Answered step by step

Verified Expert Solution

Question

1 Approved Answer

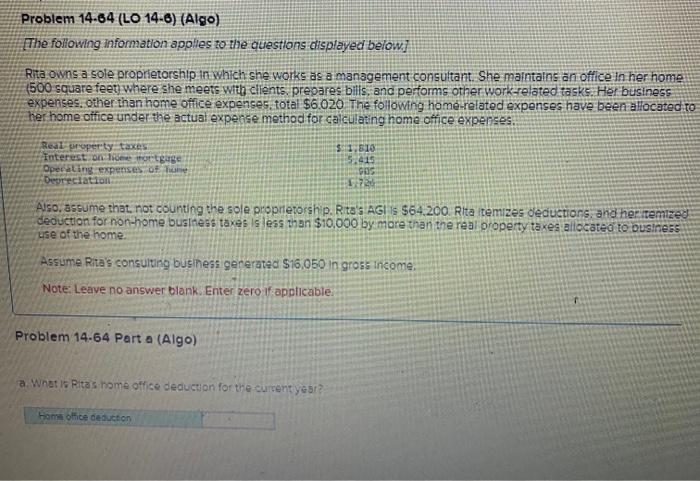

For 2023* Problem 14.64 (LO 14-6) (Algo) The following information applies to the questions displayed below? Rita owns a sole proprietorship in which she works

For 2023*

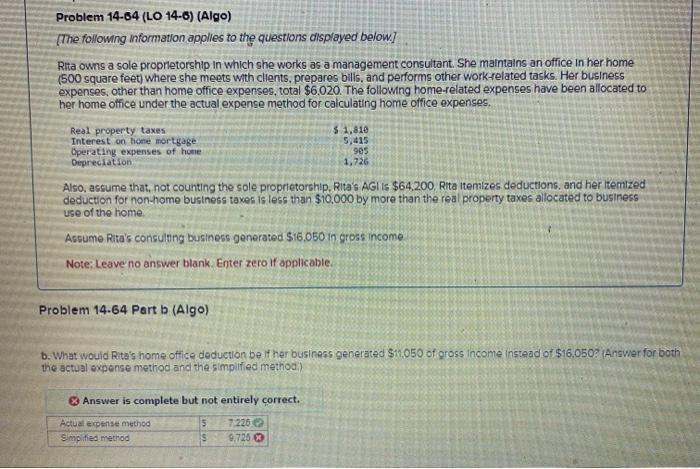

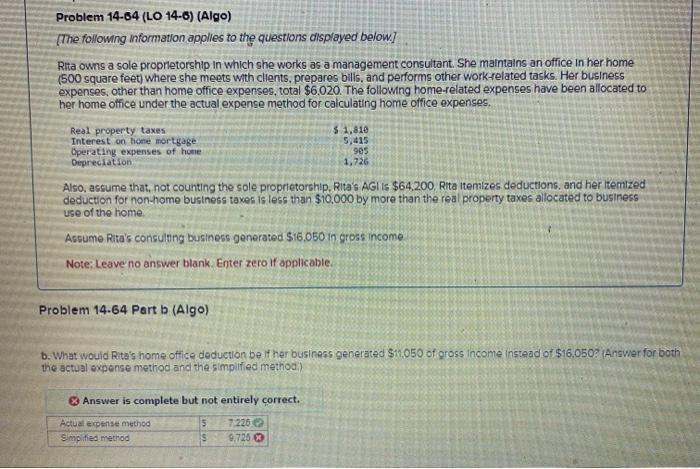

Problem 14.64 (LO 14-6) (Algo) The following information applies to the questions displayed below? Rita owns a sole proprietorship in which she works as a management consultant. She maintains an office in her home 500 square feet where she meets witb clients, prepares bilis, and performs other work-related tasks. Her business expenses, Other than home office expenses, total $6.020 The following home-related expenses have been allocated to her home office under the actual expecse method for calculating home office expenses. Also. assume that, not counting the sole proprietorship. R.ta's AGl is $64.200. Rita itemizes oleductions, and her itemized deduction for non home business taxes is less vian $10,000 by more than the real property taxes allocated to ousiness. use of the home. Assume Ritas consuiting bushess gererated $16,050 in gross income. Note: Leave no answer blank. Enter zero if applicable. Problem 14.64 Part a (Algo) a. What is Ritas home office deduction for the curtentyest? Problem 14-64 (LO 14-6) (Algo) [The following information applies to the questions olisplayed below] Rita owns a sole proprietorship in which she works as a management consultant. She maintains an office in her home (500 square feet) where she meets with clients, prepares bills, and performs other work-related tasks. Her business expenses, other than home office expenses, total $6.020. The following home-related expenses have been allocated to her home office under the actual expense method for calculating home office expenses. Also, assume that, not counting the sole proprietorship, Ritas AGI is $64,200. Rita itemizes deductions, and her itemized deduction for non thome business taxes is less than $10,000 by more than the real property taxes allocated to business use of the home. Assume Rita's consulting business generated $16,050 in gross income Note: Leave no answer blank. Enter zero lf applicable. Problem 14.64 Part b (Algo) b. What would Rita's home office deduction be it her business generated \$11,050 of gross income instead of $16,050? (Answer for both the actual expense method and the simplified methodi) Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started