Question

For all problems, sketch the timeline cash flow to represent each option. Please show the detailed calculations used to find different parameters and describe the

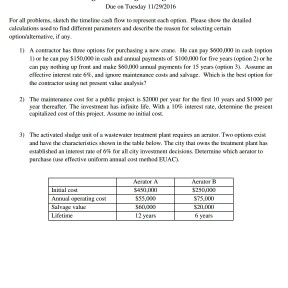

For all problems, sketch the timeline cash flow to represent each option. Please show the detailed calculations used to find different parameters and describe the reason for selecting certain option/alternative, if any. 1) A contractor has three options for purchasing a new crane. He can pay $600,000 in cash (option 1) or he can pay $150,000 in cash and annual payments of $100,000 for five years (option 2) or he can pay nothing up front and make $60,000 annual payments for 15 years (option 3). Assume an effective interest rate 6%, and ignore maintenance costs and salvage. Which is the best option for the contractor using net present value analysis?

2) The maintenance cost for a public project is $2000 per year for the first 10 years and $1000 per year thereafter. The investment has infinite life. With a 10% interest rate, determine the present capitalized cost of this project. Assume no initial cost.

3) The activated sludge unit of a wastewater treatment plant requires an aerator. Two options exist and have the characteristics shown in the table below. The city that owns the treatment plant has established an interest rate of 6% for all city investment decisions. Determine which aerator to purchase (use effective uniform annual cost method EUAC). Aerator A Aerator B Initial cost: $450,000. $250,000 Annual operating cost : $55,000. $75,000 Salvage value : $60,000. $20,000 Lifetime. : 12 years. 6 years

answer for # 1 i got. option a. = $600,000 ( F/P) option b = $571,240 (F/A,6%,5) option c= $582,732 (F/A,6%,15) option b being the best option for purchasing due to the cost being the lowest. i used the npv analysis is this correct??

Due Tuesday II/2%016 apresenrechoption Please show the detailed in cash leptin or he can pay SIS0000incash ard annual paymeebof SI00000 for five years option 2 or he pus sehing up front and make payment effective interest rate si,and iamame maintenance ont and salvage. Which the best option value 7 The maintenance a public project is impor year fr the 10 years and SI000 year thereafer. The invesmea har istiske life. With a ineest nate, detemine the preses capitalized of this project. Assume inilill 3 The activated unit waarwater tretment plant established intenst rate af i for all invesmeer decisions Dwormine which araMortoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started