Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For a stock, you are given that: i) The current stock price is 45 ii) The stock is going to pay a dividend of

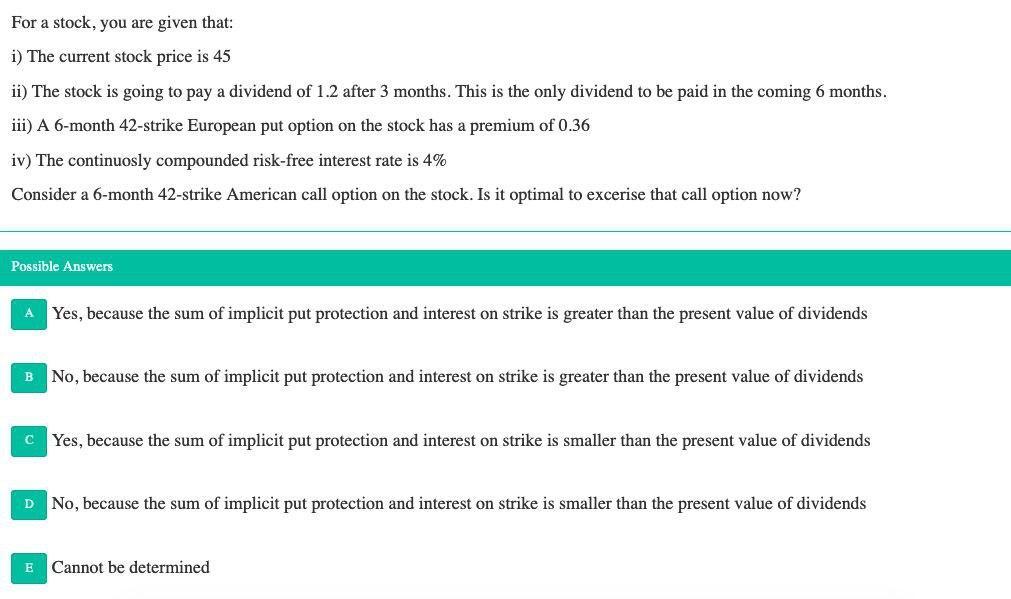

For a stock, you are given that: i) The current stock price is 45 ii) The stock is going to pay a dividend of 1.2 after 3 months. This is the only dividend to be paid in the coming 6 months. iii) A 6-month 42-strike European put option on the stock has a premium of 0.36 iv) The continuosly compounded risk-free interest rate is 4% Consider a 6-month 42-strike American call option on the stock. Is it optimal to excerise that call option now? Possible Answers A Yes, because the sum of implicit put protection and interest on strike is greater than the present value of dividends B No, because the sum of implicit put protection and interest on strike is greater than the present value of dividends cYes, because the sum of implicit put protection and interest on strike is smaller than the present value of dividends D No, because the sum of implicit put protection and interest on strike is smaller than the present value of dividends E Cannot be determined

Step by Step Solution

★★★★★

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

C Yes because the sum of implicit put protection and interest on strike is smaller than the present ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started