Answered step by step

Verified Expert Solution

Question

1 Approved Answer

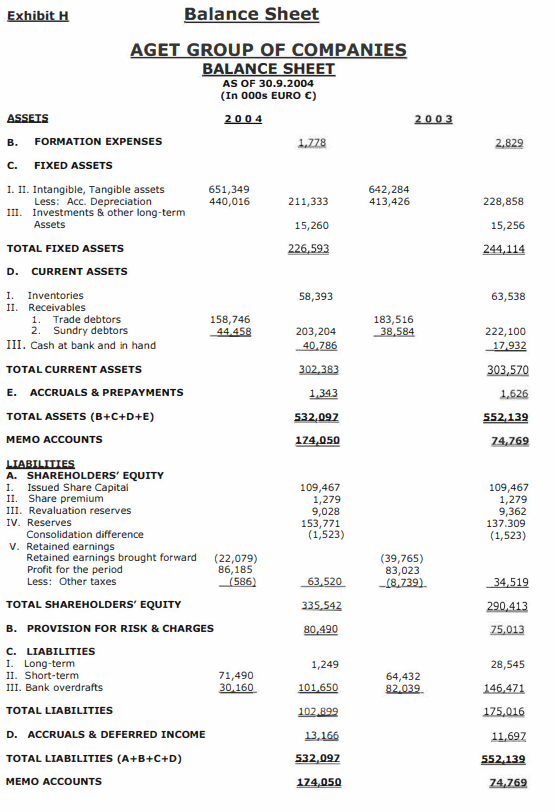

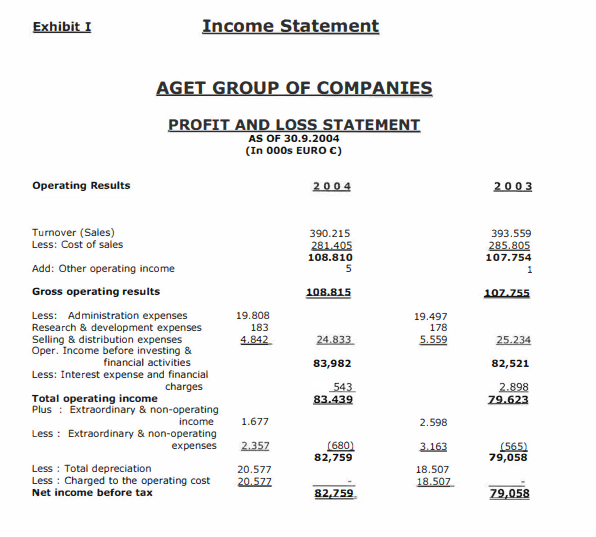

For 2008, Aget is contemplating adding two new dry-process kilns for an investment of 10.7 million . That investment is expected to increase current capacity

For 2008, Aget is contemplating adding two new dry-process kilns for an investment of 10.7 million . That investment is expected to increase current capacity by 18%.

- Assuming the most current operational cost levels, what sales must it generate to recoup the above investment?

- If we assume 2004 prices of 45.91 /mt, what does the new break-even level do to the utilization rate, given its new capacity level? What can you say about its effect upon Agets pricing?

- It is expected that the dry-process technology will help achieve an increase of 22% in production cost efficiencies, compared to current level. How might such an increase affect price competitiveness?

