Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For a long year, Car Painting Company has provided their services for automobiles in its region. Manufacturers of various metal products have relied on the

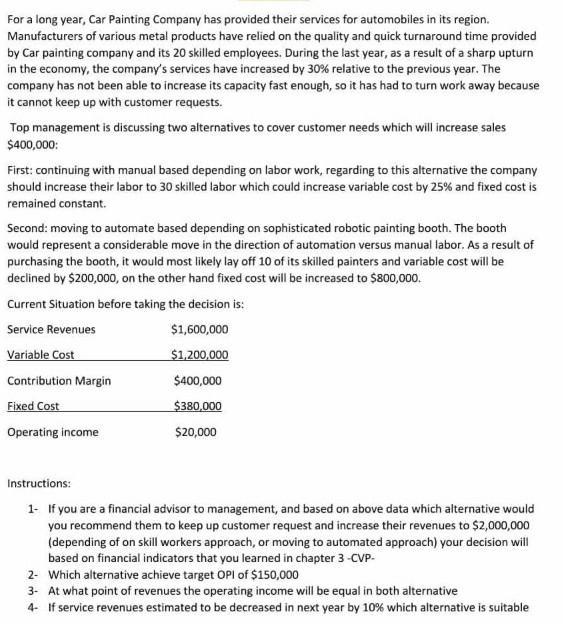

For a long year, Car Painting Company has provided their services for automobiles in its region. Manufacturers of various metal products have relied on the quality and quick turnaround time provided by Car painting company and its 20 skilled employees. During the last year, as a result of a sharp upturn in the economy, the company's services have increased by 30% relative to the previous year. The company has not been able to increase its capacity fast enough, so it has had to turn work away because it cannot keep up with customer requests. Top management is discussing two alternatives to cover customer needs which will increase sales $400,000 First: continuing with manual based depending on labor work, regarding to this alternative the company should increase their labor to 30 skilled labor which could increase variable cost by 25% and fixed cost is remained constant. Second: moving to automate based depending on sophisticated robotic painting booth. The booth would represent a considerable move in the direction of automation versus manual labor. As a result of purchasing the booth, it would most likely lay off 10 of its skilled painters and variable cost will be declined by $200,000, on the other hand fixed cost will be increased to $800,000. Current Situation before taking the decision is: Service Revenues $1,600,000 Variable Cost $1,200,000 Contribution Margin $400,000 Fixed Cost $380,000 Operating income $20,000 Instructions: 1- If you are a financial advisor to management, and based on above data which alternative would you recommend them to keep up customer request and increase their revenues to $2,000,000 (depending of on skill workers approach, or moving to automated approach) your decision will based on financial indicators that you learned in chapter 3 -CVP- 2- Which alternative achieve target OPI of $150,000 3. At what point of revenues the operating income will be equal in both alternative 4- If service revenues estimated to be decreased in next year by 10% which alternative is suitable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started