For a business with no interest income, what is the limitation on business interest deductions? What businesses are not subject to this limitation? For a

- For a business with no interest income, what is the limitation on business interest deductions?

- What businesses are not subject to this limitation?

- For a business that is subject to the limitation, what benefit can the business get from interest payments that exceed the limit? Give an example. For this question please refer to the screenshot posted.

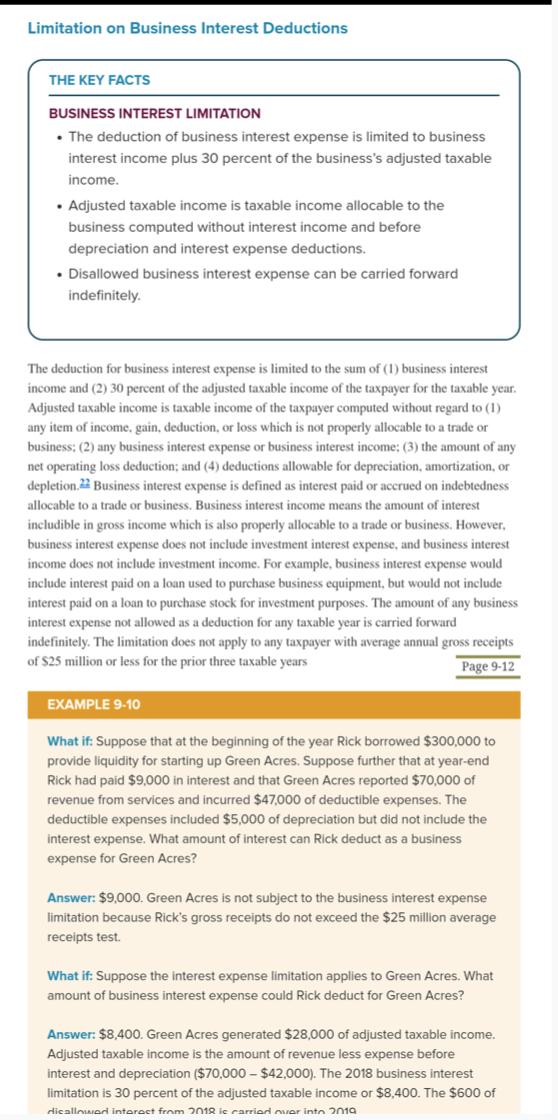

Limitation on Business Interest Deductions THE KEY FACTS BUSINESS INTEREST LIMITATION The deduction of business interest expense is limited to business interest income plus 30 percent of the business's adjusted taxable income. Adjusted taxable income is taxable income allocable to the business computed without interest income and before depreciation and interest expense deductions. Disallowed business interest expense can be carried forward indefinitely. The deduction for business interest expense is limited to the sum of (1) business interest income and (2) 30 percent of the adjusted taxable income of the taxpayer for the taxable year. Adjusted taxable income is taxable income of the taxpayer computed without regard to (1) any item of income, gain, deduction, or loss which is not properly allocable to a trade or business; (2) any business interest expense or business interest income; (3) the amount of any net operating loss deduction; and (4) deductions allowable for depreciation, amortization, or depletion.22 Business interest expense is defined as interest paid or accrued on indebtedness allocable to a trade or business. Business interest income means the amount of interest includible in gross income which is also properly allocable to a trade or business. However, business interest expense does not include investment interest expense, and business interest income does not include investment income. For example, business interest expense would include interest paid on a loan used to purchase business equipment, but would not include interest paid on a loan to purchase stock for investment purposes. The amount of any business interest expense not allowed as a deduction for any taxable year is carried forward indefinitely. The limitation does not apply to any taxpayer with average annual gross receipts of $25 million or less for the prior three taxable years Page 9-12 EXAMPLE 9-10 What if: Suppose that at the beginning of the year Rick borrowed $300,000 to provide liquidity for starting up Green Acres. Suppose further that at year-end Rick had paid $9,000 in interest and that Green Acres reported $70,000 of revenue from services and incurred $47,000 of deductible expenses. The deductible expenses included $5,000 of depreciation but did not include the interest expense. What amount of interest can Rick deduct as a business expense for Green Acres? Answer: $9,000. Green Acres is not subject to the business interest expense limitation because Rick's gross receipts do not exceed the $25 million average receipts test. What if: Suppose the interest expense limitation applies to Green Acres. What amount of business interest expense could Rick deduct for Green Acres? Answer: $8,400. Green Acres generated $28,000 of adjusted taxable income. Adjusted taxable income is the amount of revenue less expense before interest and depreciation ($70,000-$42,000). The 2018 business interest limitation is 30 percent of the adjusted taxable income or $8,400. The $600 of dicallowed interact from 2018 is carried over into 2019

Step by Step Solution

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

For a business with no interest income what is the limitation on business interest deductions The bu...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started