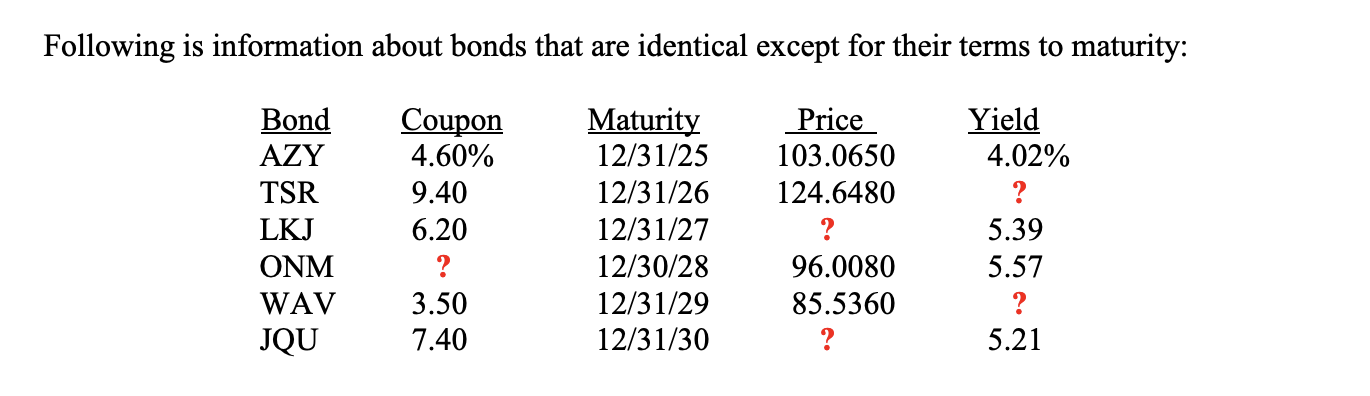

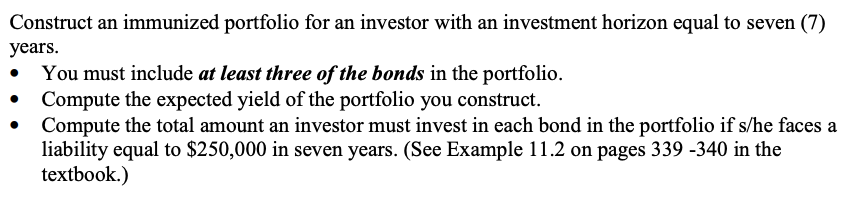

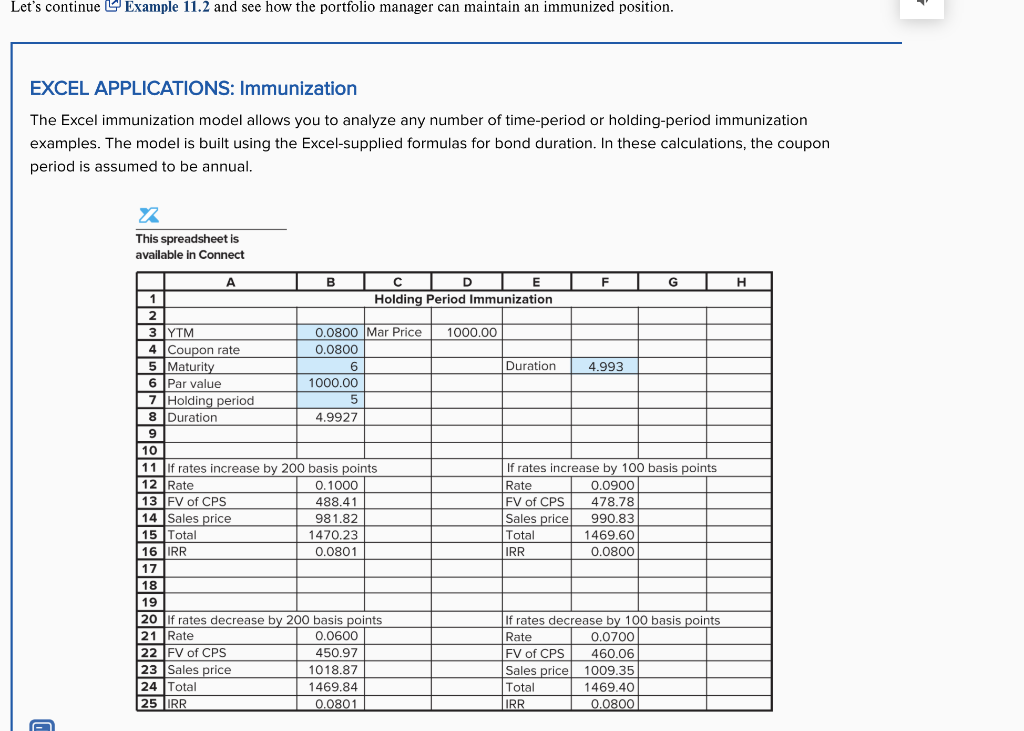

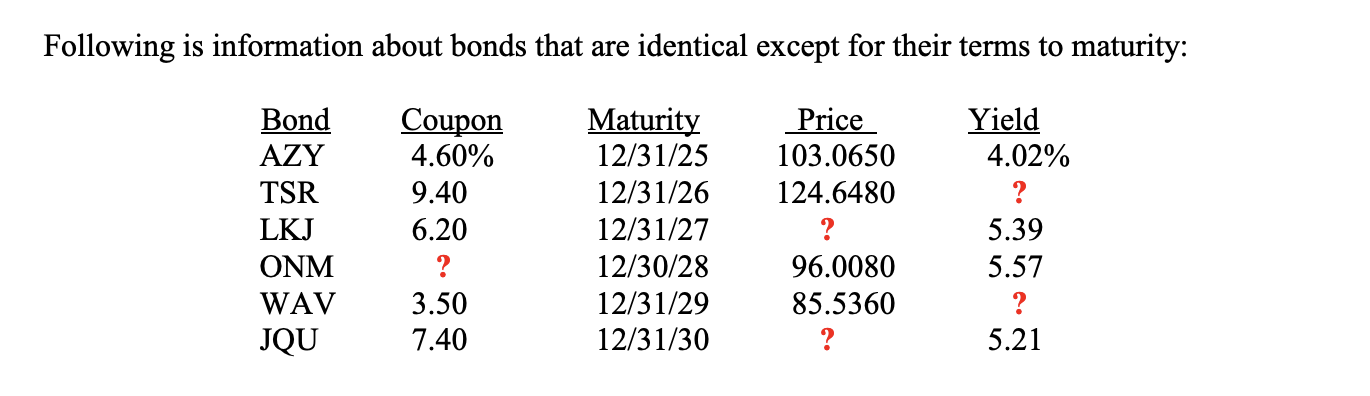

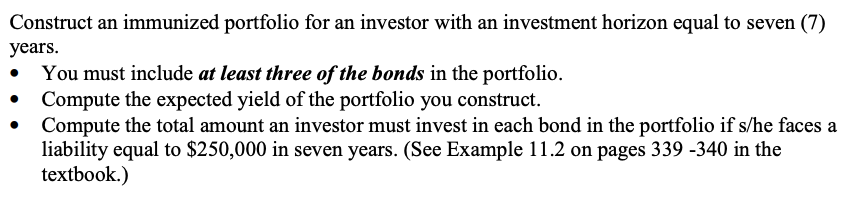

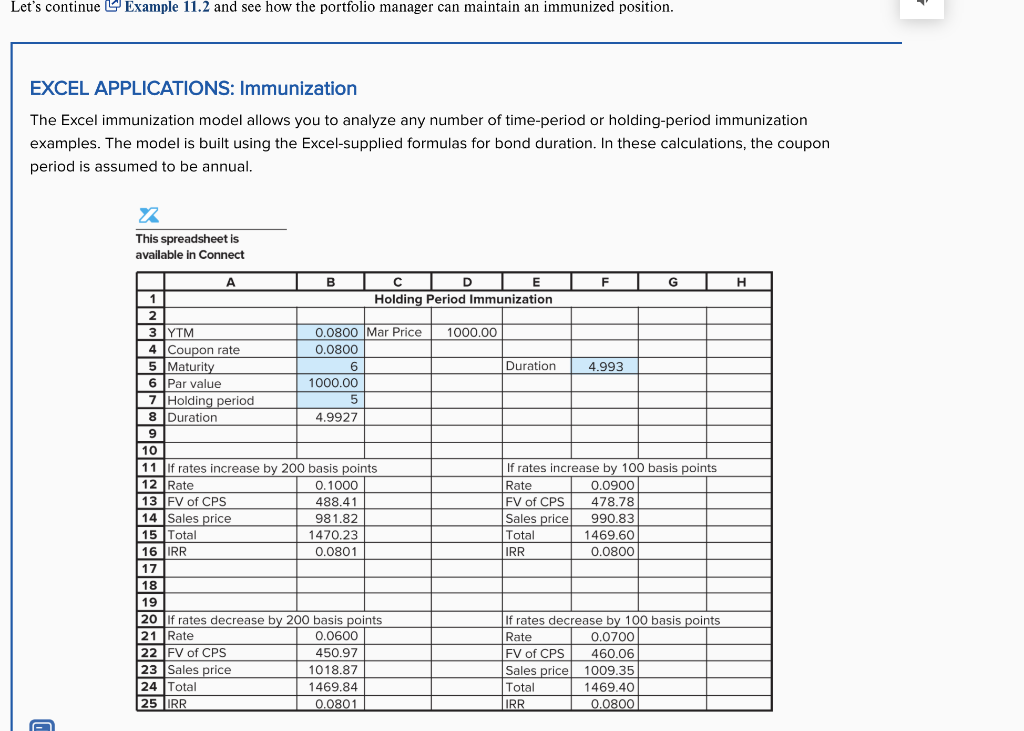

Following is information about bonds that are identical except for their terms to maturity: Price 103.0650 124.6480 Yield 4.02% Bond AZY TSR LKJ ONM WAV JQU Coupon 4.60% 9.40 6.20 ? 3.50 Maturity 12/31/25 12/31/26 12/31/27 12/30/28 12/31/29 12/31/30 96.0080 85.5360 5.39 5.57 ? 5.21 7.40 Construct an immunized portfolio for an investor with an investment horizon equal to seven (7) years. You must include at least three of the bonds in the portfolio. Compute the expected yield of the portfolio you construct. Compute the total amount an investor must invest in each bond in the portfolio if s/he faces a liability equal to $250,000 in seven years. (See Example 11.2 on pages 339-340 in the textbook.) Let's continue Example 11.2 and see how the portfolio manager can maintain an immunized position. EXCEL APPLICATIONS: Immunization The Excel immunization model allows you to analyze any number of time-period or holding-period immunization examples. The model is built using the Excel-supplied formulas for bond duration. In these calculations, the