For Apple ( year 2018-2019 ) & microsoft ( year 2019-2020 )

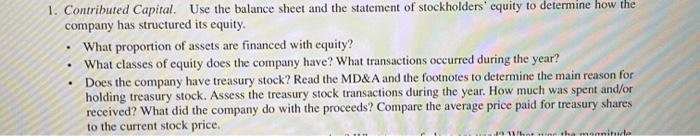

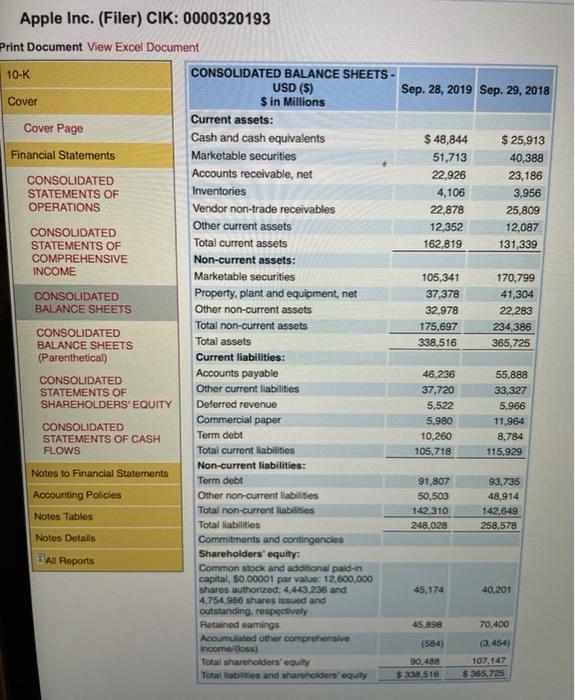

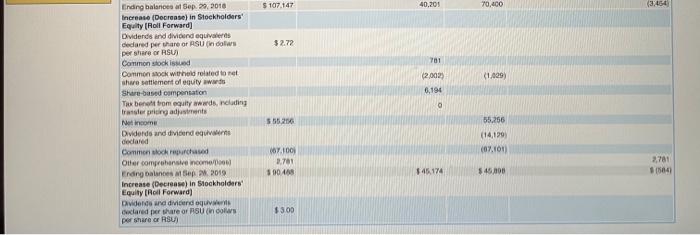

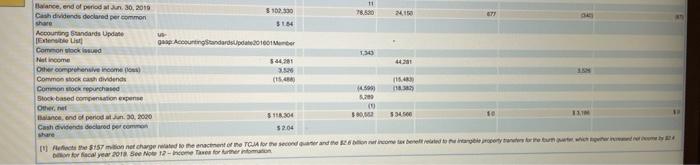

. 1. Contributed Capital. Use the balance sheet and the statement of stockholders' equity to determine how the company has structured its equity. What proportion of assets are financed with equity? What classes of equity does the company have? What transactions occurred during the year? Does the company have treasury stock? Read the MD&A and the footnotes to determine the main reason for holding treasury stock. Assess the treasury stock transactions during the year. How much was spent and/or received? What did the company do with the proceeds? Compare the average price paid for treasury shares to the current stock price. monitude Sep. 28, 2019 Sep. 29, 2018 $ 48,844 51,713 22,926 4,106 22,878 12,352 162,819 $ 25,913 40,388 23,186 3,956 25,809 12,087 131,339 Apple Inc. (Filer) CIK: 0000320193 Print Document view Excel Document 10-K CONSOLIDATED BALANCE SHEETS - USD (5) Cover $ in Millions Current assets: Cover Page Cash and cash equivalents Financial Statements Marketable securities Accounts receivable, net CONSOLIDATED STATEMENTS OF Inventories OPERATIONS Vendor non-trade receivables Other current assets CONSOLIDATED STATEMENTS OF Total current assets COMPREHENSIVE Non-current assets: INCOME Marketable securities CONSOLIDATED Property, plant and equipment, net BALANCE SHEETS Other non-current assets Total non-current assets CONSOLIDATED Total assets BALANCE SHEETS (Parenthetical) Current liabilities: Accounts payable CONSOLIDATED STATEMENTS OF Other current liabilities SHAREHOLDERS' EQUITY Deferred revenue Commercial paper CONSOLIDATED Term debt STATEMENTS OF CASH FLOWS Total current liabilities Non-current liabilities: Notes to Financial Statements Term debt Accounting Policies Other non-current liabilities Total non-current liabilities Notes Tables Total liabilities Notes Details Commitments and contingencies Shareholders' equity: All Reports Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorized: 4.443.236 and 4,754,986 shares issued and outstanding, respectively Retained eamings Accumulated other comprehensive income/floss) Total shareholders' equity Total abilities and shareholders oquity 105,341 37,378 32,978 175.697 338,516 170,799 41,304 22,283 234.386 365,725 46.236 37,720 5,522 5,980 10,260 105,718 55,888 33,327 5,966 11,964 8,784 115.929 91,807 50,503 142,310 248,029 93.735 48,914 142,649 258,578 45.174 40,201 45,898 70,400 (584) (3.454) 90.488 $ 338 518 107,147 $365,725 Jun 30, 2020 Jun 30, 2019 $ 13,576 122.951 $ 11,356 122,463 136,527 133,819 32,011 29,524 1,895 11,482 181.915 2,063 10,146 175,552 44.151 36,477 MICROSOFT CORP (Filer) CIK: 0000789019 Print Document View Excel Document 10-K BALANCE SHEETS- USD (S) Sin Millions Cover Current assets: Document and Entity Cash and cash equivalents Information Short-term investments Total cash, cash equivalents, and short- Financial Statements term investments INCOME STATEMENTS Accounts receivable, net of allowance for doubtful accounts of $788 and 5411 COMPREHENSIVE Inventories INCOME STATEMENTS Other current assets BALANCE SHEETS Total current assets Property and equipment, net of BALANCE SHEETS accumulated depreciation of $43,197 (Parenthetical) and $35,330 CASH FLOWS Operating lease right-of-use assets STATEMENTS Equity investments Goodwill STOCKHOLDERS' EQUITY STATEMENTS Intangible assets, net Other long-term assets Notes to Financial Statements Total assets Current liabilities: Accounting Policies Accounts payable Notes Tables Current portion of long-term dett Accrued compensation Notes Details Short-term income taxes Short-term unearned revenue Other current liabilities Total current liabilities Long-term