Question

Following were the financial statement of SINO Berhad provided: SINO Berhad Statement of financial position as at 30 June 2021 2020 RM'000 RM'000 Non-current assets

Following were the financial statement of SINO Berhad provided:

| SINO Berhad

Statement of financial position as at 30 June | ||

|

| 2021 | 2020 |

|

| RM'000 | RM'000 |

|

|

|

|

| Non-current assets |

|

|

| Property, plant and equipment | 19,500 | 12,510 |

| Investments (3 years) | 1,035 | 1,020 |

|

|

|

|

|

| 20,535 | 13,530 |

| Current assets |

|

|

|

|

| |

| Inventories | 3,690 | 1,920 |

| Trade receivables | 6,900 | 5,295 |

| Investment (9 months) | - | 300 |

| Cash | 3,150 | 1,455 |

|

|

|

|

|

| 13,740 | 8,970 |

| Current liabilities |

|

|

|

|

| |

| Trade payables | 3,660 | 4,665 |

| Bank overdraft | 6,555 | 3,105 |

| Tax payable | 75 | - |

|

|

|

|

|

| (10,290) | (7,770) |

| Non-current liabilities |

|

|

|

|

| |

| Debentures | (11,340) | (8,325) |

|

|

|

|

| Net Assets | 12,645 | 6,405 |

| EQUITY |

|

|

|

|

| |

|

|

| |

| Capital and reserves |

|

|

| Share capital | 10,905 | 6,015 |

| Retained profits | 1,740 | 390 |

|

|

|

|

|

| 12,645 | 6,405 |

|

|

|

|

1. General and administrative costs are represented by depreciation RM435,000 and other operating expenses of RM1,290,000.

2. The short-term investment is not considered as cash equivalents and it was disposed of at a profit of RM75,000.

3. Dividends paid during the year were RM735,000.

In accordance with MFRS107(IAS 7) Statement of cashflow, required:

- Prepare Statement of cashflow for the year ended 31 December 2021 using the indirect method.

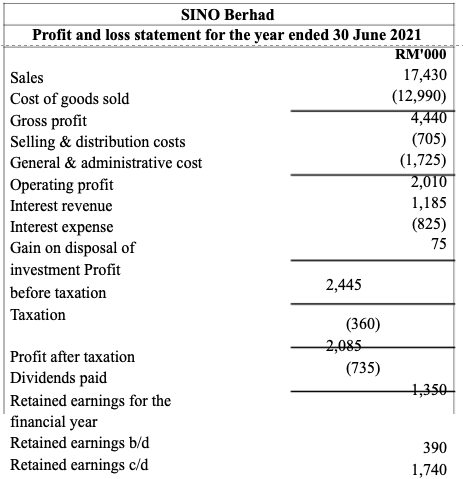

SINO Berhad Profit and loss statement for the year ended 30 June 2021 RM'000 Sales 17,430 Cost of goods sold (12,990) Gross profit 4,440 Selling & distribution costs (705) General & administrative cost (1,725) Operating profit 2,010 Interest revenue 1,185 Interest expense (825) Gain on disposal of 75 investment Profit before taxation 2,445 Taxation (360) 2,085 Profit after taxation (735) Dividends paid 1,350 Retained earnings for the financial year Retained earnings b/d 390 Retained earnings c/d 1,740

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started