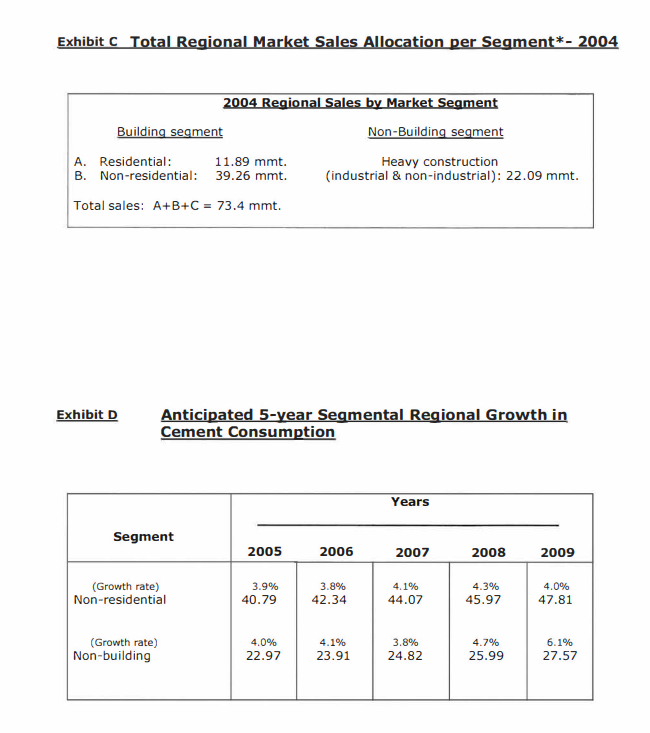

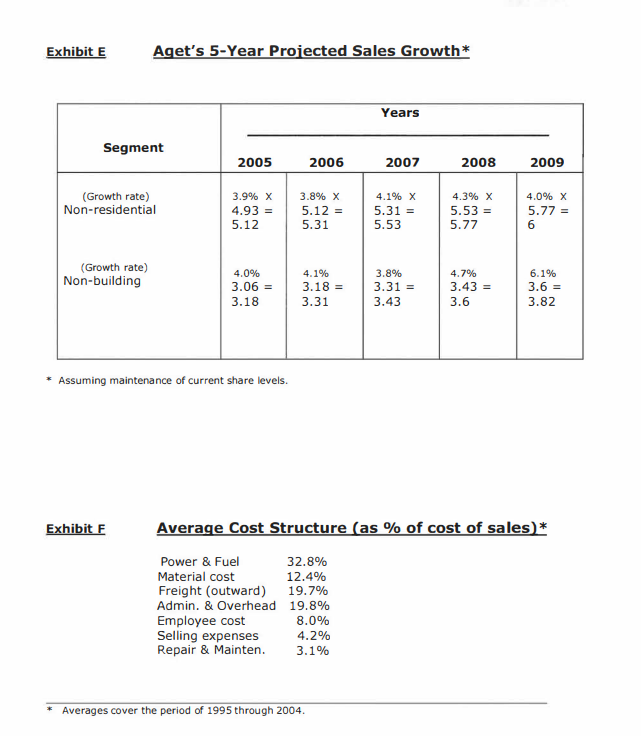

- Assuming that Agets sales by 2008 will have grown at the forecasted global market rate increase of 22.6% over those of 2004, what will be its production and utilization rate?

- If Aget does capture 20% market share in the markets of Lebanon, Kuwait and UAE, as estimated, at what sales units and revenues, will it break-even? What is the B/E market share?

- In case Aget reduced price by 10%:

- What effect would such price reduction have on gross margin?

- By how much must sales increase to avoid a loss in gross profit?

- What can you say about the potential implications of such price reductions, upon the industry and the market?

- Based on your analysis, is Agets contemplated expansion into Lebanon, Kuwait, and UAE advisable or inadvisable? Argue your position.

Company Background Lafarge - Aget Heracles Aget cement (written "aget" but pronounced "ayet"), a major Greek company, was formed in 1911. In 1992 sold its 50.5% shares to the Italian Calcestruzzi, SpA., currently in the Italcementi group. In 1996, Aget acquired Halkis Cement Group, reducing the number of domestic players in the Greek market. In 2000, 54.48% of its shares were sold to the English Group Blue Circle Industries, plc. In 2001, Blue Circle Industries, plc was acquired by the French Group Lafarge, a global building materials producer. Aget, a national company, has major regional operations throughout the prosperous market of Middle East and periphery with terminals and bulk cement storage and concrete/aggregate facilities in Egypt, Saudi Arabia, Nigeria, and Algeria. It presently contemplates expanding into Lebanon, Kuwait and UAE. Aget is regionally famous for having a top quality product and in the Greek market enjoys a large market share, about 50% in the cement/concrete (beton) business. It has a large share of the public works and other institutional markets. Its major competitors are Titan cement and Halyps cement, currently a subsidiary of the Italcementi group, whose combined share almost equals the other 50% of the market. Aget's presence in the Middle East is threatened by the conglomerate Italcementi's aggressive entry into the above market. The Italcementi group is a vertically integrated company, owning limestone gypsum and rock quarries, processing plants and distribution facilities in more than ten countries while Aget must rely on suppliers for gypsum and rock. Aget has a collective production capacity of 11.2 million tons, but achieves about 8.5 million tons in annual sales, indicating a utilization rate of about 76%. Its cement is distributed and delivered by sea-vessels and trucks. The Product Cement may be used, in combination with other ingredients, to produce concrete for a variety of construction needs. The product may be delivered for mixing at the building site or already mixed and delivered for immediate use upon arrival at the site. Cement is a solid gray powder manufactured using pyroprocessing in kilns from limestone, silica sand, clay, slate and other additives using a chemical process and a 1 2004 Sales: 390,215 45.91 = 8.49 mmt. (see P&L statement, exhibit I) Professor Constantine G. Polychroniou developed this case for class discussion. The case is developed for class discussion and does not serve as a source of primary information or to indicate effectiveness or ineffectiveness of managerial action. The author brings into the case information that he had gained when he was in an advisory capacity with Aget Heracles in the early 80's. Other data have been pulled in from public sources. Certain company information or data have been subtly disguised so as to enhance, or conversely not affect, the pedagogical effect of the case 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To address the questions lets break them down one by one Question 1 Calculate the sales needed to recoup the investment of 107 million To find the breakeven sales revenue we need to consider the contr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started