Answered step by step

Verified Expert Solution

Question

1 Approved Answer

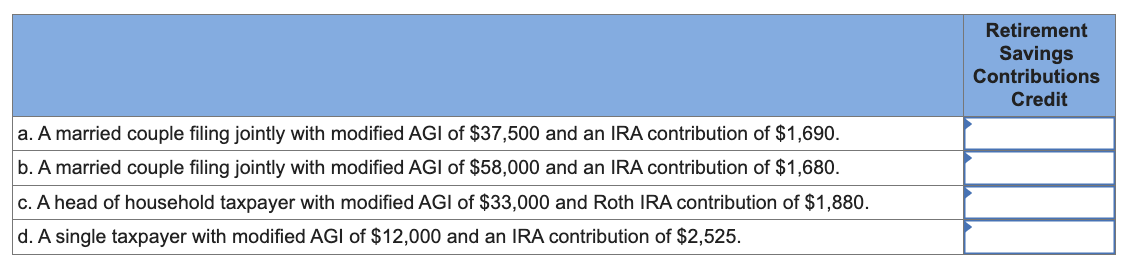

For 2022, begin{tabular}{|l|l|} hline & RetirementSavingsContributionsCredit hline a. A married couple filing jointly with modified AGI of $37,500 and an IRA contribution of $1,690.

For 2022,

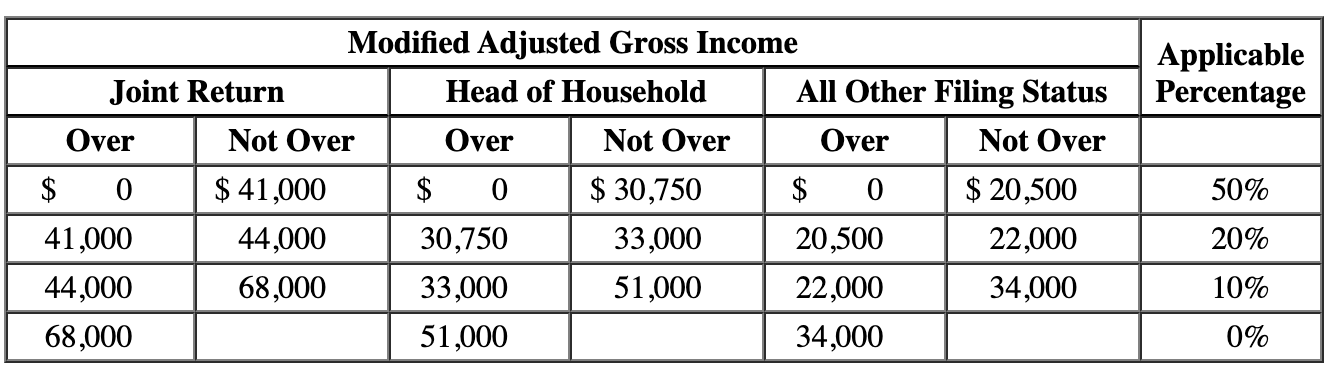

\begin{tabular}{|l|l|} \hline & RetirementSavingsContributionsCredit \\ \hline a. A married couple filing jointly with modified AGI of $37,500 and an IRA contribution of $1,690. \\ \hline b. A married couple filing jointly with modified AGI of $58,000 and an IRA contribution of $1,680. \\ \hline c. A head of household taxpayer with modified AGI of $33,000 and Roth IRA contribution of $1,880. & \\ \hline d. A single taxpayer with modified AGI of $12,000 and an IRA contribution of $2,525. & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Modified Adjusted Gross Income } & \multirow{2}{*}{ApplicablePercentage} \\ \hline \multicolumn{2}{|c|}{ Joint Return } & \multicolumn{2}{c|}{ Head of Household } & \multicolumn{2}{c|}{ All Other Filing Status } & \\ \hline Over & Not Over & Over & Not Over & Over & Not Over & \\ \hline$ & $41,000 & $ & $30,750 & $10 & $20,500 & 50% \\ \hline 41,000 & 44,000 & 30,750 & 33,000 & 20,500 & 22,000 & 20% \\ \hline 44,000 & 68,000 & 33,000 & 51,000 & 22,000 & 34,000 & 10% \\ \hline 68,000 & & 51,000 & & 34,000 & & 0% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started