Answered step by step

Verified Expert Solution

Question

1 Approved Answer

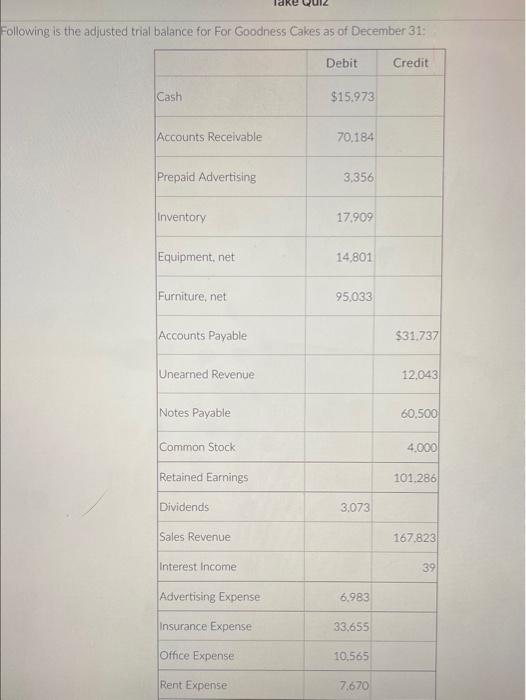

Following is the adjusted trial balance for For Goodness Cakes as of December 31: Cash Accounts Receivable Prepaid Advertising Inventory Equipment, net Furniture, net

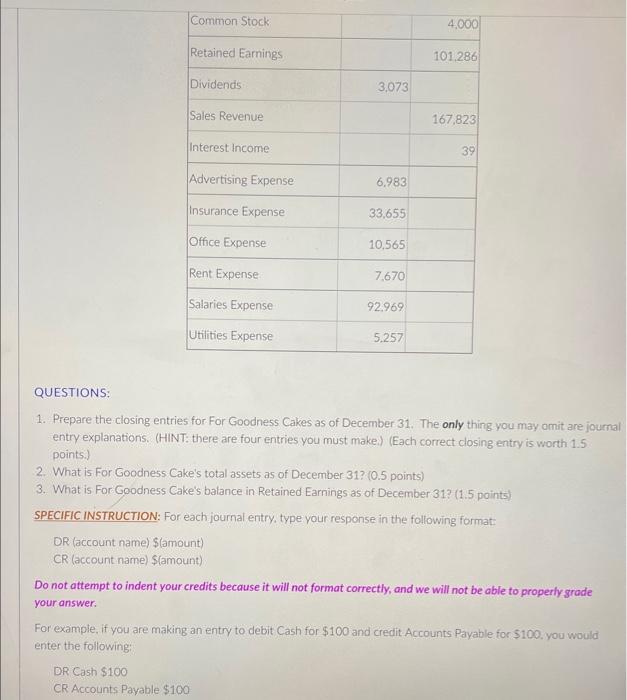

Following is the adjusted trial balance for For Goodness Cakes as of December 31: Cash Accounts Receivable Prepaid Advertising Inventory Equipment, net Furniture, net Accounts Payable Unearned Revenue Notes Payable Common Stock Retained Earnings Dividends Sales Revenue Interest Income Advertising Expense Insurance Expense Office Expense Rent Expense Debit $15,973 70,184 3,356 17.909 14,801 95,033 3.073 6,983 33.655 10,565 7,670 Credit $31.737 12,043 60,500 4.000 101.286 167,823 39 Common Stock Retained Earnings Dividends Sales Revenue Interest Income Advertising Expense Insurance Expense Office Expense Rent Expense Salaries Expense Utilities Expense 3,073 DR (account name) $(amount) CR (account name) $(amount) 6,983 DR Cash $100 CR Accounts Payable $100 33,655 10,565 7,670 92.969 5.257 4,000 101.286 167,823 QUESTIONS: 1. Prepare the closing entries for For Goodness Cakes as of December 31. The only thing you may omit are journal entry explanations. (HINT: there are four entries you must make.) (Each correct closing entry is worth 1.5 points.) 39 2. What is For Goodness Cake's total assets as of December 31? (0.5 points) 3. What is For Goodness Cake's balance in Retained Earnings as of December 31? (1.5 points) SPECIFIC INSTRUCTION: For each journal entry, type your response in the following format: Do not attempt to indent your credits because it will not format correctly, and we will not be able to properly grade your answer. For example, if you are making an entry to debit Cash for $100 and credit Accounts Payable for $100, you would enter the following:

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started