Answered step by step

Verified Expert Solution

Question

1 Approved Answer

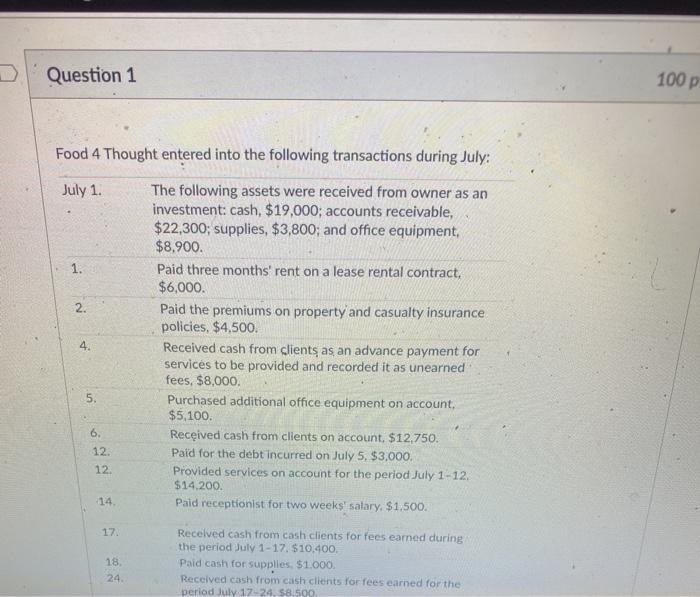

Food 4 Thought entered into the following transactions during July: July 1. The following assets were received from owner as an investment: cash, $19,000; accounts

Food 4 Thought entered into the following transactions during July:

| July 1. | The following assets were received from owner as an investment: cash, $19,000; accounts receivable, $22,300; supplies, $3,800; and office equipment, $8,900. | |

| 1. | Paid three months' rent on a lease rental contract, $6,000. | |

| 2. | Paid the premiums on property and casualty insurance policies, $4,500. | |

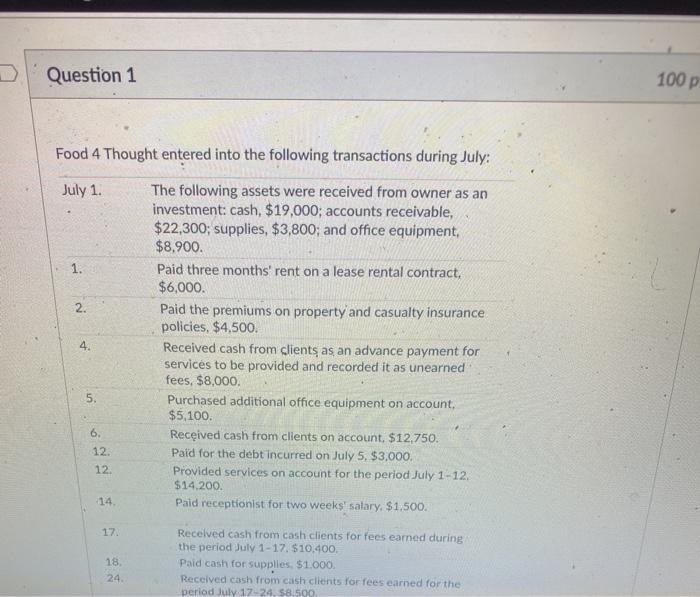

| 4. | Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $8,000. | |

| 5. | Purchased additional office equipment on account, $5,100. | |

| 6. | Received cash from clients on account, $12,750. | |

| 12. | Paid for the debt incurred on July 5, $3,000. | |

| 12. | Provided services on account for the period July 112, $14,200. | |

| 14. | Paid receptionist for two weeks' salary, $1,500. |

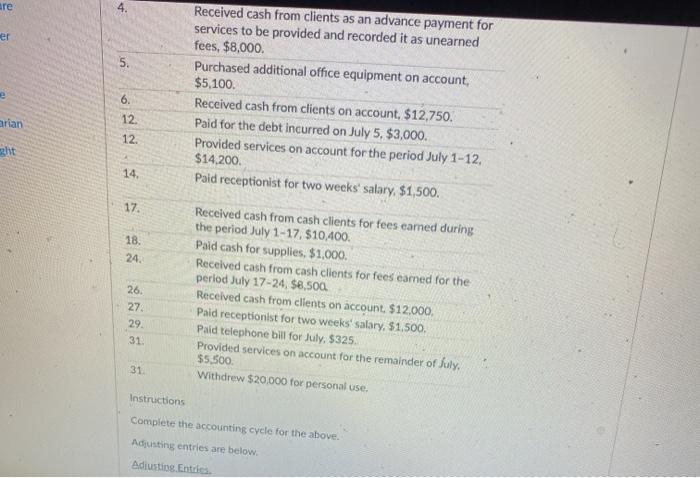

| 17. | Received cash from cash clients for fees earned during the period July 117, $10,400. | |

| 18. | Paid cash for supplies, $1,000. | |

| 24. | Received cash from cash clients for fees earned for the period July 1724, $8,500. | |

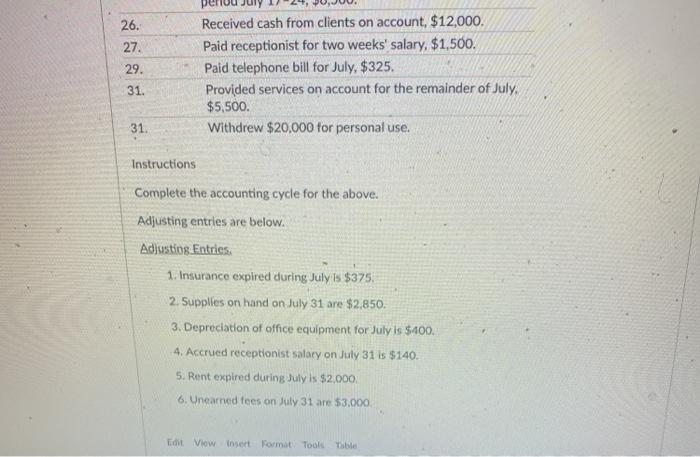

| 26. | Received cash from clients on account, $12,000. | |

| 27. | Paid receptionist for two weeks' salary, $1,500. | |

| 29. | Paid telephone bill for July, $325. | |

| 31. | Provided services on account for the remainder of July, $5,500. | |

| 31. | Withdrew $20,000 for personal use. |

Instructions

Complete the accounting cycle for the above.

Adjusting entries are below.

Adjusting Entries.

Insurance expired during July is $375.

Supplies on hand on July 31 are $2,850.

Depreciation of office equipment for July is $400.

Accrued receptionist salary on July 31 is $140.

Rent expired during July is $2,000.

-

Unearned fees on July 31 are $3,000.

assets=liabilities+owners equity

you do not have to put a income summary.

do not include income summary.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started