Question

For all parts of this problem, if you can, do the math in Excel with correct referencing to cells with intermediate results. This will allow

For all parts of this problem, if you can, do the math in Excel with correct referencing to cells with intermediate results. This will allow you to avoid rounding errors. Otherwise, increase decimal places - the more the better! Say, 6 or even higher.

(a) Take a look at slide 42. For the lender, it shows that the annual interest rate for this participation loan is 10.17%. So, where did this number come from??

| Click on the turkey to save it, and it'll give you a HINT as a reward! |

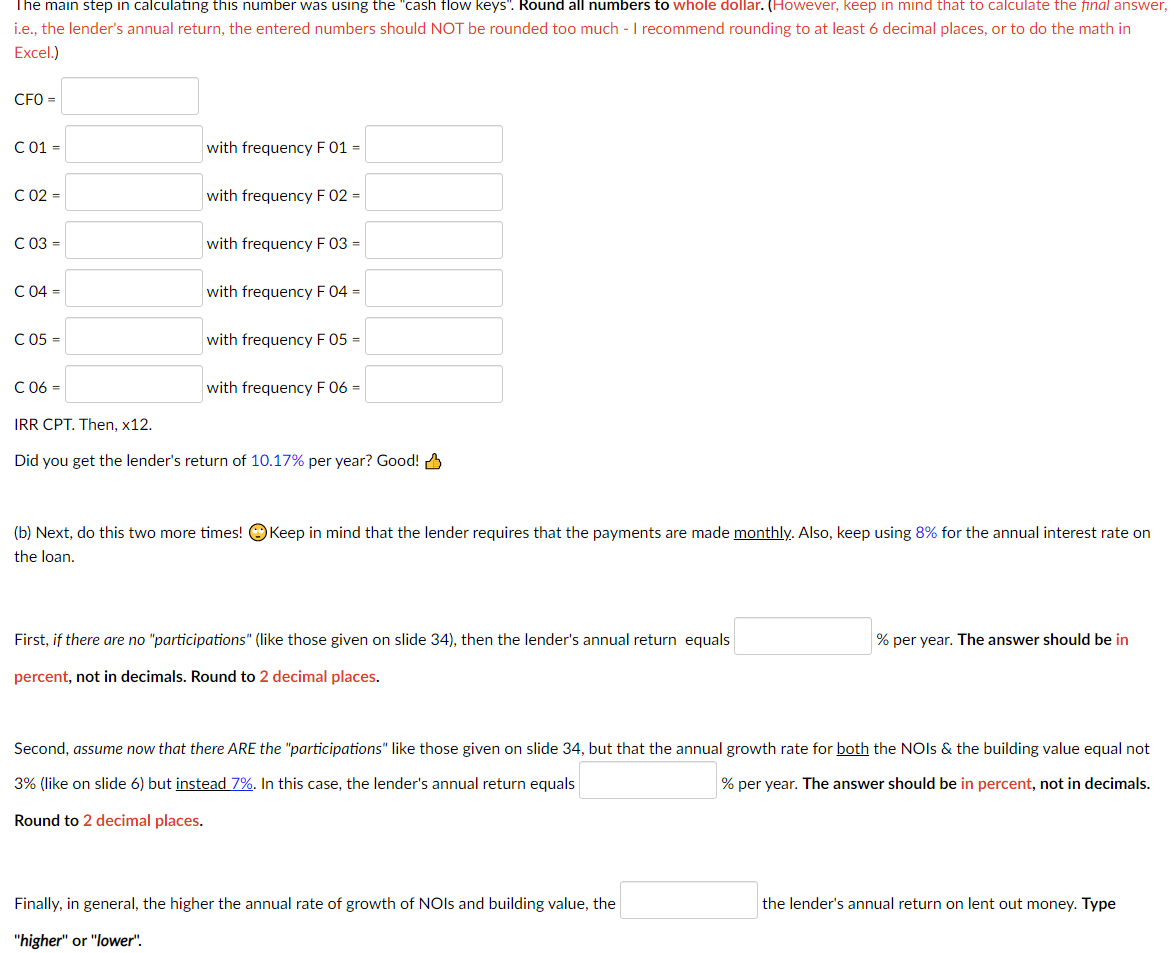

The main step in calculating this number was using the "cash flow keys". Round all numbers to whole dollar. (However, keep in mind that to calculate the final answer, i.e., the lender's annual return, the entered numbers should NOT be rounded too much - I recommend rounding to at least 6 decimal places, or to do the math in Excel.)

CF0 = C 01 = with frequency F 01 = C 02 = with frequency F 02 = C 03 = with frequency F 03 = C 04 = with frequency F 04 = C 05 = with frequency F 05 = C 06 = with frequency F 06 = IRR CPT. Then, x12.

Did you get the lender's return of 10.17% per year? Good!

(b) Next, do this two more times! Keep in mind that the lender requires that the payments are made monthly. Also, keep using 8% for the annual interest rate on the loan.

First, if there are no "participations" (like those given on slide 34), then the lender's annual return equals % per year. The answer should be in percent, not in decimals. Round to 2 decimal places.

Second, assume now that there ARE the "participations" like those given on slide 34, but that the annual growth rate for both the NOIs & the building value equal not 3% (like on slide 6) but instead 7%. In this case, the lender's annual return equals % per year. The answer should be in percent, not in decimals. Round to 2 decimal places.

Finally, in general, the higher the annual rate of growth of NOIs and building value, the the lender's annual return on lent out money. Type "higher" or "lower".

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started