Question

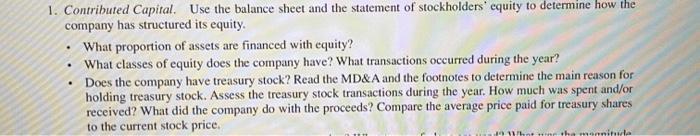

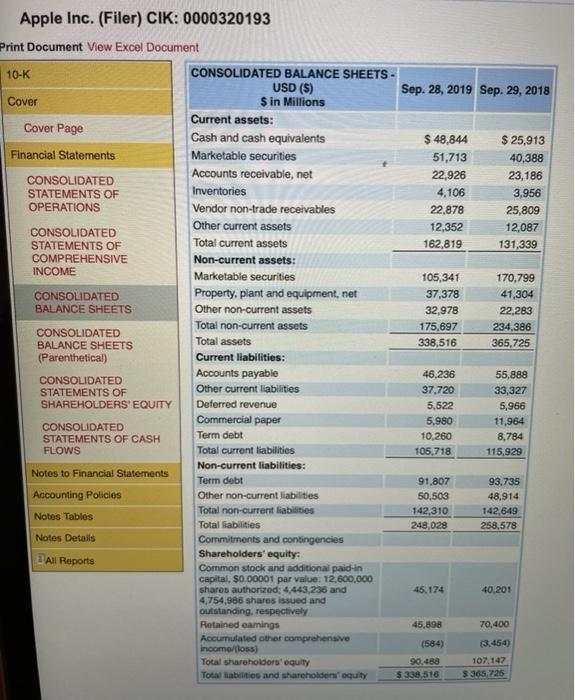

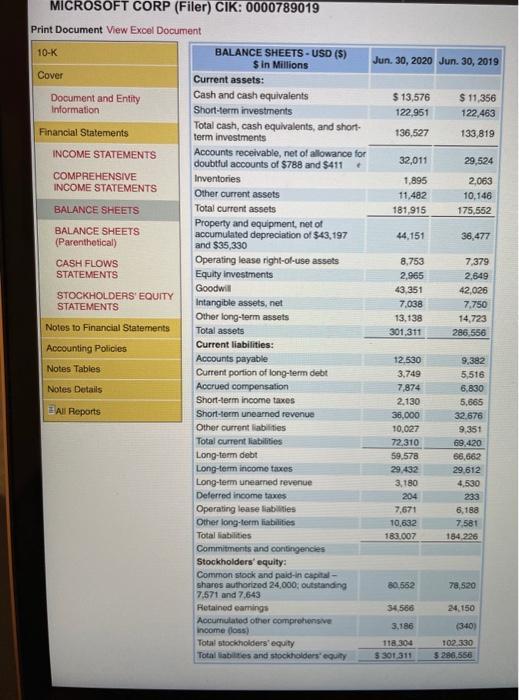

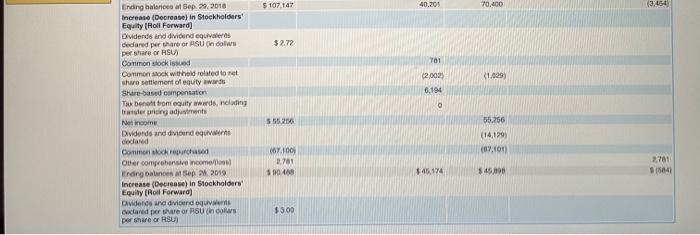

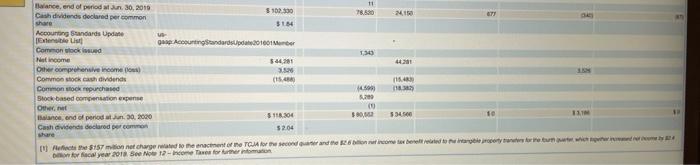

For Apple ( year 2018-2019 ) & microsoft ( year 2019-2020 ) 1. Contributed Capital. Use the balance sheet and the statement of stockholders' equity

1. Contributed Capital. Use the balance sheet and the statement of stockholders' equity to determine how the company has structured its equity. What proportion of assets are financed with equity? What classes of equity does the company have? What transactions occurred during the year? Does the company have treasury stock? Read the MD&A and the footnotes to determine the main reason for holding treasury stock. Assess the treasury stock transactions during the year. How much was spent and/or received? What did the company do with the proceeds? Compare the average price paid for treasury shares to the current stock price. . . in the mannitude

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Ans This is the price that shareholders paid for their stake in the company Contributed capital is r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Contemporary Financial Management

Authors: R. Charles Moyer, James R. McGuigan, Ramesh P. Rao

14th edition

1337090581, 978-1337090582

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App