Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following the 4-step approach of preparation of a statement of cash flows to prepare the 2020 statement of cash flows for Newport. Clearly mark each

- Following the 4-step approach of preparation of a statement of cash flows to prepare the 2020 statement of cash flows for Newport. Clearly mark each step. For Step #4, using the indirect method for the operating activities. What additional information should Newport disclose if the indirect method is used for the statement of cash flows?

- Prepare the operating activities portion of the statement of cash flows using the direct method and the analysis in Part 2. What additional information should Newport disclose if the direct method statement of cash flows is reported?

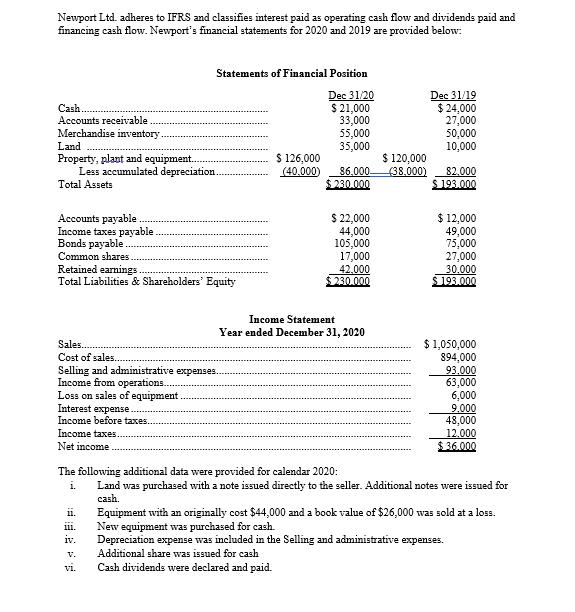

Newport Ltd. adheres to IFRS and classifies interest paid as operating cash flow and dividends paid and financing cash flow. Newport's financial statements for 2020 and 2019 are provided below: Cash. Accounts receivable Merchandise inventory. Land Property, plant and equipment.. Total Assets Accounts payable. Income taxes payable Bonds payable. Less accumulated depreciation. Common shares. Retained earnings Total Liabilities & Shareholders' Equity Interest expense Income before taxes.. Income taxes.. Net income Statements of Financial Position Dec 31/20 $ 21,000 33,000 55,000 35,000 Sales... Cost of sales. Selling and administrative expenses. Income from operations.... Loss on sales of equipment 11. 111. iv. V. vi. $ 126,000 (40,000) 86,000 $ 230.000 $ 22,000 44,000 105,000 17,000 42,000 $ 230.000 Income Statement Year ended December 31, 2020 $ 120,000 (38,000) Dec 31/19 $ 24,000 27,000 50,000 10,000 82,000 $ 193.000 $ 12,000 49,000 75,000 27,000 30,000 $ 193.000 The following additional data were provided for calendar 2020: i. Land was purchased with a note issued directly to the seller. Additional notes were issued for cash. $ 1,050,000 894,000 93.000 63,000 6,000 9.000 48,000 12,000 $36.000 Equipment with an originally cost $44,000 and a book value of $26,000 was sold at a loss. New equipment was purchased for cash. Depreciation expense was included in the Selling and administrative expenses. Additional share was issued for cash Cash dividends were declared and paid.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

ATTACHED IMAGE NEWPORT LTD CASH FLOW FROM OPERATING ACTIVITIES INDIRECT METHOD FOR THE YEAR ENDING 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started