coupon period is assumed to be annual. > This spreadsheet is available in Connect A | B | | F | G | H C | D | E Holding Period Immunization 2 1000.00 Duration 4.993 3 YTM 0.0800 Mar Price 4 Coupon rate 0.0800 5 Maturity 6 Par value 1000.00 7 Holding period 8 Duration 4.9927 9 10 11 If rates increase by 200 basis points 12 Rate 0.1000 13 FV of CPS 488.41 14 Sales price 981.82 15 Total 1470.23 16 IRR 0.0801 17 If rates increase by 100 basis points Rate 0.0900 FV of CPS 478.78 Sales price 990.83 Total 1469.60 IRR 0.0800 18 19 20 If rates decrease by 200 basis points 21 Rate 0.0600 22 FV of CPS 450.97 23 Sales price 1018.87 24 Total 1469.84 25 IRR 0.0801 If rates decrease by 100 basis points Rate | 0.0700 FV of CPS 460.06 Sales price 1009.35 Total 1469.40 IRR 0.0800 Following is information about bonds that are identical except for their terms to maturity: Price 103.0650 124.6480 Yield 4.02% Bond AZY TSR LKJ ONM WAV JQU Coupon 4.60% 9.40 6.20 ? 3.50 Maturity 12/31/25 12/31/26 12/31/27 12/30/28 12/31/29 12/31/30 96.0080 85.5360 5.39 5.57 ? 5.21 7.40 Construct an immunized portfolio for an investor with an investment horizon equal to seven (7) years. You must include at least three of the bonds in the portfolio. Compute the expected yield of the portfolio you construct. Compute the