Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For an upfront cost of $12 million dollars, the CEO of Totally Legit promises to develop a drug with amazing potential. Though it will

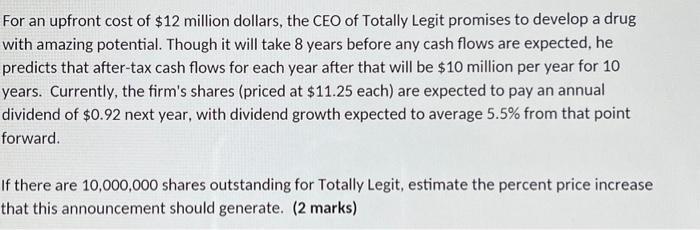

For an upfront cost of $12 million dollars, the CEO of Totally Legit promises to develop a drug with amazing potential. Though it will take 8 years before any cash flows are expected, he predicts that after-tax cash flows for each year after that will be $10 million per year for 10 years. Currently, the firm's shares (priced at $11.25 each) are expected to pay an annual dividend of $0.92 next year, with dividend growth expected to average 5.5% from that point forward. If there are 10,000,000 shares outstanding for Totally Legit, estimate the percent price increase that this announcement should generate. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Analyzing the Information and Estimating Price Increase Heres how we can approach this problem and estimate the potential price increase 1 Value the f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started