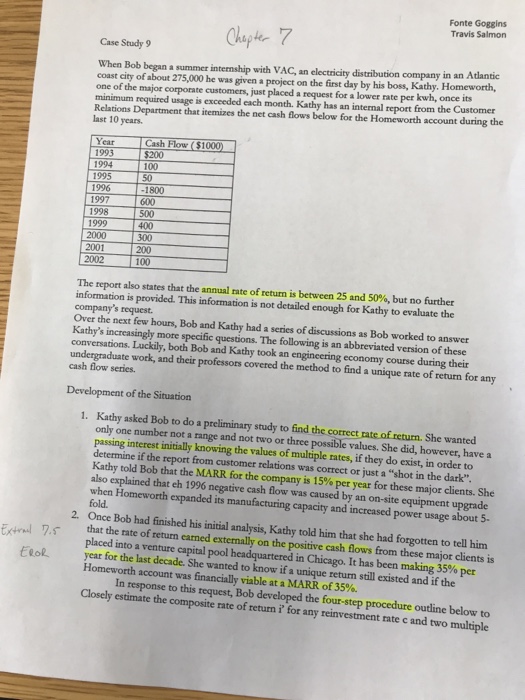

Fonte Goggins Travis Salmon Case Study 9 When Bob began a summer internship with VAC, an electricity distribution company in an Adantic coast city of about 275,000 he was given a project on the first day by his boss, Kathy. Homeworth, one of the major corporate customers, just placed a request for a lower rate per kwh, once its minimum required usage is exceeded each month. Kathy has an internal report from the Customer Relations Department that itemizes the net cash flows below for the Homeworth account during the last 10 years. Year 1993 1994 1995 1996 1997 Flow $200 100 1800 600 500 400 300 200 100 1999 2000 2001 2002 The report also states that the annual rate of return is between 25 and 50%, but no further information is provided. This information is not detailed enough for Kathy to evaluate the company's request. Over the next few hours, Bob and Kathy had a series of discussions as Bob worked to answer Kathy's increasingly more specific questions. The following is an abbreviated version of these conversations. Luckily, both Bob and Kathy took an engineering economy course during their undergraduate wotk, and their professors covered the method to find a unique rate of return for any cash flow series Development of the Situation Kathy asked Bob to do a preliminary study to find the correct rate of return. She wanted only one number not a range and not two or three possible passing interest initially knowing the values of multiple rates, if they do exist, in order to determine if the report from customer relations was correct or just a "shot in the dark" Kathy told Bob that the MARR for the company is 15% per year for these major clients. She also explained that eh 1996 negative cash flow was caused by an on-site equipment upgrade fold when Homeworth expanded its manufacturing capacity and increased power usage about 5- Once Bob had finished his initial analysis, Kathy told him that she had forgotten to tell him that the rate of return earned externally on the positive cash flows from these major clients is placed into a venture capital pool headquartered in Chicago. It has been making 35% per 1. values. She did, however, have a 2. Elolyear for the last decade. She wanted to know if a unique return still existed and if the Homeworth account was financially viable at a MARR of 35%. In response to this request, Bob developed the four-step procedure ouline below to Closely estimate the composite rate of return i? for any reinvestment rate c and two multiple Fonte Goggins Travis Salmon Case Study 9 When Bob began a summer internship with VAC, an electricity distribution company in an Adantic coast city of about 275,000 he was given a project on the first day by his boss, Kathy. Homeworth, one of the major corporate customers, just placed a request for a lower rate per kwh, once its minimum required usage is exceeded each month. Kathy has an internal report from the Customer Relations Department that itemizes the net cash flows below for the Homeworth account during the last 10 years. Year 1993 1994 1995 1996 1997 Flow $200 100 1800 600 500 400 300 200 100 1999 2000 2001 2002 The report also states that the annual rate of return is between 25 and 50%, but no further information is provided. This information is not detailed enough for Kathy to evaluate the company's request. Over the next few hours, Bob and Kathy had a series of discussions as Bob worked to answer Kathy's increasingly more specific questions. The following is an abbreviated version of these conversations. Luckily, both Bob and Kathy took an engineering economy course during their undergraduate wotk, and their professors covered the method to find a unique rate of return for any cash flow series Development of the Situation Kathy asked Bob to do a preliminary study to find the correct rate of return. She wanted only one number not a range and not two or three possible passing interest initially knowing the values of multiple rates, if they do exist, in order to determine if the report from customer relations was correct or just a "shot in the dark" Kathy told Bob that the MARR for the company is 15% per year for these major clients. She also explained that eh 1996 negative cash flow was caused by an on-site equipment upgrade fold when Homeworth expanded its manufacturing capacity and increased power usage about 5- Once Bob had finished his initial analysis, Kathy told him that she had forgotten to tell him that the rate of return earned externally on the positive cash flows from these major clients is placed into a venture capital pool headquartered in Chicago. It has been making 35% per 1. values. She did, however, have a 2. Elolyear for the last decade. She wanted to know if a unique return still existed and if the Homeworth account was financially viable at a MARR of 35%. In response to this request, Bob developed the four-step procedure ouline below to Closely estimate the composite rate of return i? for any reinvestment rate c and two multiple