total amount an investor must invest in each bond in the portfolio if s/he faces a liability equal to $250,000 in seven years. (See Example 11.2 on pages 339-340 in the textbook.) Let's continue Example 11.2 and see how the portfolio manager can maintain an immunized position. EXCEL APPLICATIONS: Immunization The Excel immunization model allows you to analyze any number of time-period or holding-period immunization examples. The model is built using the Excel-supplied formulas for bond duration. In these calculations, the coupon period is assumed to be annual. > This spreadsheet is available in Connect A | B | | F | G | H C | D | E Holding Period Immunization 2 1000.00 Duration 4.993 3 YTM 0.0800 Mar Price 4 Coupon rate 0.0800 5 Maturity 6 Par value 1000.00 7 Holding period 8 Duration 4.9927 9 10 11 If rates increase by 200 basis points 12 Rate 0.1000 13 FV of CPS 488.41 14 Sales price 981.82 15 Total 1470.23 16 IRR 0.0801 17 If rates increase by 100 basis points Rate 0.0900 FV of CPS 478.78 Sales price 990.83 Total 1469.60 IRR 0.0800 18 19 20 If rates decrease by 200 basis points 21 Rate 0.0600 22 FV of CPS 450.97 23 Sales price 1018.87 24 Total 1469.84 25 IRR 0.0801 If rates decrease by 100 basis points Rate | 0.0700 FV of CPS 460.06 Sales price 1009.35 Total 1469.40 IRR 0.0800