Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following your team's financial evaluation (NPV) of Proposal 1 (winery in China) and Proposal 2 (luxury resort), which project would you recommend? Show your

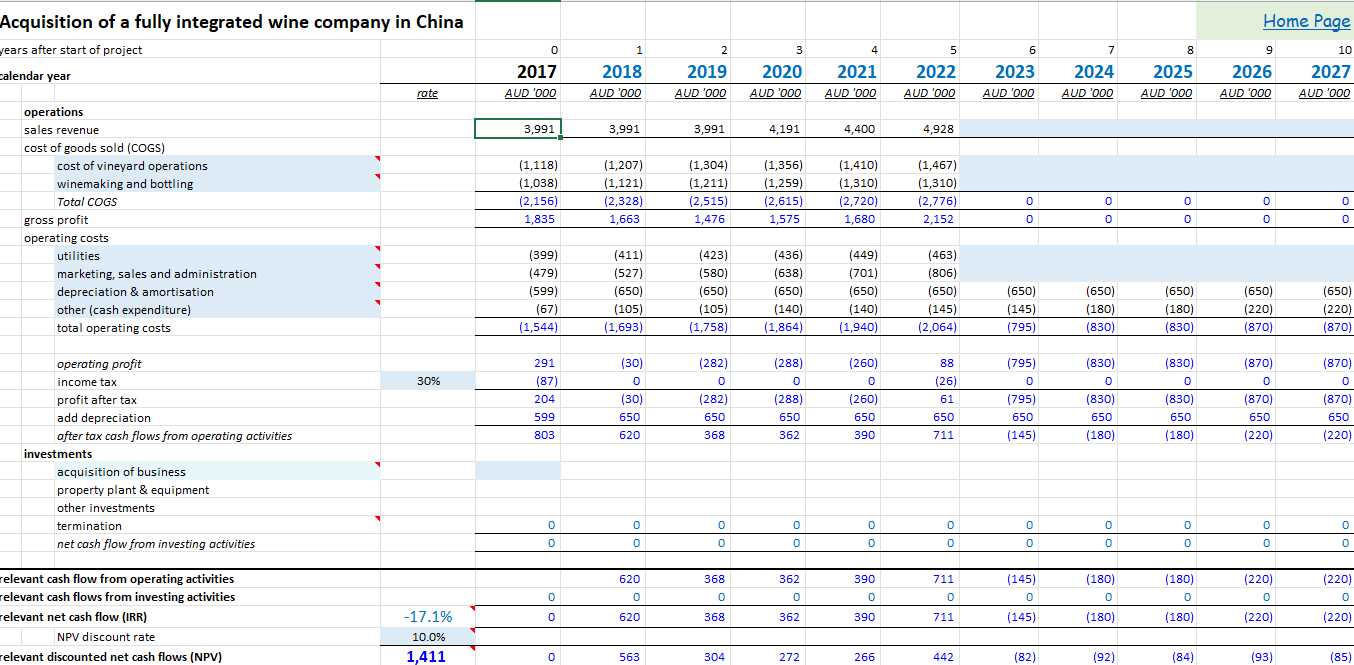

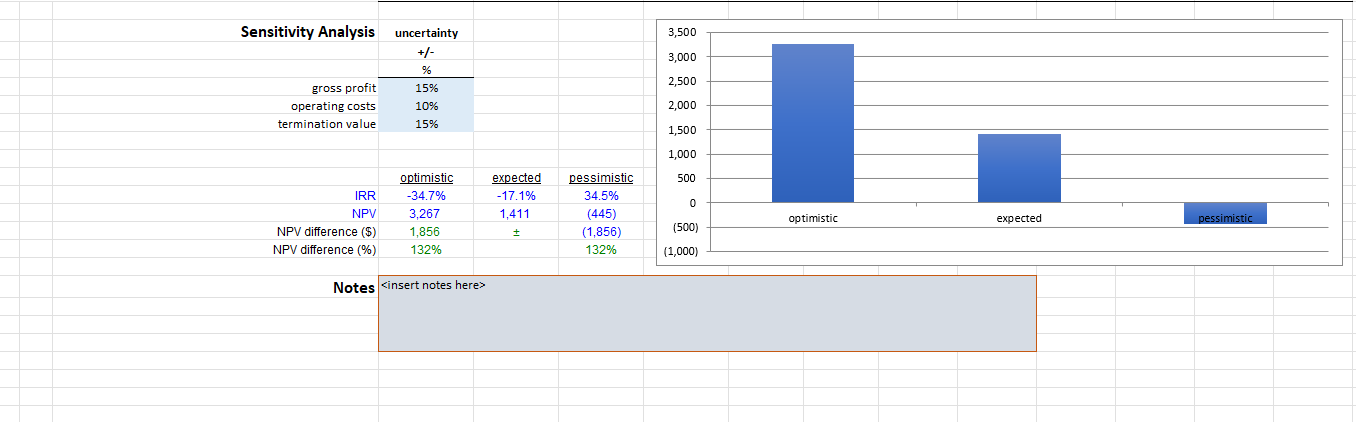

Following your team's financial evaluation (NPV) of Proposal 1 (winery in China) and Proposal 2 (luxury resort), which project would you recommend? Show your calculations by placing screenshots of your team's completed NPV analysis (Steps 1 and 2 of the SIAM template) in the Kilgors simulation - one for Proposal 1 and another one for Proposal 2 in the answer box provided for Question 1 in your team's Assessment 2 Part B Team Answer Booklet (see blank sample image below). folio of haury holiday resorts and hotale Home Page 2 2017 2018 2019 2020 2021 2022 2025 2024 2025 2026 2027 M Acquisition of a fully integrated wine company in China years after start of project calendar year operations sales revenue cost of goods sold (COGS) cost of vineyard operations winemaking and bottling Total COGS gross profit operating costs utilities marketing, sales and administration depreciation & amortisation other (cash expenditure) total operating costs operating profit income tax profit after tax add depreciation after tax cash flows from operating activities investments acquisition of business property plant & equipment other investments termination net cash flow from investing activities relevant cash flow from operating activities relevant cash flows from investing activities relevant net cash flow (IRR) NPV discount rate