debt Long-term income taxes Long-term uneamed revenue Deferred income taxes Operating lease liabilities Other long-term fiabilities Total abilities Commitments and contingencies Stockholders' equity: Common stock and paid-in capital- shares authorized 24,000, outstanding 7,571 and 7.643 Retained earnings Accumulated other comprehensive Income (oss) Total stockholders' equity Total abilities and stockholders' equity 8,753 2.965 43,351 7,038 13,138 301,311 7.379 2.649 42,026 7.750 14,723 296.556 All Reports 12.530 3,749 7,874 2.130 36,000 10,027 72.310 59.578 29.432 3,180 204 7,671 10.632 183.007 9,382 5,516 6.830 5,665 32.676 9,351 69,420 66,662 29 612 4,530 233 6,188 7,581 184.226 80552 78,520 34566 24.150 (340) 3.186 118 304 5 301311 102 330 $ 280,556 $ 107,147 40,201 70,000 70,400 (3454 $2.72 701 (1.029 (2002) 6,194 Ending balance at Sep 29, 2018 Increase (Decrease) in Stockholders Equity (Roll Forward) Dividends and dividend equivalents dedared per hare or ASU (in cows per share or RSU Common stock issued Common stock with related to me shwe settlement of equity www Share-based compensation Tax benetrom gilly wwwds, reading transfer pricing adjustments Net Income Dividers and dividend equivos declared Common stock purchased Other comprehensive common Ending balances Mep 2019 Increase (Decrease) in Stockholders Equity Roll Forward) Dividence and dividendoque declared per share or PSU (now por share or RSUS 555.2016 55,256 (14120 (07.101 7.100 3.781 SOAS 2,781 1564 $45.174 $45.000 $300 Balance, and of periodu. 30, 2010 11 $ 102 300 Cash dividends declared per common 78.830 NI share $184 Accounting sundards Update - EL Accounting Standards201001 Common tecked No income 5400 44 Other comprehensive income 3.5 Common stock vends (15.48 . Common stock purchased Stock-based compensation expense Other 0 Biance end of periodu. 30, 2020 $118.304 30, 5345 11 Cashdvidede declared or com 52.04 U Aufh5157 mercharged to the ancient Greecond and the income or bred to hear ynfortuni focal year 2018 No 12-income for further 12 . 1. Contributed Capital. Use the balance sheet and the statement of stockholders' equity to determine how the company has structured its equity. What proportion of assets are financed with equity? What classes of equity does the company have? What transactions occurred during the year? Does the company have treasury stock? Read the MD&A and the footnotes to determine the main reason for holding treasury stock. Assess the treasury stock transactions during the year. How much was spent and/or received? What did the company do with the proceeds? Compare the average price paid for treasury shares to the current stock price. monitude Sep. 28, 2019 Sep. 29, 2018 $ 48,844 51,713 22,926 4,106 22,878 12,352 162,819 $ 25,913 40,388 23,186 3,956 25,809 12,087 131,339 Apple Inc. (Filer) CIK: 0000320193 Print Document view Excel Document 10-K CONSOLIDATED BALANCE SHEETS - USD (5) Cover $ in Millions Current assets: Cover Page Cash and cash equivalents Financial Statements Marketable securities Accounts receivable, net CONSOLIDATED STATEMENTS OF Inventories OPERATIONS Vendor non-trade receivables Other current assets CONSOLIDATED STATEMENTS OF Total current assets COMPREHENSIVE Non-current assets: INCOME Marketable securities CONSOLIDATED Property, plant and equipment, net BALANCE SHEETS Other non-current assets Total non-current assets CONSOLIDATED Total assets BALANCE SHEETS (Parenthetical) Current liabilities: Accounts payable CONSOLIDATED STATEMENTS OF Other current liabilities SHAREHOLDERS' EQUITY Deferred revenue Commercial paper CONSOLIDATED Term debt STATEMENTS OF CASH FLOWS Total current liabilities Non-current liabilities: Notes to Financial Statements Term debt Accounting Policies Other non-current liabilities Total non-current liabilities Notes Tables Total liabilities Notes Details