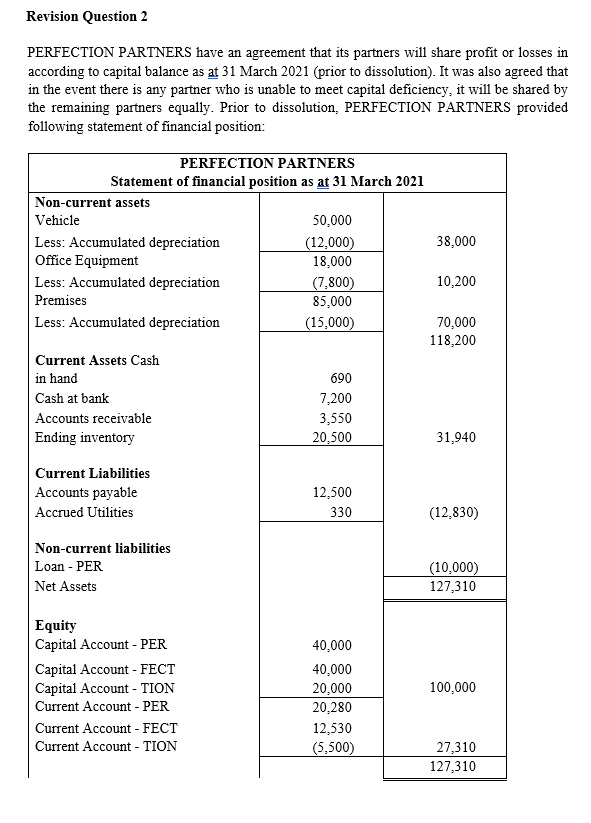

Question

Following were the terms agreed by partners upon dissolution: i. Dissolution cost was incurred and paid. Details of the dissolution cost are legal fees $900,

Following were the terms agreed by partners upon dissolution:

i. Dissolution cost was incurred and paid. Details of the dissolution cost are legal fees $900, Valuer fees $1,100 and other miscellaneous cost $300.

ii. Partner PER decided to take over the vehicle at a loss of $3,000 and partner FECT decided to take over office equipment at a loss of $1,000. However, premises were sold to local government for $85,000.

iii. Due to immediate dissolution, business was only able to recover 50% of the outstanding with remaining 50% will be written off.

- Inventory was sold for at net realizable value 75% of cost.

- All accounts payable was fully settled with 10% discount. All other liabilities were fully settled.

- All payment and receipts were made through bank account. All cash in hand were transferred to bank account at the beginning of dissolution process.

Required:

- Prepare a realization account.

- Prepare capital account of partners.

- Prepare bank account.

- Due to COVID-19 pandemic, most partnership businesses are struggling to survive. This has led to dissolution of the business. One of the causes for dissolution is a partner has been declared bankrupt. Briefly explain how this partners capital deficiency will be recovered.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started