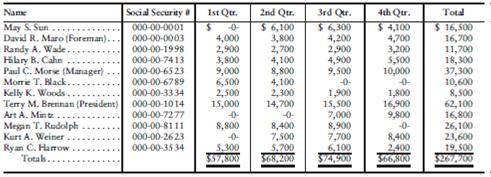

Question: The information listed below refers to the employees of Brennan Company for the year ended December 31, 2013. The wages are separated into the quarters

The information listed below refers to the employees of Brennan Company for the year ended December 31, 2013. The wages are separated into the quarters in which they were paid to the individual employees.

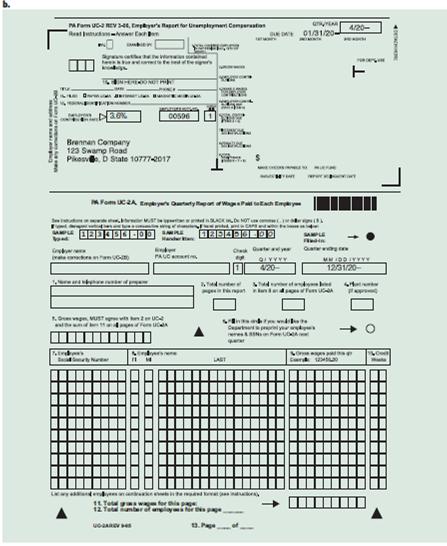

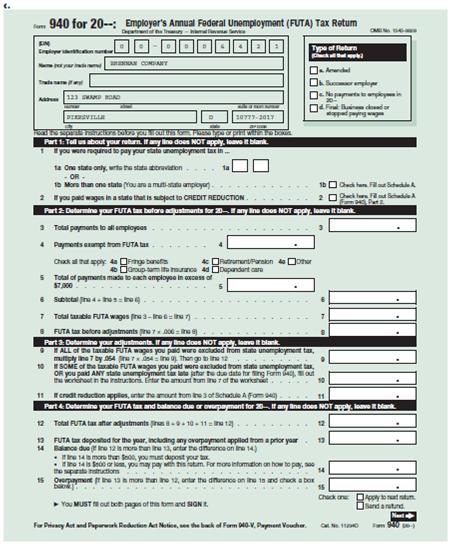

For 2013, State D’s contribution rate for Brennan Company, based on the experience-rating system of the state, was 3.6% of the first $7,000 of each employee’s earnings. The state tax returns are due one month after the end of each calendar quarter. During 2013, the company paid $3,024.00 of contributions to State D’s unemployment fund.

Employer’s phone number: (613) 555-0029. Employer’s State D reporting number: 00596.

Using the forms supplied on pages 5-52 to 5-54, complete the following for 2013:

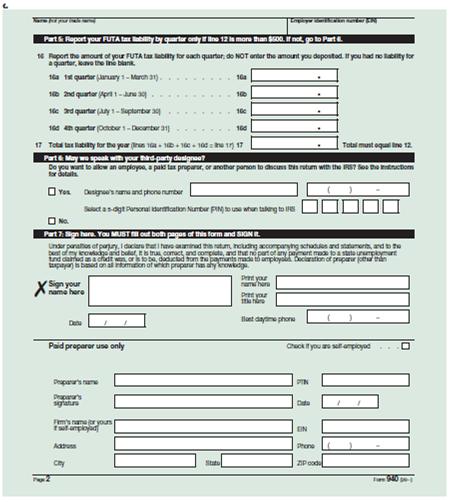

a. The last payment of the year is used to pay the FUTA tax for the fourth quarter (the first three-quarter’s liability was more than the $500 threshold). State D is not a credit reduction state.

Tax Payment:

Date _____________ Amount $____________

b. Employer’s Report for Unemployment Compensation, State D—4th quarter only. Item 1 is the number of employees employed in the pay period that includes the 12th of each month in the quarter. For Brennan Company, the number of employees is ten in October, nine in November, and eight in December. All employees earned 13 credit weeks during the last quarter except for Sun (8) and Harrow (9).

c. Employer’s Annual Federal Unemployment (FUTA) Tax Return—Form 940

Indicate on each form the date that the form should be submitted and the amount of money that must be paid.

The president of the company prepares and signs all tax forms.

Name Social Security 1st Qur. 2nd Qur. 3rd Qu. 4th Qtr. Total May S. Sun David R. Maro (Foreman).. Randy A. Wade Hilary B. Cahn Paul C. Morse (Manager) Morrie T. Black. Kelly K. Woods . Terry M. Brennan (President) Art A. Mint $ 6,100 3,800 2,700 4,100 8,800 4,100 2,300 14,700 -0- $ 6,300 4,200 2,900 4,900 9,500 -0- $ 4,100 4,700 3,200 5,500 10,000 $ 16,500 16,700 11,700 18,300 37,300 10,600 8,500 62,100 16,800 26,100 23,600 19,500 $267,700 000-00-0001 -0- 000-00-0003 000-00-1998 000-00-74 13 4,000 2,900 3,800 9,000 6,500 2,500 15,000 000-00-6523 000-00-6789 1,900 15,500 7,000 8,900 7,700 6,100 $74,900 000-00-3334 1,800 16,900 9,800 -0- 000-00-1014 000-00-7277 000-00-8111 8,800 Megan T. Rudolph Kurt A. Weiner 8,400 7,500 5,700 S68, 2000 8,400 2,400 S66,800 000-00-2623 Ryan C. Harrow Totak.. 000-00-35 34 5,300 $57,800

Step by Step Solution

3.34 Rating (169 Votes )

There are 3 Steps involved in it

Answer a Tax Paymen... View full answer

Get step-by-step solutions from verified subject matter experts