Answered step by step

Verified Expert Solution

Question

1 Approved Answer

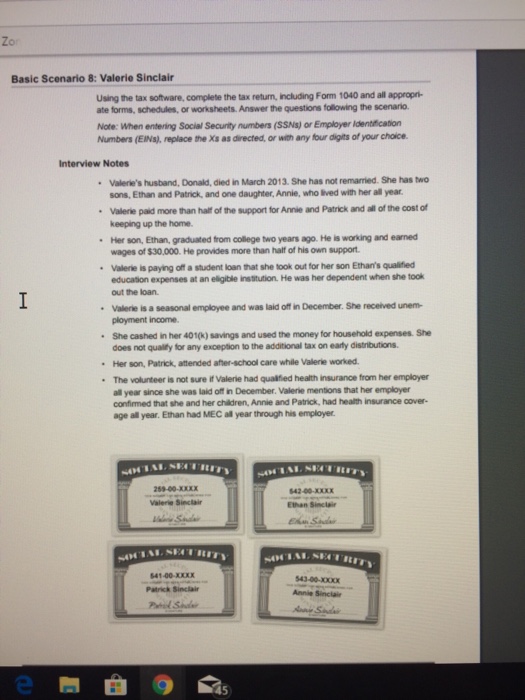

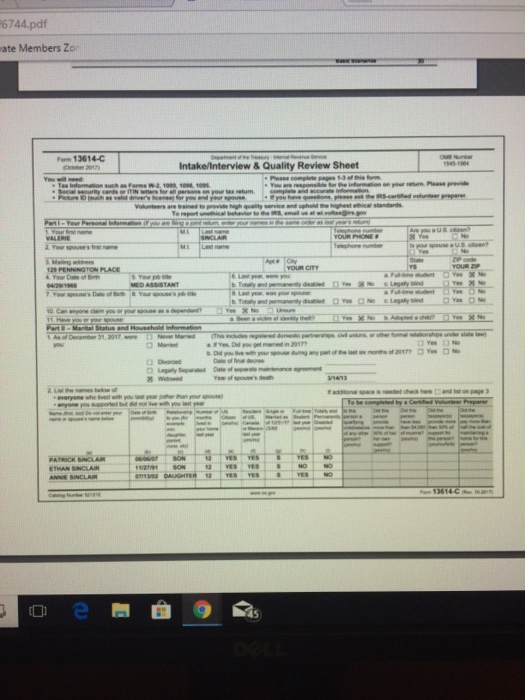

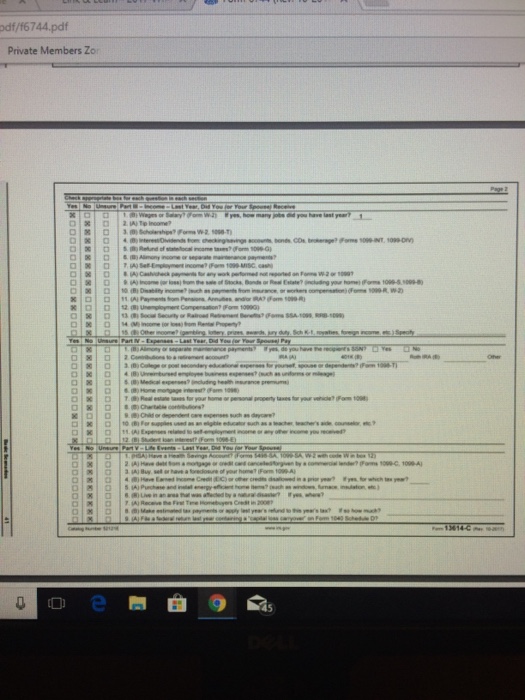

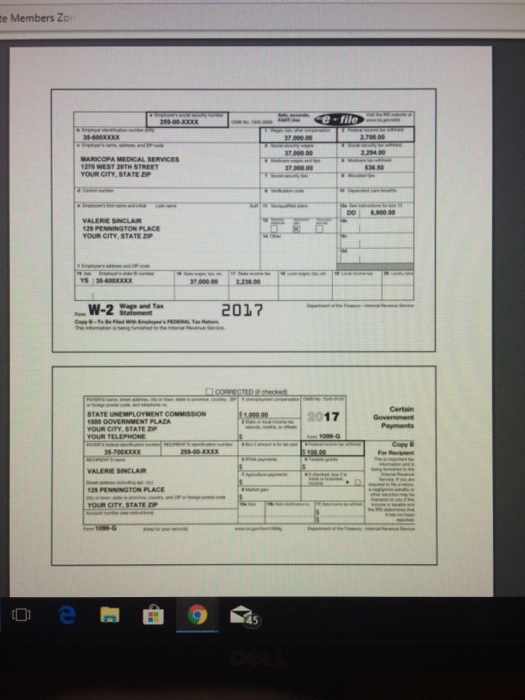

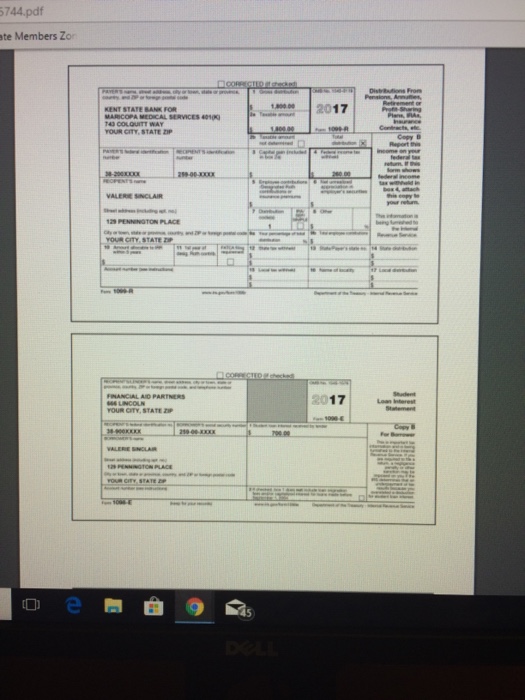

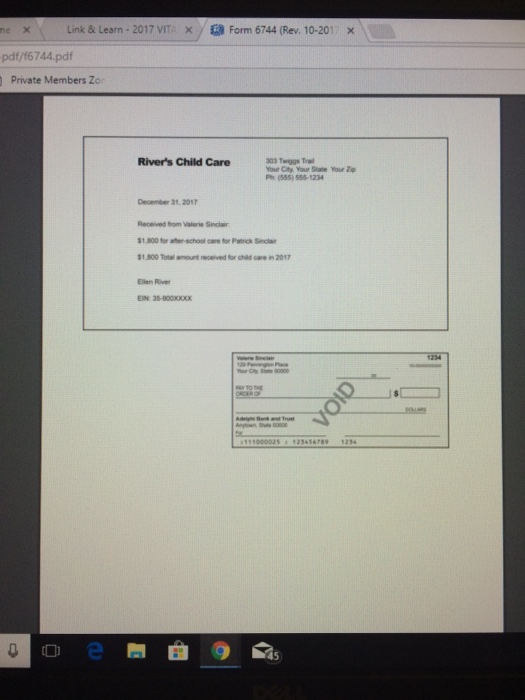

