FOLLOWING IS THE DATA

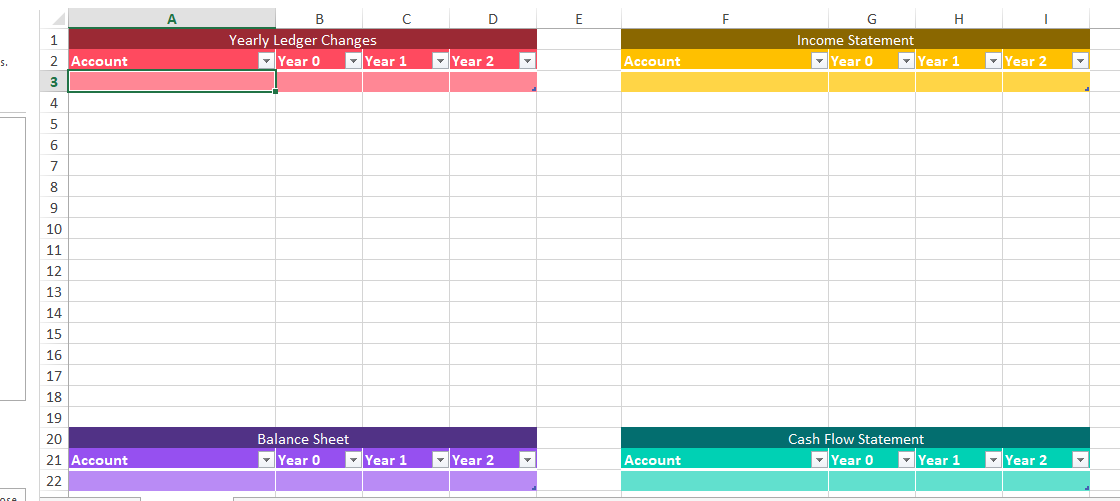

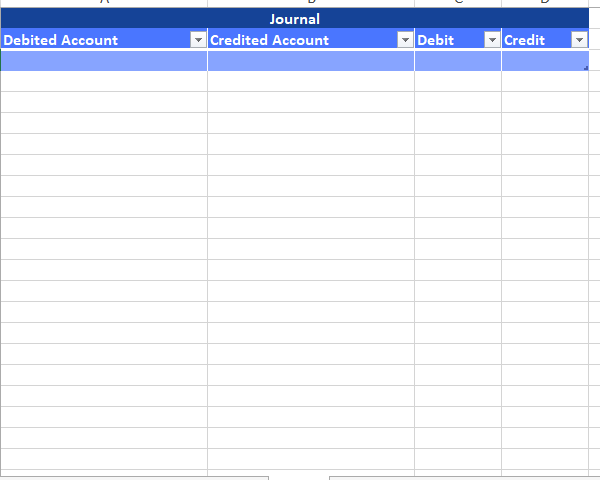

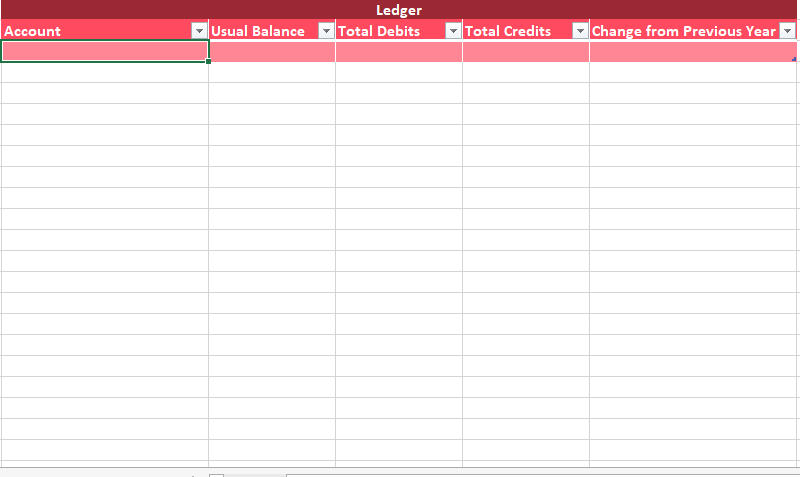

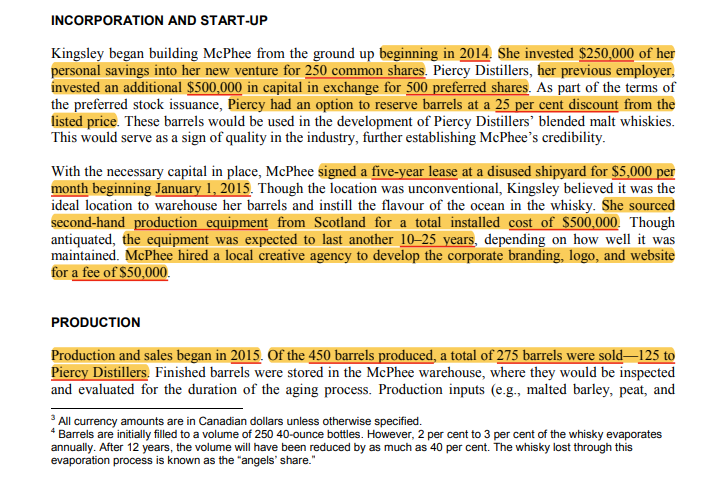

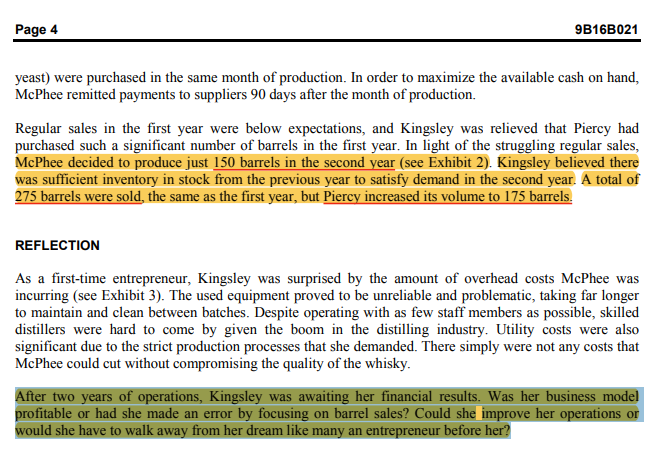

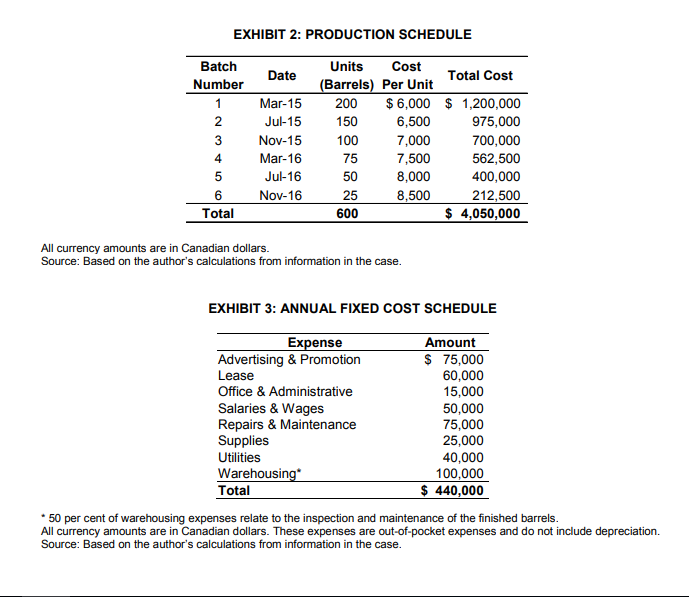

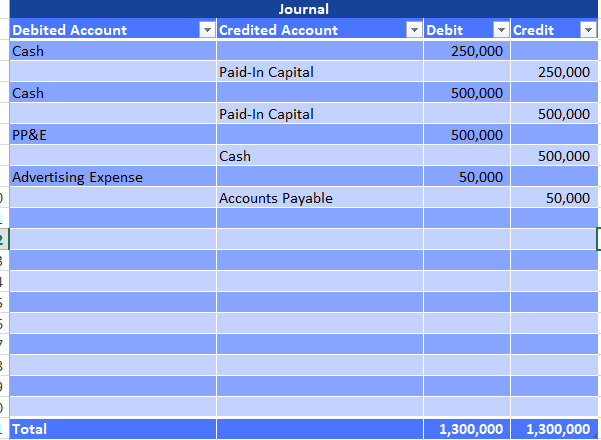

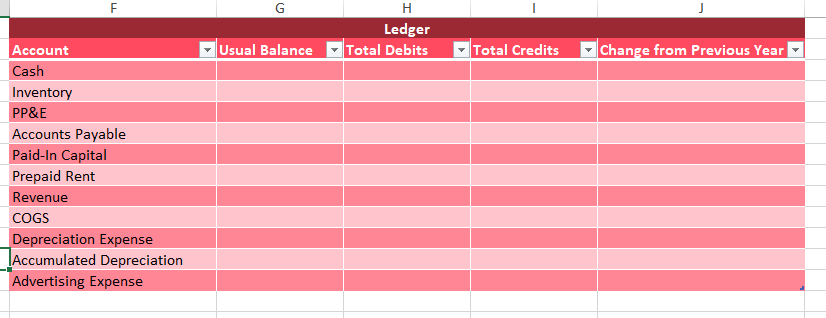

A B C D E F G H N P Yearly Ledger Changes Income Statement Account Year 0 Year 1 Year 2 Account Year 0 Year 1 Year 2 LD 00 1 U 11 12 13 14 15 16 17 18 19 20 Balance Sheet Cash Flow Statement 21 Account Year 0 * Year 1 * Year 2 Account Year 0 * Year 1 * Year 2 Y 22\fLedger Account Usual Balance Total Debits Total Credits Change from Previous YearINCORPORATION AND START-UP Kingsley began building Mcphee from the ground up beginning in 2014. She invested $250,000 of her personal savings into her new venture for 250 common shares. Piercy Distillers, her previous employer, invested an additional $500,000 in capital in exchange for 500 preferred shares. As part of the terms of the preferred stock issuance, Piercy had an option to reserve barrels at a 25 per cent discount from the listed price. These barrels would be used in the development of Piercy Distillers' blended malt whiskies. This would serve as a sign of quality in the industry, further establishing Mcphee's credibility. With the necessary capital in place, Mcphee signed a five-year lease at a disused shipyard for $5,000 per month beginning January 1, 2015. Though the location was unconventional, Kingsley believed it was the ideal location to warehouse her barrels and instill the flavour of the ocean in the whisky. She sourced second-hand production equipment from Scotland for a total installed cost of $500,000. Though antiquated, the equipment was expected to last another 10-25 years, depending on how well it was maintained. Mcphee hired a