Answered step by step

Verified Expert Solution

Question

1 Approved Answer

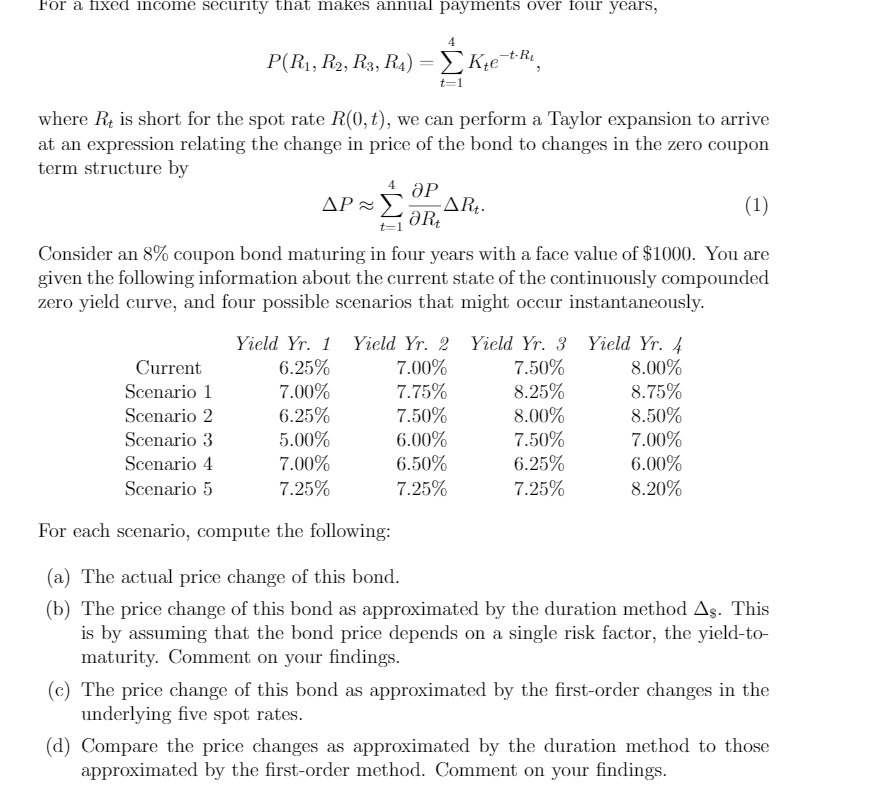

For a fixed income security that makes annual payments over four years, P(R, R2, R3, R) = K-R, Kre where R+ is short for

For a fixed income security that makes annual payments over four years, P(R, R2, R3, R) = K-R, Kre where R+ is short for the spot rate R(0, t), we can perform a Taylor expansion to arrive at an expression relating the change in price of the bond to changes in the zero coupon term structure by JP t=1 ORt (1) Consider an 8% coupon bond maturing in four years with a face value of $1000. You are given the following information about the current state of the continuously compounded zero yield curve, and four possible scenarios that might occur instantaneously. ARt. Yield Yr. 1 Yield Yr. 2 6.25% 7.00% 7.00% 7.75% 7.50% 6.00% 6.50% 7.25% 6.25% 5.00% 7.00% 7.25% Yield Yr. 3 Yield Yr. 4 7.50% 8.00% 8.25% 8.75% 8.00% 7.50% 6.25% 7.25% Current Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5 For each scenario, compute the following: (a) The actual price change of this bond. (b) The price change of this bond as approximated by the duration method As. This is by assuming that the bond price depends on a single risk factor, the yield-to- maturity. Comment on your findings. 8.50% 7.00% 6.00% 8.20% (c) The price change of this bond as approximated by the first-order changes in the underlying five spot rates. (d) Compare the price changes as approximated by the duration method to those approximated by the first-order method. Comment on your findings.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Actual price change Current P 10000081075 1000108252 10001083 100010824 95683 Scenario 1 P 1000008...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started