Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following is selected data pertaining to the financial statements of Taxaruity Corp. Pretax financial income (Year 3) Tax rate (for Years 3 thru 6)

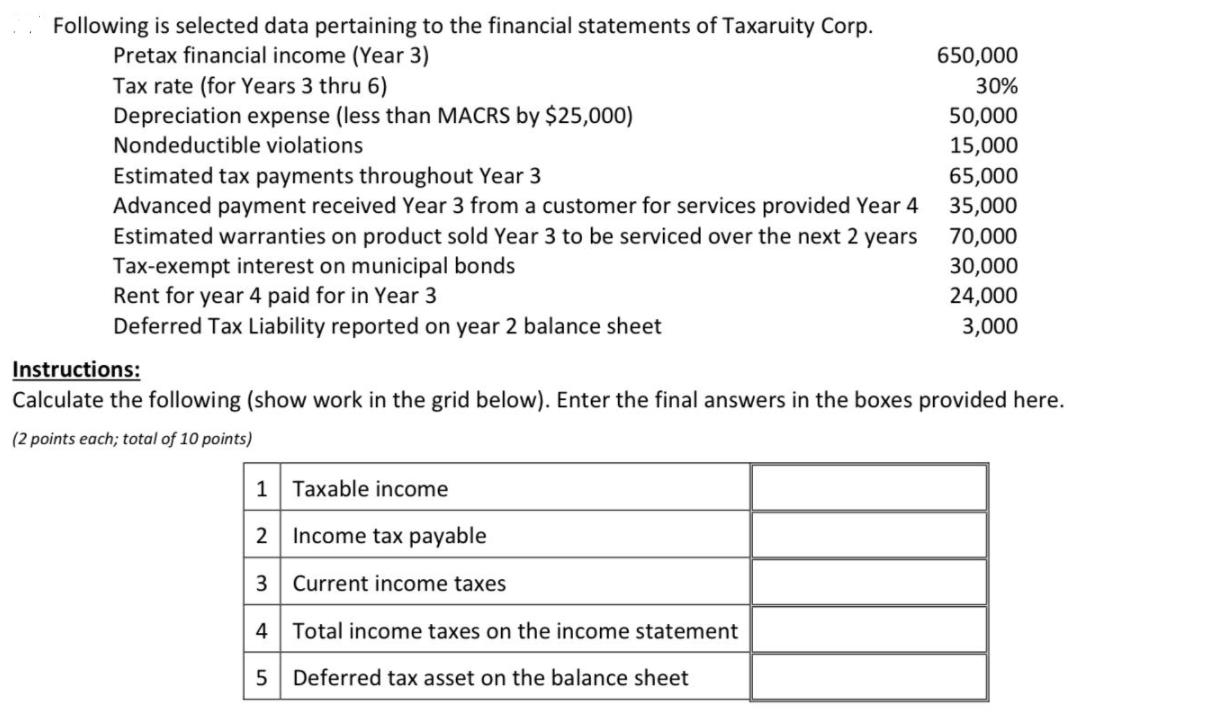

Following is selected data pertaining to the financial statements of Taxaruity Corp. Pretax financial income (Year 3) Tax rate (for Years 3 thru 6) Depreciation expense (less than MACRS by $25,000) 650,000 30% 50,000 Nondeductible violations 15,000 Estimated tax payments throughout Year 3 Advanced payment received Year 3 from a customer for services provided Year 4 Estimated warranties on product sold Year 3 to be serviced over the next 2 years Tax-exempt interest on municipal bonds Rent for year 4 paid for in Year 3 Deferred Tax Liability reported on year 2 balance sheet 65,000 35,000 70,000 30,000 24,000 3,000 Instructions: Calculate the following (show work in the grid below). Enter the final answers in the boxes provided here. (2 points each; total of 10 points) 1 Taxable income 2 Income tax payable 3 Current income taxes 4 Total income taxes on the income statement 5 Deferred tax asset on the balance sheet

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Ans 1 Taxable Income Taxable Income Formula Gross Sales Cost of Goods So...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started