local creative agency to develop the corporate branding, logo, and website for a fee of $50,000 PRODUCTION Production and sales began in 2015. Of the 450 barrels produced, a total of 275 barrels were sold-125 to Piercy Distillers. Finished barrels were stored in the Mcphee warehouse, where they would be inspected and evaluated for the duration of the aging process. Production inputs (e.g., malted barley, peat, and All currency amounts are in Canadian dollars unless otherwise specified. *Barrels are initially filled to a volume of 250 40-ounce bottles. However, 2 per cent to 3 per cent of the whisky evaporates annually. After 12 years, the volume will have been reduced by as much as 40 per cent. The whisky lost through this evaporation process is known as the *angels' share."Page 4 9B168021 yeast) were purchased in the same month of production. In order to maximize the available cash on hand, Mcphee remitted payments to suppliers 90 days after the month of production. Regular sales in the first year were below expectations, and Kingsley was relieved that Piercy had purchased such a significant number of barrels in the first year. In light of the struggling regular sales, Mcphee decided to produce just 150 barrels in the second year (see Exhibit 2). Kingsley believed there was sufficient inventory in stock from the previous year to satisfy demand in the second year. A total of 275 barrels were sold, the same as the first year, but Piercy increased its volume to 175 barrels. REFLECTION As a first-time entrepreneur, Kingsley was surprised by the amount of overhead costs Mcphee was incurring (see Exhibit 3). The used equipment proved to be unreliable and problematic, taking far longer to maintain and clean between batches. Despite operating with as few staff members as possible, skilled distillers were hard to come by given the boom in the distilling