Commitments and contingencies Shareholders' equity: All Reports Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorized: 4.443.236 and 4,754,986 shares issued and outstanding, respectively Retained eamings Accumulated other comprehensive income/floss) Total shareholders' equity Total abilities and shareholders oquity 105,341 37,378 32,978 175.697 338,516 170,799 41,304 22,283 234.386 365,725 46.236 37,720 5,522 5,980 10,260 105,718 55,888 33,327 5,966 11,964 8,784 115.929 91,807 50,503 142,310 248,029 93.735 48,914 142,649 258,578 45.174 40,201 45,898 70,400 (584) (3.454) 90.488 $ 338 518 107,147 $365,725 Jun 30, 2020 Jun 30, 2019 $ 13,576 122.951 $ 11,356 122,463 136,527 133,819 32,011 29,524 1,895 11,482 181.915 2,063 10,146 175,552 44.151 36,477 MICROSOFT CORP (Filer) CIK: 0000789019 Print Document View Excel Document 10-K BALANCE SHEETS- USD (S) Sin Millions Cover Current assets: Document and Entity Cash and cash equivalents Information Short-term investments Total cash, cash equivalents, and short- Financial Statements term investments INCOME STATEMENTS Accounts receivable, net of allowance for doubtful accounts of $788 and 5411 COMPREHENSIVE Inventories INCOME STATEMENTS Other current assets BALANCE SHEETS Total current assets Property and equipment, net of BALANCE SHEETS accumulated depreciation of $43,197 (Parenthetical) and $35,330 CASH FLOWS Operating lease right-of-use assets STATEMENTS Equity investments Goodwill STOCKHOLDERS' EQUITY STATEMENTS Intangible assets, net Other long-term assets Notes to Financial Statements Total assets Current liabilities: Accounting Policies Accounts payable Notes Tables Current portion of long-term dett Accrued compensation Notes Details Short-term income taxes Short-term unearned revenue Other current liabilities Total current liabilities Long-term debt Long-term income taxes Long-term uneamed revenue Deferred income taxes Operating lease liabilities Other long-term fiabilities Total abilities Commitments and contingencies Stockholders' equity: Common stock and paid-in capital- shares authorized 24,000, outstanding 7,571 and 7.643 Retained earnings Accumulated other comprehensive Income (oss) Total stockholders' equity Total abilities and stockholders' equity 8,753 2.965 43,351 7,038 13,138 301,311 7.379 2.649 42,026 7.750 14,723 296.556 All Reports 12.530 3,749 7,874 2.130 36,000 10,027 72.310 59.578 29.432 3,180 204 7,671 10.632 183.007 9,382 5,516 6.830 5,665 32.676 9,351 69,420 66,662 29 612 4,530 233 6,188 7,581 184.226 80552 78,520 34566 24.150 (340) 3.186 118 304 5 301311 102 330 $ 280,556 $ 107,147 40,201 70,000 70,400 (3454 $2.72 701 (1.029 (2002) 6,194 Ending balance at Sep 29, 2018 Increase (Decrease) in Stockholders Equity (Roll Forward) Dividends and dividend equivalents dedared per hare or ASU (in cows per share or RSU Common stock issued Common stock with related to me shwe settlement of equity www Share-based compensation Tax benetrom gilly wwwds, reading transfer pricing adjustments Net Income Dividers and dividend equivos declared Common stock purchased Other comprehensive common Ending balances Mep 2019 Increase (Decrease) in Stockholders Equity Roll Forward) Dividence and dividendoque declared per share or PSU (now por share or RSUS 555.2016 55,256 (14120 (07.101 7.100 3.781 SOAS 2,781 1564 $45.174 $45.000 $300 Balance, and of periodu. 30, 2010 11 $ 102 300 Cash dividends declared per common 78.830 NI share $184 Accounting sundards Update - EL Accounting Standards201001 Common tecked No income 5400 44 Other comprehensive income 3.5 Common stock vends (15.48 . Common stock purchased Stock-based compensation expense Other 0 Biance end of periodu. 30, 2020 $118.304 30, 5345 11 Cashdvidede declared or com 52.04 U Aufh5157 mercharged to the ancient Greecond and the income or bred to hear ynfortuni focal year 2018 No 12-income for further 12