relevant discounted net cash flows (NPV) 0 1 2 3 4 5 6 7 8 2017 2018 2019 2020 2021 2022 2023 2024 2025 rate AUD '000 AUD'000 AUD '000 AUD'000 AUD '000 AUD'000 AUD '000 AUD'000 AUD '000 2026 AUD '000 Home Page 9 10 2027 AUD'000 3,991 3,991 3,991 4,191 4,400 4,928 (1,118) (1,207) (1,304) (1,356) (1,410) (1,467) (1,038) (1,121) (1,211) (1,259) (1,310) (1,310) (2,156) (2,328) (2,515) (2,615) (2,720) (2,776) 0 0 0 1,835 1,663 1,476 1,575 1,680 2,152 0 0 0 0 0 0 (399) (411) (423) (436) (449) (463) (479) (527) (580) (638) (701) (806) (599) (650) (650) (650) (650) (650) (650) (650) (650) (650) (650) (67) (105) (105) (140) (140) (145) (145) (180) (180) (220) (220) (1,544) (1,693) (1,758) (1,864) (1,940) (2,064) (795) (830) (830) (870) (870) 291 (30) (282) (288) (260) 88 (795) (830) (830) (870) (870) 30% (87) 0 0 0 0 (26) 0 0 0 0 0 204 (30) (282) (288) (260) 61 (795) (830) (830) (870) 599 650 650 650 650 650 650 650 650 803 620 368 362 390 711 (145) (180) (180) 650 (220) (870) 650 (220) 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 620 368 362 390 711 (145) (180) (180) (220) (220) 0 0 0 0 0 0 0 0 0 0 0 -17.1% 0 620 368 362 390 711 (145) (180) (180) (220) (220) 10.0% 1,411 0 563 304 272 266 442 (82) (92) (84) (93) (85) Sensitivity Analysis uncertainty 3,500 +/- 3,000 % gross profit 15% operating costs 10% termination value 15% 2,500 2,000 1,500 1,000 optimistic IRR -34.7% NPV 3,267 expected pessimistic -17.1% 1,411 500 34.5% 0 (445) optimistic expected pessimistic NPV difference ($) 1,856 (1,856) (500) NPV difference (%) 132% 132% (1,000) Notes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started