Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following Receipt and Payment Account was prepared from the cash book of Delhi Charitable Trust for the year ending December 31, 2017 Receipts Balance

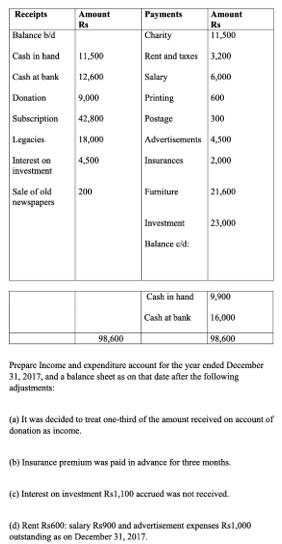

Following Receipt and Payment Account was prepared from the cash book of Delhi Charitable Trust for the year ending December 31, 2017 Receipts Balance bid Cash in hand Cash at bank Donation Subscription Legacies Interest on investment Sale of old newspapers Amount Rs 11,500 12,600 9,000 42,800 18,000 4,500 200 98,600 Payments Charity Rent and taxes Salary Printing Postage Advertisements 4,500 2,000 Insurances Furniture Investment Balance old: Amount Rs 11,500 3,200 6,000 600 300 Cash in hand Cash at bank 21,600 23,000 9,900 16,000 98,600 Prepare Income and expenditure account for the year ended December 31, 2017, and a balance sheet as on that date after the following adjustments: (a) It was decided to treat one-third of the amount received on account of donation as income. (b) Insurance premium was paid in advance for three months. (c) Interest on investment Rs1,100 accrued was not received. (d) Rent Rs600: salary R$900 and advertisement expenses Rs1,000 outstanding as on December 31, 2017.

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started