Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Food Service Corp. offers a meal service for commuting college students. In the month of January, 1,800 meals were served at a total cost

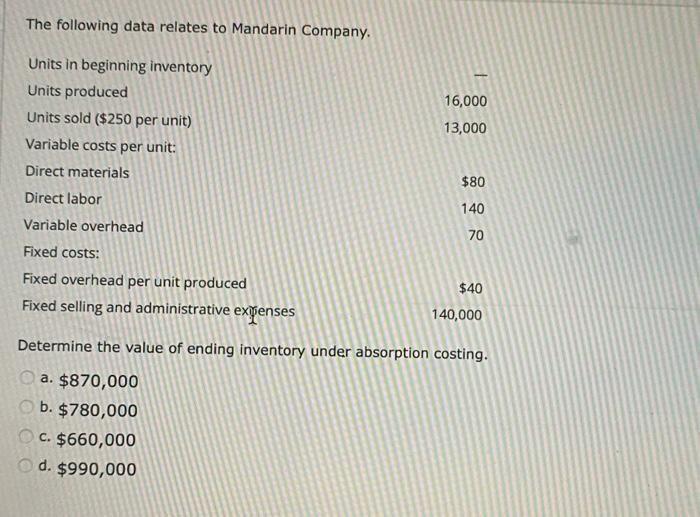

Food Service Corp. offers a meal service for commuting college students. In the month of January, 1,800 meals were served at a total cost of $9,000. In February, 1,450 meals were served at a total cost of $7,800, and the total number of meals served for March were 1,200 at a total cost of $6,600. Using the high-low method, the variable cost per unit is $4.00. What is the total fixed cost and the total variable cost for January? a. The total fixed cost is $3,000, and the variable cost is $6,000. b. The total fixed cost is $6,000, and the variable cost is $3,000. O C. The total fixed cost is $7,200, and the variable cost is $1,800. O d. The total fixed cost is $1,800, and the variable cost is $7,200. The following data relates to Mandarin Company. Units in beginning inventory Units produced 16,000 Units sold ($250 per unit) 13,000 Variable costs per unit: Direct materials $80 Direct labor 140 Variable overhead 70 Fixed costs: Fixed overhead per unit produced $40 Fixed selling and administrative expenses 140,000 Determine the value of ending inventory under absorption costing. O a. $870,000 O b. $780,000 OC. $660,000 Od. $990,000 Mahogany Company manufactures computer keyboards. The total cost of producing 12,000 keyboards is $404,000. The total fixed cost amounts to $140,000. Determine the total cost of manufacturing 27,000 keyboards. a. $734,000 b. $668,000 O C. $924,000 O d. $594,000 Food Service Corp. offers a meal service for commuting college students. In the month of January, 1,800 meals were served at a total cost of $9,000. In February, 1,450 meals were served at a total cost of $7,800, and the total number of meals served for March were 1,200 at a total cost of $6,600. Using the high-low method, the variable cost per unit is $4.00. What is the total fixed cost and the total variable cost for January? a. The total fixed cost is $3,000, and the variable cost is $6,000. b. The total fixed cost is $6,000, and the variable cost is $3,000. O C. The total fixed cost is $7,200, and the variable cost is $1,800. O d. The total fixed cost is $1,800, and the variable cost is $7,200. The following data relates to Mandarin Company. Units in beginning inventory Units produced 16,000 Units sold ($250 per unit) 13,000 Variable costs per unit: Direct materials $80 Direct labor 140 Variable overhead 70 Fixed costs: Fixed overhead per unit produced $40 Fixed selling and administrative expenses 140,000 Determine the value of ending inventory under absorption costing. O a. $870,000 O b. $780,000 OC. $660,000 Od. $990,000 Mahogany Company manufactures computer keyboards. The total cost of producing 12,000 keyboards is $404,000. The total fixed cost amounts to $140,000. Determine the total cost of manufacturing 27,000 keyboards. a. $734,000 b. $668,000 O C. $924,000 O d. $594,000 Food Service Corp. offers a meal service for commuting college students. In the month of January, 1,800 meals were served at a total cost of $9,000. In February, 1,450 meals were served at a total cost of $7,800, and the total number of meals served for March were 1,200 at a total cost of $6,600. Using the high-low method, the variable cost per unit is $4.00. What is the total fixed cost and the total variable cost for January? a. The total fixed cost is $3,000, and the variable cost is $6,000. b. The total fixed cost is $6,000, and the variable cost is $3,000. O C. The total fixed cost is $7,200, and the variable cost is $1,800. O d. The total fixed cost is $1,800, and the variable cost is $7,200. The following data relates to Mandarin Company. Units in beginning inventory Units produced 16,000 Units sold ($250 per unit) 13,000 Variable costs per unit: Direct materials $80 Direct labor 140 Variable overhead 70 Fixed costs: Fixed overhead per unit produced $40 Fixed selling and administrative expenses 140,000 Determine the value of ending inventory under absorption costing. O a. $870,000 O b. $780,000 OC. $660,000 Od. $990,000 Mahogany Company manufactures computer keyboards. The total cost of producing 12,000 keyboards is $404,000. The total fixed cost amounts to $140,000. Determine the total cost of manufacturing 27,000 keyboards. a. $734,000 b. $668,000 O C. $924,000 O d. $594,000 Food Service Corp. offers a meal service for commuting college students. In the month of January, 1,800 meals were served at a total cost of $9,000. In February, 1,450 meals were served at a total cost of $7,800, and the total number of meals served for March were 1,200 at a total cost of $6,600. Using the high-low method, the variable cost per unit is $4.00. What is the total fixed cost and the total variable cost for January? a. The total fixed cost is $3,000, and the variable cost is $6,000. b. The total fixed cost is $6,000, and the variable cost is $3,000. O C. The total fixed cost is $7,200, and the variable cost is $1,800. O d. The total fixed cost is $1,800, and the variable cost is $7,200. The following data relates to Mandarin Company. Units in beginning inventory Units produced 16,000 Units sold ($250 per unit) 13,000 Variable costs per unit: Direct materials $80 Direct labor 140 Variable overhead 70 Fixed costs: Fixed overhead per unit produced $40 Fixed selling and administrative expenses 140,000 Determine the value of ending inventory under absorption costing. O a. $870,000 O b. $780,000 OC. $660,000 Od. $990,000 Mahogany Company manufactures computer keyboards. The total cost of producing 12,000 keyboards is $404,000. The total fixed cost amounts to $140,000. Determine the total cost of manufacturing 27,000 keyboards. a. $734,000 b. $668,000 O C. $924,000 O d. $594,000

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

I Answer Option d Total fixed cost 1800 and variable cost 7...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started