Answered step by step

Verified Expert Solution

Question

1 Approved Answer

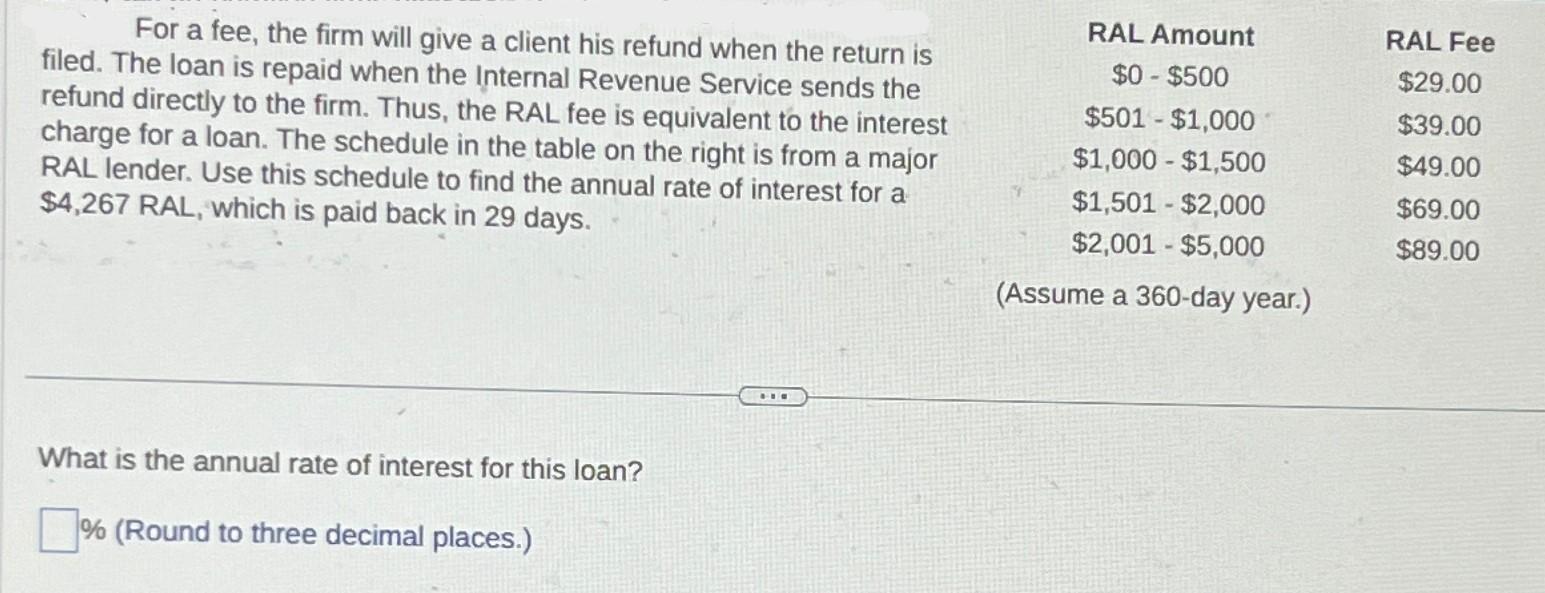

For a fee, the firm will give a client his refund when the return is filed. The loan is repaid when the Internal Revenue

For a fee, the firm will give a client his refund when the return is filed. The loan is repaid when the Internal Revenue Service sends the refund directly to the firm. Thus, the RAL fee is equivalent to the interest charge for a loan. The schedule in the table on the right is from a major RAL lender. Use this schedule to find the annual rate of interest for a $4,267 RAL, which is paid back in 29 days. RAL Amount $0-$500 $501-$1,000 RAL Fee $29.00 $39.00 $1,000 $1,500 $49.00 $1,501-$2,000 $69.00 $2,001-$5,000 $89.00 (Assume a 360-day year.) What is the annual rate of interest for this loan? % (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To find the annual rate of interest for the 4267 refund antici...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started