Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The People's Republic of Chrystal seeks to maintain a target exchange rate of u PRC 6 relative to the US dollar. Should the actual

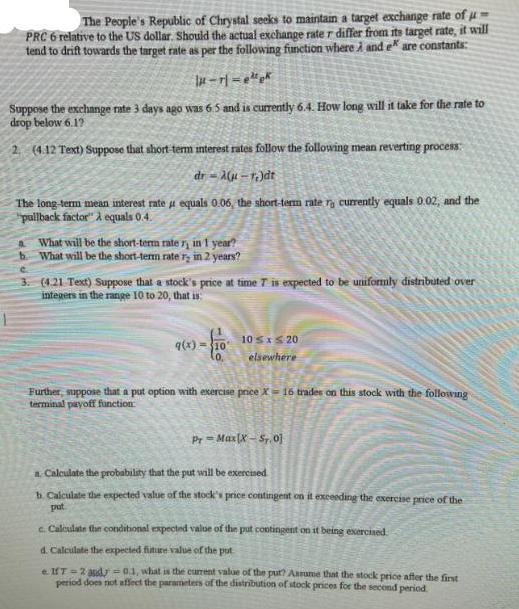

The People's Republic of Chrystal seeks to maintain a target exchange rate of u PRC 6 relative to the US dollar. Should the actual exchange rate r differ from its target rate, it will tend to drift towards the target rate as per the following function where A and e" are constants: |-|-epk Suppose the exchange rate 3 days ago was 6.5 and is currently 6.4. How long will it take for the rate to drop below 6.17 2 (4.12 Text) Suppose that short-term interest rates follow the following mean reverting process: dr-A(n-r.)dt The long-term mean interest rate u equals 0.06, the short-term rate r currently equals 0.02, and the "pullback factor" equals 0.4. a What will be the short-term rate ri in 1 year? b. What will be the short-term rate r in 2 years? e. 3. (4.21 Text) Suppose that a stock's price at time 7 is expected to be uniformly distributed over integers in the range 10 to 20, that is q(x)- 10- 10 x 20 elsewhere Further suppose that a put option with exercise price X = 16 trades on this stock with the following terminal payoff function: Pr-Max[X-ST.01 a Calculate the probability that the put will be exercised b. Calculate the expected value of the stock's price contingent on it exceeding the exercise price of the put c. Calculate the conditional expected value of the put contingent on it being exercised d. Calculate the expected future value of the put elfT-2 d-0.1, what is the current value of the pur? Asrume that the stock price after the first period does not affect the parameters of the distribution of stock prices for the second period.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Your image displays a page with mathematical and financial questions I will address these questions one by one 1 The differential equation describing the mean reverting process is given as dr rdt wher...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started