Question

For assessment task 1, the student is required to review existing financial information and prepare budgets. What do students need in order to complete this

For assessment task 1, the student is required to review existing financial information and prepare budgets.

What do students need in order to complete this assessment?

•Computer and Microsoft Office

•Access to the internet for research and to access web sites such as the Australian Tax Office

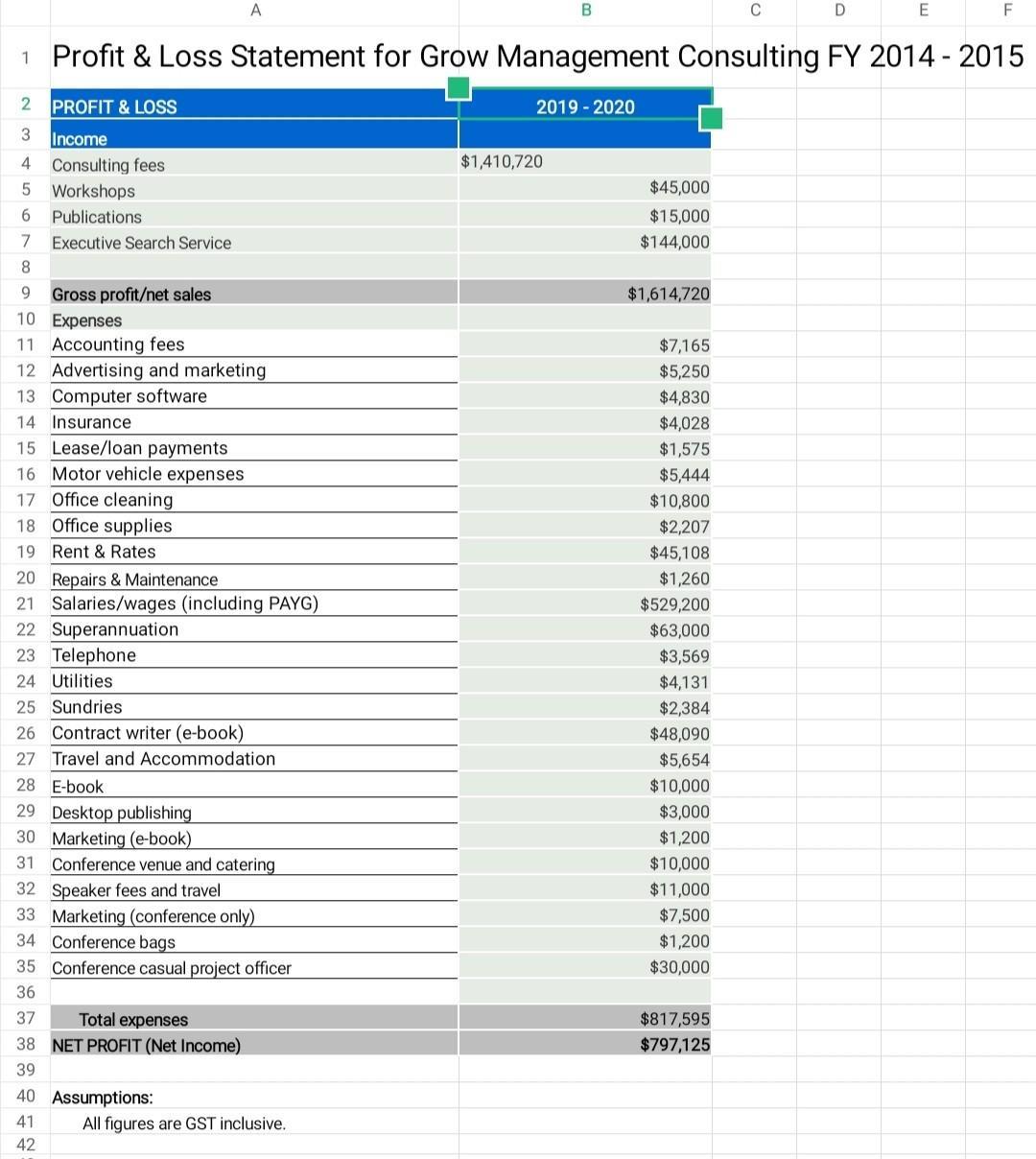

•2019 – 2020 Profit and Loss Statement

•2019 - 2020 Cash flow statements

•Financial performance report template

•Business Plan Grow Management Consultants

•Financial Management Policy and procedure

•Conference/e-book costs and income

__________

WHAT DO STUDENTS HAVE TO SUBMIT?

•Financial performance report

•Completed budgets for 2020 – 2021

A 1 Using this Profit & Loss Statement 2 3 This profit & loss statement contains a list of suggested profit items and expenses a typical business may have. You can edit these items by removing or adding rows and typing in your own items. Don't forget to enter the financial year at the top of the statement. Please note: This statement assumes all figures are GST inclusive. 45 6 7 8 234 9 10 Calculations 11 12 13 14 15 16 Formulas 17 B When you add your figures, the sheet will automatically calculate your totals and net profit at the bottom. If you are adding or removing rows please double-check your figures to ensure the calculations have been preserved. Gross profit/net sales equals Sales minus cost of goods sold minus any other expenses related to the production of a good or service. Net profit equals Gross profit/net sales minus Total expenses. This profit & loss statement is intended as a GUIDE ONLY and DOES NOT constitute financial advice, please verify and discuss your financial statements with a qualified accountant, solicitor or financial advisor. This profit & loss statement has been developed by business.gov.au, located within the Department of Industry. Copies of the latest version of this spreadsheet can be downloaded from www. business.gov.au. If you need further information, assistance or referral about a small business issue, please contact us on 13 28 46.

Step by Step Solution

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer Championship boxing Inc Comparitive Balance sheet 1 Dec 31 20Y8 Dec 31 20Y7 2 Assets 3 Cash 6...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started