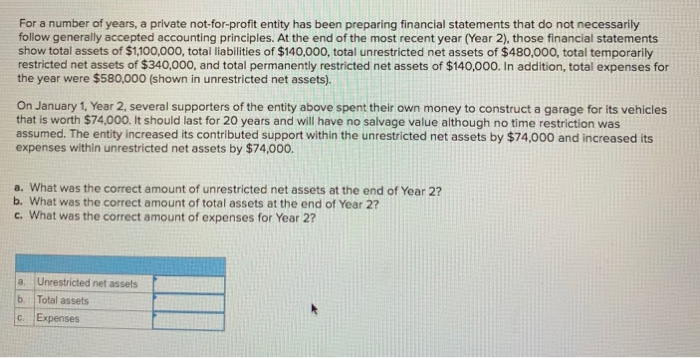

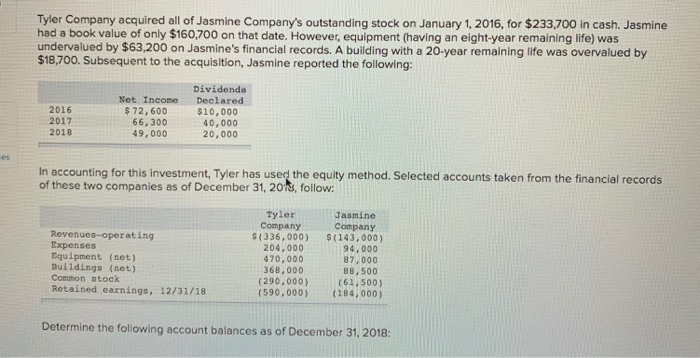

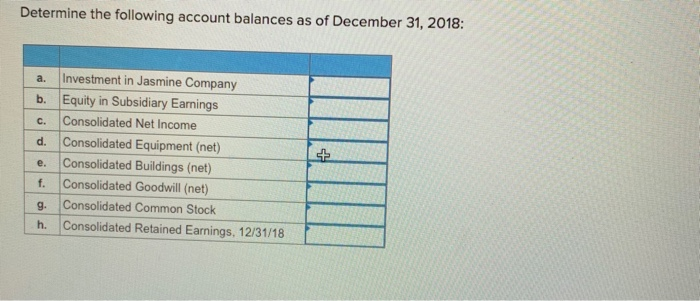

For a number of years, a private not-for-profit entity has been preparing financial statements that do not necessarily follow generally accepted accounting principles. At the end of the most recent year (Year 2), those financial statements show total assets of $1,100,000, total liabilities of $140,000, total unrestricted net assets of $480,000, total temporarily restricted net assets of $340,000, and total permanently restricted net assets of $140,000. In addition, total expenses for the year were $580,000 (shown in unrestricted net assets). On January 1, Year 2, several supporters of the entity above spent their own money to construct a garage for its vehicles that is worth $74,000. It should last for 20 years and will have no salvage value although no time restriction was assumed. The entity increased its contributed support within the unrestricted net assets by $74,000 and increased its expenses within unrestricted net assets by $74,000. a. What was the correct amount of unrestricted net assets at the end of Year 2? b. What was the correct amount of total assets at the end of Year 2? c. What was the correct amount of expenses for Year 2? a b. Unrestricted net assets Total assets Expenses c Tyler Company acquired all of Jasmine Company's outstanding stock on January 1, 2016, for $233,700 in cash. Jasmine had a book value of only $160,700 on that date. However, equipment (having an eight-year remaining life) was undervalued by $63,200 on Jasmine's financial records. A building with a 20-year remaining life was overvalued by $18,700. Subsequent to the acquisition, Jasmine reported the following: 2016 2017 2018 Net Income $ 72,600 66,300 49,000 Dividends Declared $10,000 40,000 20,000 In accounting for this investment, Tyler has used the equity method. Selected accounts taken from the financial records of these two companies as of December 31, 2018, follow: Revenues-operating Expenses Equipment (net) Duildings (net) Common stock Retained earnings, 12/31/18 Tyler Company $(336,000) 204,000 470,000 368,000 (290,000) (590,000) Jasmine Company $(143,000) 94,000 87,000 88,500 (61,500) (184,000) Determine the following account balances as of December 31, 2018: Determine the following account balances as of December 31, 2018: c. a. Investment in Jasmine Company b. Equity in Subsidiary Earnings Consolidated Net Income d. Consolidated Equipment (net) Consolidated Buildings (net) Consolidated Goodwill (net) g. Consolidated Common Stock h. Consolidated Retained Earnings, 12/31/18 e. f