Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following the death of Parman, a resident trust body known as PAMA Trust was established by his family lawyer, Hanif who acts as trustee.

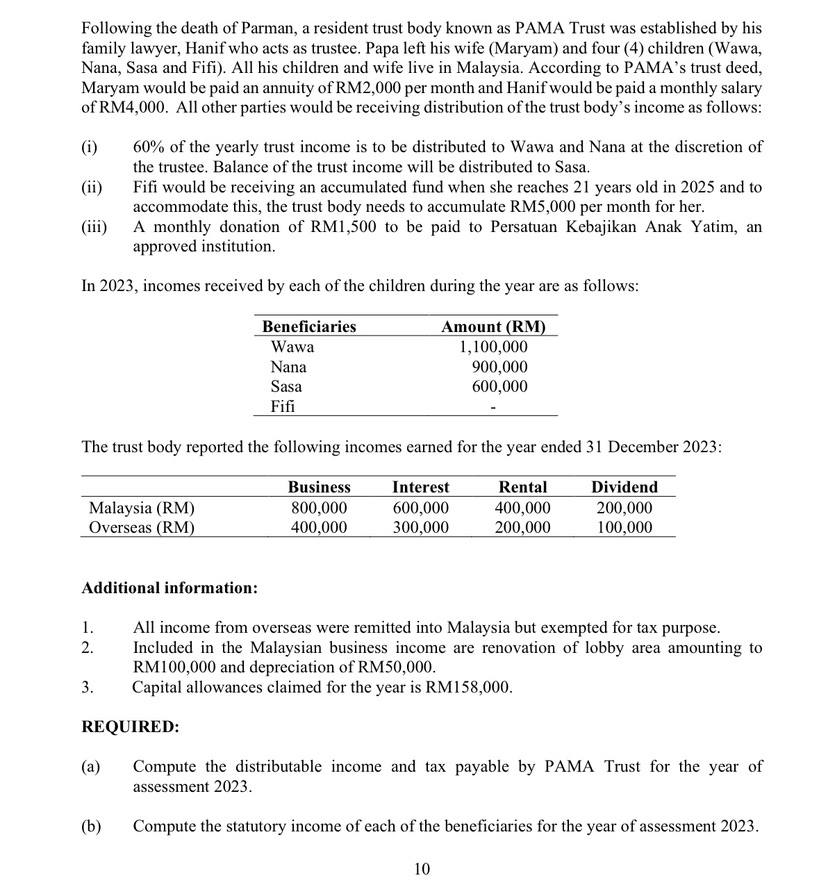

Following the death of Parman, a resident trust body known as PAMA Trust was established by his family lawyer, Hanif who acts as trustee. Papa left his wife (Maryam) and four (4) children (Wawa, Nana, Sasa and Fifi). All his children and wife live in Malaysia. According to PAMA's trust deed, Maryam would be paid an annuity of RM2,000 per month and Hanif would be paid a monthly salary of RM4,000. All other parties would be receiving distribution of the trust body's income as follows: (i) (ii) (iii) Fifi would be receiving an accumulated fund when she reaches 21 years old in 2025 and to accommodate this, the trust body needs to accumulate RM5,000 per month for her. A monthly donation of RM1,500 to be paid to Persatuan Kebajikan Anak Yatim, an approved institution. In 2023, incomes received by each of the children during the year are as follows: Beneficiaries Amount (RM) 1,100,000 Wawa Nana 900,000 Sasa 600,000 Fifi The trust body reported the following incomes earned for the year ended 31 December 2023: Interest Rental 600,000 400,000 300,000 200,000 Malaysia (RM) Overseas (RM) 60% of the yearly trust income is to be distributed to Wawa and Nana at the discretion of the trustee. Balance of the trust income will be distributed to Sasa. Additional information: 1. 2. 3. (a) REQUIRED: (b) Business 800,000 400,000 All income from overseas were remitted into Malaysia but exempted for tax purpose. Included in the Malaysian business income are renovation of lobby area amounting to RM100,000 and depreciation of RM50,000. Capital allowances claimed for the year is RM158,000. Dividend 200,000 100,000 Compute the distributable income and tax payable by PAMA Trust for the year of assessment 2023. Compute the statutory income of each of the beneficiaries for the year of assessment 2023. 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To compute the distributable income and tax payable by PAMA Trust for the year of assessment 2023 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started