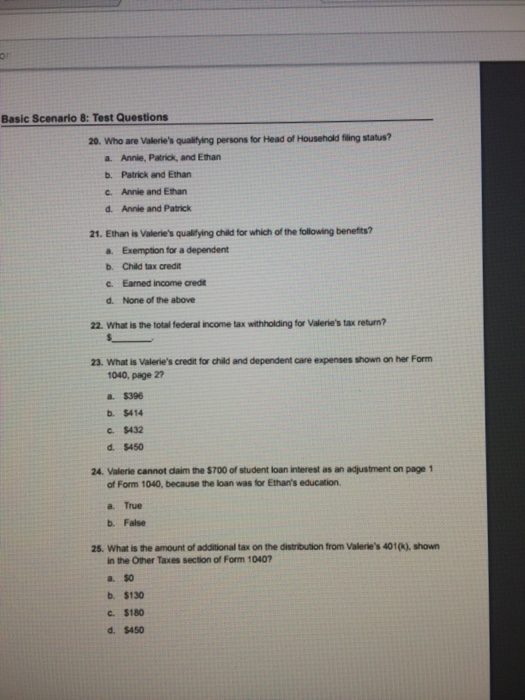

For better picture go to https://www.irs.gov/pub/irs-pdf/f6744.pdf pages 39-47 Zor Basic Scenario 8: Valerie Sinclair Using the tax software, complete the tax return, including Form 1040

For better picture go to https://www.irs.gov/pub/irs-pdf/f6744.pdf pages 39-47

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started