Question

Following is financial information describing the six operating segments that make up Fairfield, Inc. (in thousands): Consider the following questions independently. None of the six

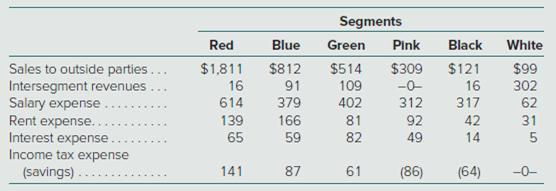

Following is financial information describing the six operating segments that make up Fairfield, Inc. (in thousands):

Consider the following questions independently. None of the six segments has a primarily financial nature.

a. What minimum revenue amount must any one segment generate to be of significant size to require disaggregated disclosure?

b. If only Red, Blue, and Green necessitate separate disclosure, is Fairfield disclosing disaggregated data for enough segments?

c. What volume of revenues must a single customer generate to necessitate disclosing the existence of a major customer?

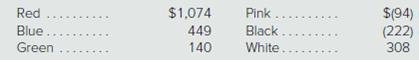

d. If each of these six segments has a profit or loss (in thousands) as follows, which warrants separate disclosure?

Segments Red Blue Green Pink Black White Sales to outside parties... Intersegment revenues Salary expense. Rent expense. Interest expense Income tax expense $1,811 $812 91 $514 $309 $121 $99 16 109 -0- 16 302 614 379 166 402 312 317 62 139 81 92 42 31 65 59 82 49 14 5 (savings). 141 87 61 (86) (64) -0-

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started