industry. Utility costs were also significant due to the strict production processes that she demanded. There simply were not any costs that Mcphee could cut without compromising the quality of the whisky. After two years of operations, Kingsley was awaiting her financial results. Was her business model profitable or had she made an error by focusing on barrel sales? Could she improve her operations or would she have to walk away from her dream like many an entrepreneur before her?EXHIBIT 2: PRODUCTION SCHEDULE Batch Date Units Cost Number (Barrels) Per Unit Total Cost Mar-15 200 $ 6,000 $ 1,200,000 Jul-15 150 6,500 975,000 Nov-15 100 7,000 700,000 Mar-16 75 7,500 562,500 Jul-16 50 8,000 400,000 Nov-16 25 8,500 212,500 Total 600 $ 4,050,000 All currency amounts are in Canadian dollars. Source: Based on the author's calculations from information in the case. EXHIBIT 3: ANNUAL FIXED COST SCHEDULE Expense Amount Advertising & Promotion $ 75,000 Lease 60,000 Office & Administrative 15,000 Salaries & Wages 50,000 Repairs & Maintenance 75,000 Supplies 25,000 Utilities 40,000 Warehousing" 100,000 Total $ 440,000 *50 per cent of warehousing expenses relate to the inspection and maintenance of the finished barrels. All currency amounts are in Canadian dollars. These expenses are out-of-pocket expenses and do not include depreciation. Source: Based on the author's calculations from information in the case.Journal Debited Account Credited Account Debit Credit Cash 250,000 Paid-In Capital 250,000 Cash 500,000 Paid-In Capital 500,000 PP&E 500,000 Cash 500,000 Advertising Expense 50,000 Accounts Payable 50,000 Total 1,300,000 1,300,000F G H Ledger Account Usual Balance Total Debits Total Credits Change from Previous Year Cash Inventory PP&E Accounts Payable Paid-In Capital Prepaid Rent Revenue COGS Depreciation Expense Accumulated Depreciation Advertising Expense