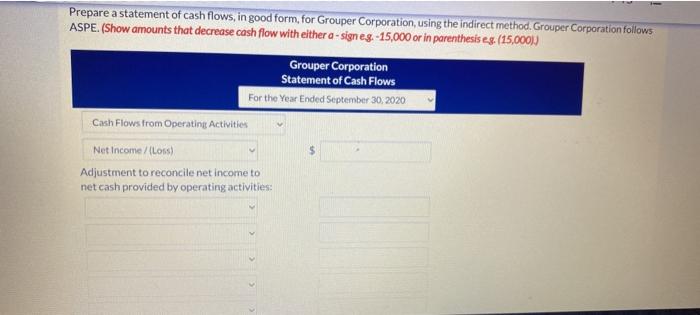

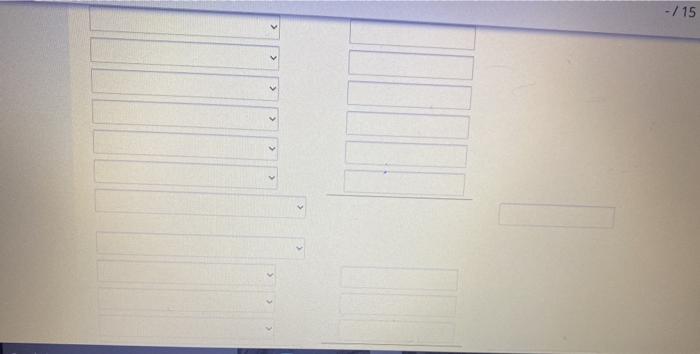

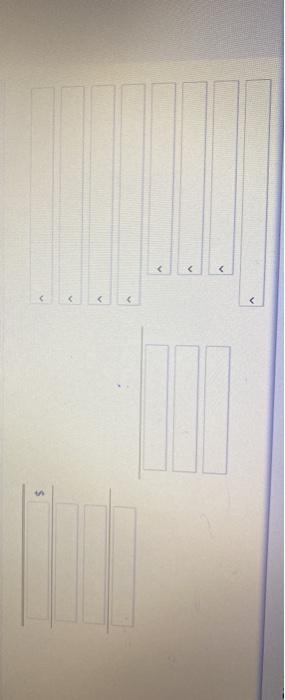

Following is a comparative statement of financial position and income statement for Grouper Corporation: Grouper Corporation Balance Sheet As at September 30 Assets 2020 Cash 95.150 Accounts receivable 105.950 Inventory 110,550 Prepaid operating expenses 26.050 Long term investments 251,300 Equipment 1,419,900 Less: Accumulated depreciation (520,000) 1.488.900 Liabilities and Shareholders' Equity 74.200 Accounts payable 21.550 Income tax payable 2019 128,550 81,400 227,150 19,200 122.600 1.321.900 (450,000 1.450.800 82 200 14.550 Income tax payable Bonds payable Common shares Retained earnings 21,550 900,900 201,100 291,150 1.488.900 14,550 950,900 140,400 262,750 1.450,800 Grouper Corporation Income Statement For the year ended September 30, 2020 Sales revenue 891,750 Cost of goods sold 625,000 Gross profit 266.750 Operating expenses 185.000 Income from operations 81.750 Interest expense 3.000 Gain on disposal of equipment 2.800 Income before income tax 81,550 Income tax expense 32.000 Net income $49,550 ADDITIONAL INFORMATION: Depreciation expense is included in operating expenses. All accounts payable transactions were related to the purchase of inventory During the year, a piece of equipment that originally cost $100,000 was sold for cash. The equipment was 60% depreciated at the time of the sale. Long-term investments were purchased for cash during the year. . Prepare a statement of cash flows, in good form for Grouper Corporation, using the indirect method Grouper Corporation follows ASPE(Show amounts that decrease cash flow with either a - sign 03.-15,000 or in parenthesis es. (15,0001) Grouper Corporation Statement of Cash Flows For the Year Ended September 30, 2020 Cash Flows from Operating Activities 7224 Prepare a statement of cash flows in good form, for Grouper Corporation, using the indirect method Grouper Corporation follows ASPE.(Show amounts that decrease cash flow with either a-signes. -15,000 or in parenthesis eg. (15,000)) Grouper Corporation Statement of Cash Flows For the Year Ended September 30, 2020 Cash Flows from Operating Activities Net Income /(Loss) Adjustment to reconcile net income to net cash provided by operating activities: -/15 >