Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For an income balance sheet excel table, I have to input net revenue/net sales and use the cost of goods sold to compute gross

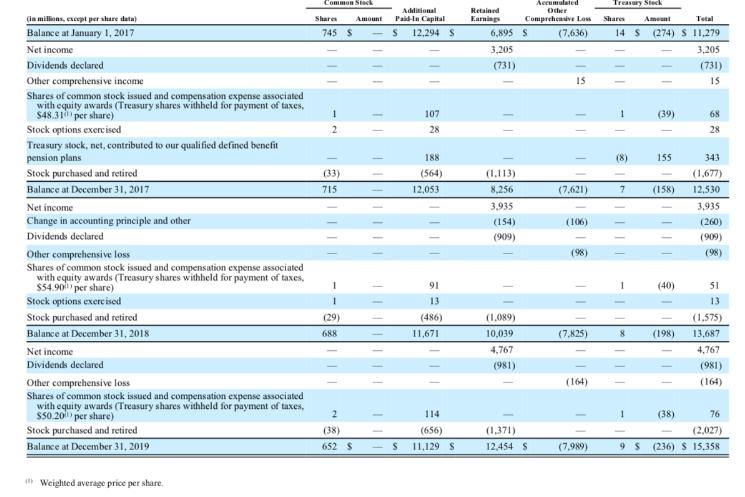

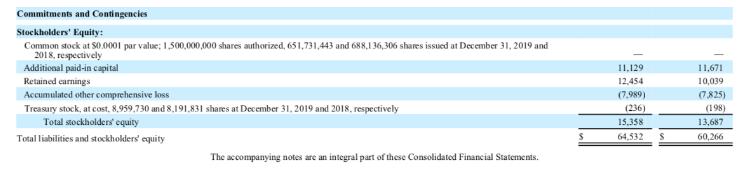

For an income balance sheet excel table, I have to input net revenue/net sales and use the cost of goods sold to compute gross profit. For DAL, there's no section in the 10-K that explicitly states either, I'm assuming since they are an airline and sell services the format is a little different. Would total operating revenue and operating expenses be the correct substitute for these? For the same balance sheet I had trouble addressing this question: "What is the dollar amount of contributed capital? [preferred stock + common stock + additional paid-in capital - treasury stock]", I was having trouble solving for it since the common stock entry has no given value (I attached a screenshot of shareholder's equity for reference) and the only time preferred stock is explicitly referenced in the 10-K is in the following quote from Authorized Shares of Capital Stock: "500,000,000 shares of preferred stock, without par value". I looked up the definition of the term without par value and determined it means that these stocks are the price investors are willing to pay on the open market. However, I'm not sure how this would translate into a numerical value for the given equation. I don't need anyone to solve the equation for me, I only need help identifying the values to put into the equation for preferred stock and common stock since they aren't obvious/explicit. One final clarification point, does the amount of comparative data years include the most prior year, so in my case 2019? DELTA AIR LINES, INC. Consolidated Statements of Stockholders' Equity (in millions, cxcel por share data) Balance at January 1, 2017 Net income Dividends declared Other comprehensive income Shares of common stock issued and compensation expense associated with equity awards (Treasury shares withheld for payment of taxes, $48.31 per share) Stock options exercised Treasury stock, net, contributed to our qualified defined benefit pension plans Stock purchased and retired Balance at December 31, 2017 Net income Change in accounting principle and other Dividends declared Other comprehensive loss Shares of common stock issued and compensation expense associated with equity awards (Treasury shares withheld for payment of taxes, $54.900 per share) Stock options exercised Stock purchased and retired Balance at December 31, 2018 Net income Dividends declared Other comprehensive loss Shares of common stock issued and compensation expense associated with equity awards (Treasury shares withheld for payment of taxes, $50.20 per share) Stock purchased and retired Balance at December 31, 2019 Weighted average price per share. Common Stock Additional Shares Amount Paid-In Capital 745 S S 12,294 S 1 (33) 715 (29) 688 2 (38) 652 S 111 - 11111111111111 S 111 107 28 188 (564) 12,053 91 13 (486) 11,671 114 (656) 11,129 S Retained Earnings 6,895 3,205 (731) (1.113) 8,256 3,935 (154) (909) (1,089) 10,039 4,767 (981) Accumulated Other Comprehensive Loss (7,636) S (1,371) 12,454 S 15 11 1 (7,621) (106) (98) (7.825) (164) (7,989) Treasury Steck Amount Total 14 S (274) S 11,279 1 7 1 1 (39) 155 (158) (40) (198) (38) 3,205 (731) 15 68 28 343 (1,677) 12,530 3,935 (260) (909) (98) 51 13 (1,575) 13,687 4,767 (981) (164) 76 (2,027) 9 S (236) $ 15.358 Commitments and Contingencies Stockholders' Equity: Common stock at $0.0001 par value; 1,500,000,000 shares authorized, 651,731,443 and 688,1 36,306 shares issued at December 31, 2019 and 2018, respectively Additional paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost, 8,959,730 and 8,191.831 shares at December 31, 2019 and 2018, respectively Total stockholders' equity Total liabilities and stockholders' equity The accompanying notes are an integral part of these Consolidated Financial Statements. 11,129 12,454 (7.989) (236) 15.358 64,532 11,671 10,039 (7.825) (198) 13,687 60,266

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started