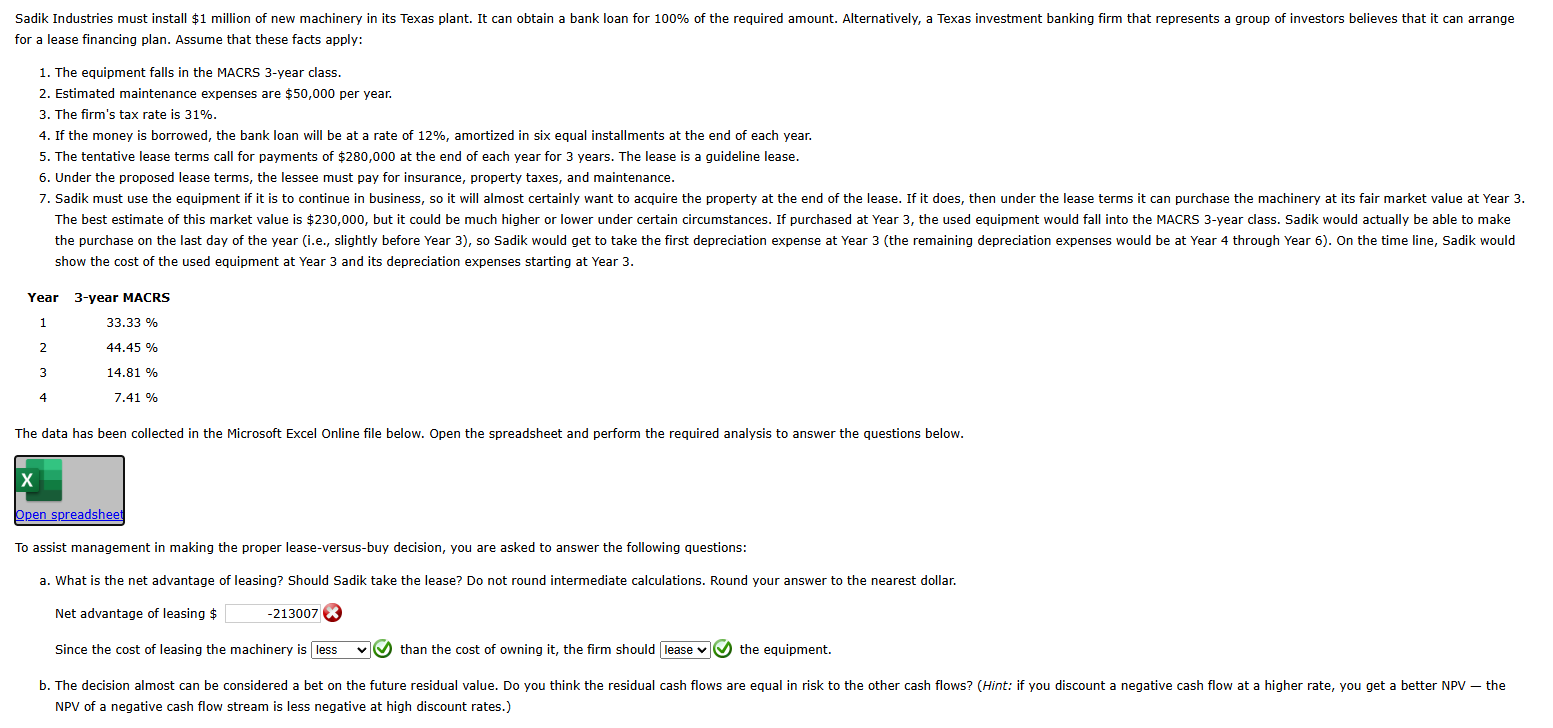

Question: for a lease financing plan. Assume that these facts apply: 1 . The equipment falls in the MACRS 3 - year class. 2 . Estimated

for a lease financing plan. Assume that these facts apply: The equipment falls in the MACRS year class. Estimated maintenance expenses are $ per year. The firm's tax rate is If the money is borrowed, the bank loan will be at a rate of amortized in six equal installments at the end of each year. The tentative lease terms call for payments of $ at the end of each year for years. The lease is a guideline lease. Under the proposed lease terms, the lessee must pay for insurance, property taxes, and maintenance. show the cost of the used equipment at Year and its depreciation expenses starting at Year The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet To assist management in making the proper leaseversusbuy decision, you are asked to answer the following questions: a What is the net advantage of leasing? Should Sadik take the lease? Do not round intermediate calculations. Round your answer to the nearest dollar. Net advantage of leasing $ Since the cost of leasing the machinery is than the cost of owning it the firm should the equipment. NPV of a negative cash flow stream is less negative at high discount rates.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock