Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For a stock, you are given: ( i ) The stock's price is 4 0 . ( ii ) The stock pays no dividends. (

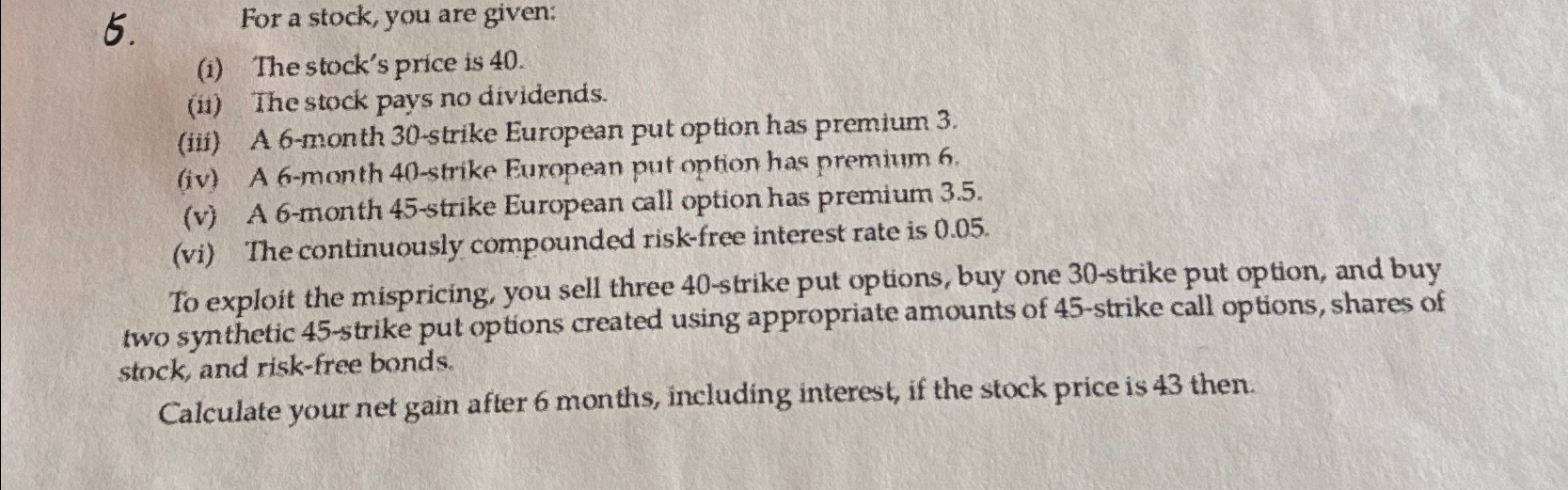

For a stock, you are given:

i The stock's price is

ii The stock pays no dividends.

iii A month strike European put option has premium

iv A month strike Furopean put option has premium

v A month strike European call option has premium

vi The continuously compounded riskfree interest rate is

To exploit the mispricing, you sell three strike put options, buy one strike put option, and buy two synthetic strike put options created using appropriate amounts of strike call options, shares of stock, and riskfree bonds.

Calculate your net gain after months, including interest, if the stock price is then.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started